Crypto inflows reached $1.9 billion last week, bringing the year-to-date (YTD) flows to $4.8 billion and extending the January streak.

The surge in inflows is largely attributed to recent executive orders issued by President Donald Trump, proposing the establishment of Bitcoin as a strategic reserve asset.

Bitcoin as a Strategic Reserve Asset

According to the latest CoinShares report, Trump’s executive orders to create a digital asset stockpile reinvigorated investor confidence. Specifically, it sparked significant trading activity, even as prices remained relatively flat.

“…likely as a result of recent presidential executive orders that proposed the initiation of a strategic reserve asset in Bitcoin. Despite the relatively flat price action last week, trading volumes were high at $25 billion for the week, comprising 37% of all trading volumes on trusted crypto exchanges,” an excerpt in the report read.

Bitcoin was the standout performer, attracting $1.6 billion in inflows and bringing its YTD total to $4.4 billion. This accounted for 92% of all digital asset inflows. Notably, Trump’s executive orders propelled a Bitcoin price recovery last week.

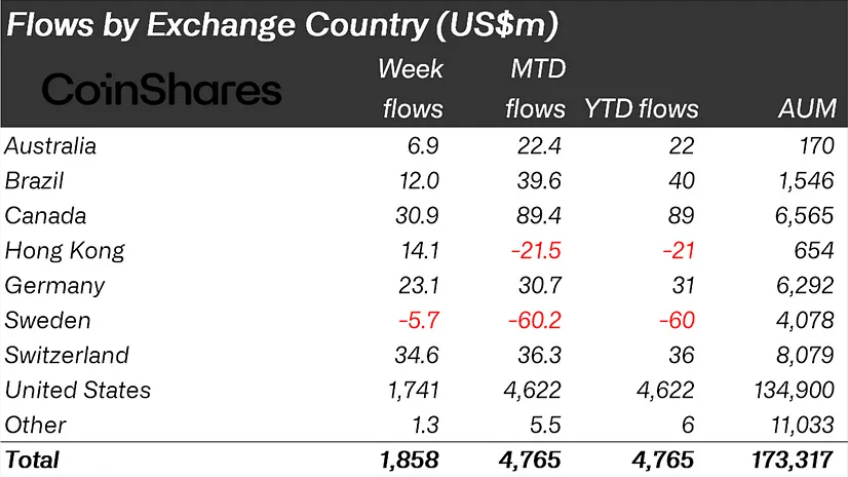

Indeed, Trump’s executive orders reflected Bitcoin and crypto’s potential as a cornerstone of the US national financial strategy. As BeInCrypto reported, he directed departments and agencies to identify and make recommendations on industry regulations. Against this backdrop, CoinShares’ James Butterfill highlights that the US led the charge, recording inflows of $1.7 billion.

Nevertheless, the executive orders have had a ripple effect, boosting sentiment in other regions. Canada saw inflows of $31 million, Switzerland $35 million, and Germany $23 million, reflecting widespread optimism. In the same tone, the European Central Bank (ECB), citing the momentum generated by Bitcoin’s adoption, has renewed its call for a digital euro.

Meanwhile, the latest CoinShares report adds to a streak of positive flows for the first month of 2025. The previous week’s inflows stood at $2.2 billion, driven by excitement surrounding Trump’s inauguration and pro-crypto policies.

While last week’s inflows marked a slight decrease from the week prior, they continue the streak of positive flows in 2025, with only one exception. During the second week of January, inflows shrank to $48 million amid a brief period of uncertainty. This highlights the volatile nature of the crypto market.

The sustained inflows this year highlight a growing appetite for digital assets, with $585 million recorded in the first week of January alone. This trend reflects a broader acceptance of cryptocurrencies as viable investment vehicles. Trump’s crypto-friendly stance continues to provide additional boosts, setting a tone of optimism for the year ahead.

As the crypto market enters the final week of January, investors are closely watching upcoming US economic data. The events could significantly influence inflows into digital asset investment products.

Indicators such as GDP growth, inflation rates, and labor market statistics are expected to influence Bitcoin’s trajectory. Positive data could further bolster confidence, while any signs of economic weakness might drive additional investment into crypto as a hedge.

“Crypto markets are sensitive to macro trends. Rising global rates, inflation fears, and regulatory concerns can all fuel sell-offs. Plus, we’re heading into a big “news week” in the US—Fed decisions, economic data, and more. Uncertainty = risk-off mode,” a community lead at Solana NFT marketplace Tensor wrote.