Prominent crypto investor Layah Heilpern shares her rationale for persistently acquiring Ethereum (ETH) and her plan to liquidate her holdings as the crypto market moves into a bull run.

“I’ve been buying and will 100% sell in the bull market,” she stated.

Layah Heilpern: Rewards Outweigh Risks for Ethereum

In a series of posts on X (formerly Twitter), Heilpern states her reasons for investing in ETH while opting to sell when the market starts to see significant growth:

“Safer than all the alts and still smaller market cap than bitcoin so will pump harder when money flows in.”

Heilpern also emphasizes its safety, citing the United States Securities and Exchange Commission (SEC) not designating it as a security.

The SEC’s recent classification of numerous cryptos as securities has sparked skepticism among many investors regarding its potential impact on the broader market.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

At the time of publication, Bitcoin has a market capitalization roughly three times larger than that of Ethereum.

Bitcoin boasts a market capitalization of $680.9 billion, while Ethereum stands at $226.4 billion.

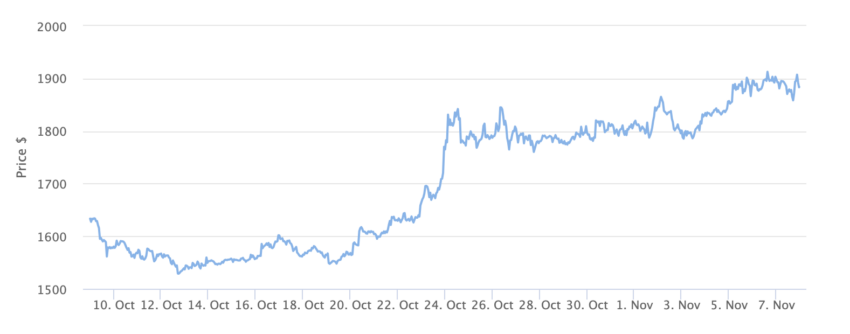

At the time of publication, Ethereum’s price is $1,881.

ETH Bull Market Gaining Steam

The price of Ethereum has been widely reported in recent times.

BeInCrypto reported on November 6 that ETH’s price broke a 200-day descending resistance trendline.

After a 203-day period of decline beneath this trendline, Ethereum’s price reached a new yearly high of $1,916.

Earlier reports stirred speculation in the crypto community as another investor amassed significant amounts of Ethereum.

Read more: How To Buy Ethereum (ETH) With a Credit Card: A Step-by-Step Guide

On November 4, BeInCrypto disclosed that a crypto whale deposited 31.8 million USDT into Binance. Subsequently, he withdrew 8,698 ETH valued at about $15.94 million just hours later.

Further investigation revealed that the same whale deposited 24,495 ETH, roughly $45 million, into Binance following Ethereum’s price increase, securing a profit of approximately $5.47 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.