80 days following the Bitcoin halving event, cautious optimism persists among crypto enthusiasts. Over half of the crypto investors still exhibit bullish sentiments despite a general market pullback that nullified initial post-halving gains.

According to a recent CoinGecko survey, 49.3% of market participants maintain a bullish outlook, whereas about one-fourth adopt a neutral stance, indicative of the prevailing uncertainties or a wait-and-see approach toward market trends.

Crypto Investors and Builders Are Bullish

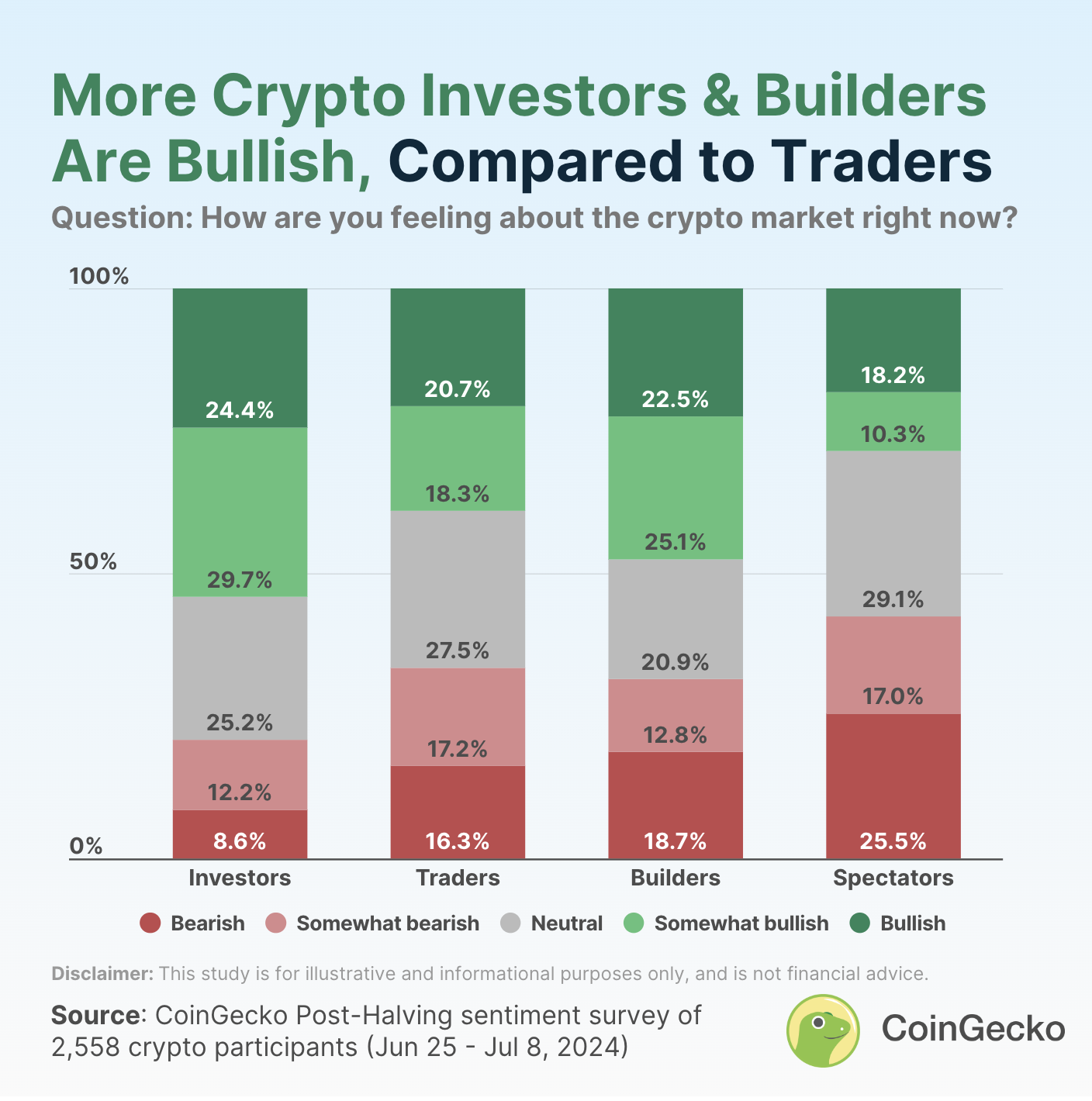

The survey analyzed different groups within the crypto community, revealing distinct sentiments across various roles. Notably, 54.1% of investors are optimistic about the market’s long-term potential, demonstrating a firm belief in the sustained value of cryptocurrencies.

Builders also exhibit resilience, with 47.6% maintaining bullish attitudes, although 31.6% express bearish sentiments.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Conversely, traders show a split view. Approximately 39% remain bullish, which sharply contrasts with their typically short-term trading strategies that react quickly to market shifts. This group’s bearish sentiment stands at 33.5%, emphasizing their acute responsiveness to recent price changes.

Spectators—the less active market watchers—were found to be the most bearish group. A significant 42.4% are pessimistic, surpassing the 28.5% who are optimistic. This likely reflects broader skepticism among those who have stepped back from active participation, possibly after taking earlier profits and exiting the market.

Currently, BTC prices hover around $59,000, marking a decline of roughly 10% since the Bitcoin halving. The market’s sentiment, as measured by the crypto fear and greed index, suggests a prevailing fear. This index, at 28, signals one of the most fearful periods in over a year.

Nevertheless, some investors view this as an ideal buying opportunity, believing that market fears often precede recovery and growth.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

“As for me, I like to buy when everyone is max bearish. The crypto greed and fear index is currently in the fear zone, which is typically a good time to buy. For altcoins, the gauge is probably close to extreme fear. If you extend your horizon beyond the next 3-4 weeks, the outlook starts to look more positive. Crypto investor sentiment is notoriously fickle, and rapid changes are common,” crypto investor Kelvin Koh said.