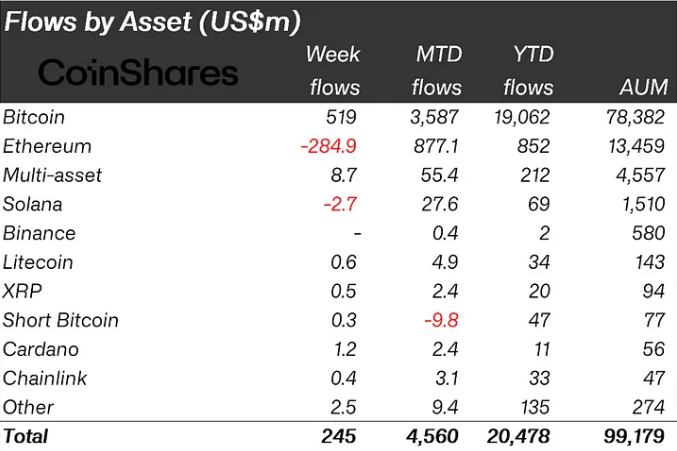

Weekly crypto investments were “relatively muted” last week, recording a meager $245 million as Ethereum suffered the brunt of the Grayscale sell-off.

Amid the lull inflows last week, Bitcoin maintained its streak of positive flows, recording $519 million and totaling $3.6 billion in July.

SponsoredCrypto Investments Dump, Ethereum Bears The Brunt

Ethereum ETFs (exchange-traded funds) saw some of the largest inflows since December 2020. According to CoinShares analysts, spot ETH ETFs saw up to $2.2 billion in inflows, but Grayscale customer sell-offs overshadowed this traction. Accordingly, Ethereum flows came in negative last week at $284.9 million.

“The launch of the US spot-based Ethereum ETFs saw some of the largest inflows since December 2020, with newly issued ETFs seeing US$2.2bn inflows, while trading volumes in ETH ETP rose by 542%. This figure is somewhat controversial as Grayscale seeded its new Mini Trust ETF (the week prior) with capital from its incumbent closed-end trust (~US$1bn), which may help explain the steady stream of outflows in recent years. Further, this week saw continued outflows from Grayscale’s incumbent trust of US$1.5bn as some investors cashed out, leading to a net outflow of US$285m last week. This is a similar situation to the Bitcoin trust outflows in the January 2024 ETF launches,” the report said.

Grayscale customers have proactively dumped their holdings since Bitcoin and Ether spot ETFs were approved. Before the two landmark launches, Grayscale Bitcoin Trust (GBTC) redeemed its shares by giving investors value against the US dollar. This means they would not sell their holdings until the Bitcoin and Ethereum ETFs debuted.

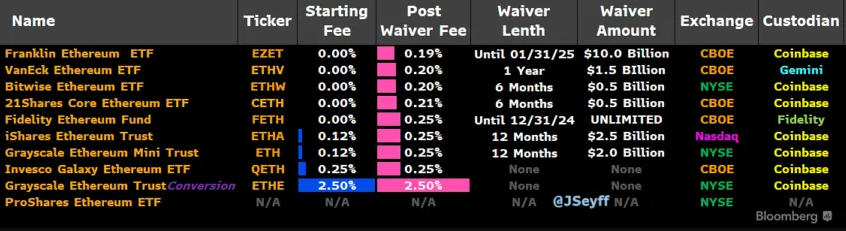

With ETH ETFs now live, Grayscale customers are dumping their holdings, just as they did when Bitcoin ETFs debuted. The sell-off comes as Grayscale charges a 2.5% fee on its ETHE ETF, the highest fee in the market. Notably, fees can significantly affect performance in the long term, as fees grow proportionately with market growth.

Read more: How to Invest in Ethereum ETFs?

Ether price bears the brunt of these sell-offs, failing to reclaim above $4,000. In January, Bitcoin behaved the same in the aftermath of spot BTC ETF launches. BTC dropped as outflows from GBTC and Bitcoin selling exceeded the combined inflows into all ten Bitcoin ETFs. Once the initial ETF demand faded, the pioneer crypto ascended to its all-time high.

“If the markets copy the price action of the Bitcoin ETF, then it’s likely that we’ll have a slight sell-off due to the outflows of the Grayscale trust. One to two weeks for downward momentum, before the real surge of Ethereum towards a new all-time high,” prominent crypto trader Michaël van de Poppe said.

Grayscale Makes Headway Amidst Fees Challenge

Amid fee concerns, Grayscale approached the US Securities and Exchange Commission (SEC) to introduce a lower-fee version of its GBTC product, the Grayscale Bitcoin Mini Trust. A percentage of GBTC shares will seed this new trust, and the spin-off will not incur capital gains taxes.

More importantly, the Grayscale Bitcoin Mini Trust fees will be competitive with existing low-cost counterparts. Although exact rates remain unknown, the new trust will trade under the BTC ticker on NYSE Arca, drawing registered investment advisors and broker networks looking for better BTC ETF options.

The New York Stock Exchange (NYSE) Arca’s proposal to list and trade Grayscale Bitcoin Mini Trust shares secured regulatory approval on Friday. The SEC indicated that this approval hinges on the trust’s regulatory compliance to prevent fraudulent activities and protect investors.

“Grayscale’s longer-term plan finally comes to fruition IMO. Will have lowest cost spot bitcoin & ether ETFs on market w/ tickers BTC & ETH. The only thing missing from the plan is options trading, which would have helped protect GBTC & ETHE to a certain degree,” ETF Store president Nate Geraci said.

Read more: Ethereum ETF Explained: What It Is and How It Works

Nevertheless, despite efforts to leverage reduced fees, Grayscale’s mini-trust is bound to face stiff competition from peers like Fidelity and Blackrock, which also offer access to the same financial instrument.