Despite high-profile bankruptcies and a weak overall market, many crypto investors in Singapore remain steadfast. However, overall confidence has taken a hit, according to a recent survey.

Another report confirms that Singapore also tops significant cities in terms of crypto layoffs in the last year.

Singapore Crypto Investments Continue to Grow

According to Independent Reserve’s most recent study, Singapore earned 55 on the IRCI scale this year. This is a significant dip compared to a score of 61 last year. But, a blow to cryptocurrency trust has not deterred Singaporeans from making active crypto investments.

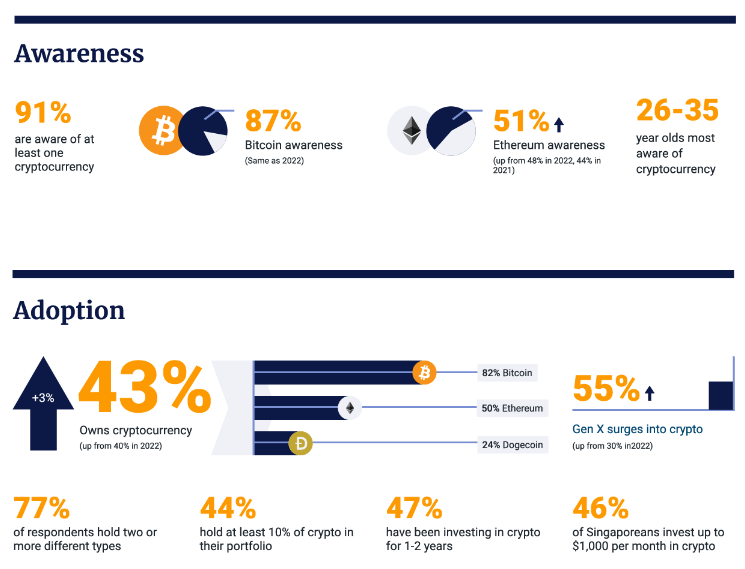

Sponsored46% of Singaporean crypto investors spend up to $1,000 monthly on cryptocurrencies, and 44% have at least 10% of their portfolio in the asset class, IRCI revealed.

91% of the respondents were aware of at least one cryptocurrency.

Singapore has made efforts to position itself as the crypto hub. However, the Monetary Authority of Singapore recently suggested several measures to limit retail cryptocurrency access. Despite this, those between the ages of 26 and 35 were revealed to be the most familiar with crypto.

Despite cryptocurrency experiencing a challenging time, 47% of investors have invested in the digital asset class in the last 1-2 years.

The FTX implosion in November prolonged the crypto winter. Previously, it was ascertained that many who lost money due to the FTX collapse were in Asia. Meanwhile, the liquidity problem spread to the traditional banking sector as a result of the collapses of Silvergate, Silicon Valley, and Signature Bank.

Layoffs Amid Broader Tech Weakness

Singapore also ranked first on a list of major cities that fired employees from the crypto business between February 2022 and February 2023.

According to a report by Bitcoin Casinos, 3,719 people were laid off by businesses headquartered in Singapore. San Francisco Bay Area was a close second with 3,454 layoffs, followed by New York City (1,754 layoffs).

Notably, the figures are significantly impacted by layoffs at Singapore-based Crypto.com. They reportedly fired 2,750 employees in the last year.

Meanwhile, with the tech sector experiencing a general weakness, 40% of Singaporean investors are expected to invest in cryptocurrencies over the next 12 months. Additionally, according to IRCI, 48% of respondents intend to grow their existing cryptocurrency holdings, reflecting positive sentiments towards the sector.