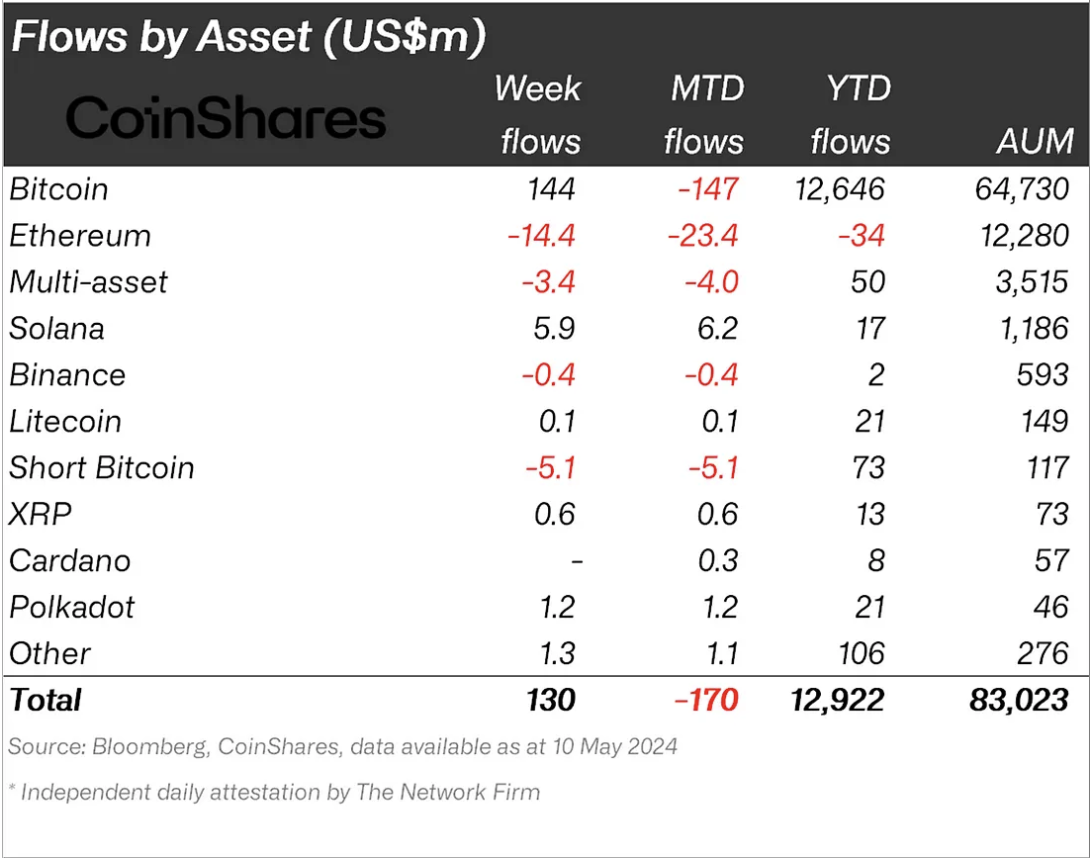

For the first time in over a month, crypto investment products have registered net inflows totaling approximately $130 million, predominantly in the United States, according to a recent CoinShares report.

This significant shift marks a positive change in investor sentiment following weeks of stagnant or negative growth across various cryptocurrency assets.

SponsoredFirst Inflows in 5 Weeks Totalling $130 Million

This resurgence in investment activity is largely attributed to inflows in Bitcoin, which garnered about $144 million last week. This aligns with broader market trends, suggesting renewed confidence among investors despite ongoing challenges.

In contrast, the United States continues to pull ahead in the crypto market, with inflows reaching $135 million. This robust performance is the country’s pivotal role in the global cryptocurrency market, even as regulatory landscapes evolve. Meanwhile, Grayscale reported its smallest outflow since January, totaling $171 million, a sign of potential stabilization in investor appetite.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2024

The scenario appears less optimistic in Hong Kong. The region recorded a modest inflow of $19 million, indicating a sluggish response to recent market opportunities, such as the launch of a Bitcoin ETF. This underperformance could signal a cautious or bearish outlook among Asian investors regarding immediate future gains.

Amidst these developments, Ethereum continues to face challenges due to the delay in approving Ethereum ETFs in the US. A recent analysis by research firm 10X Research pointed to a possible decline in Ethereum’s price to $2,500, citing weakened fundamentals and a reduced role in propelling the current market cycle.

“Low interaction by the US regulators with ETF issuer applications for a spot Ethereum ETF have increased speculation that the ETF approval is not imminent, this has been reflected in outflows which totalled US$14m last week,” analyst at 10X Research said.

Furthermore, the overall participation of ETP in the crypto ecosystem has diminished, only 22% of the total volume on exchanges. That equates to a 31% decrease from the previous month. This shift indicates a diversification of investment strategies from traditional ETPs to possibly more dynamic or diversified approaches.