The crypto gaming market may be out of the spotlight for now, but that’s exactly when traders should start paying attention. While the overall GameFi market cap sits at $12.1 billion, per CoinGecko data, down 4% over the past 24 hours, a handful of crypto gaming coins are showing early signs of positioning for potential August breakouts.

From falling exchange reserves to whale accumulation and strong technical levels, these three tokens stand out. Let’s break down the on-chain strength and chart setups of FLOKI, MAGIC, and RNDR, followed by a quick look at BEAM as a potential sleeper crypto gaming token.

Floki (FLOKI)

Floki is a meme-inspired crypto gaming coin and metaverse token that’s evolved into a full-fledged DeFi and GameFi ecosystem. Unlike most meme coins, Floki actually delivers infrastructure, including FlokiFi Locker and the Valhalla metaverse.

Now, it’s starting August with the strongest on-chain setup of any crypto gaming token, despite the 12% week-on-week drop.

According to Nansen, the top 100 wallets have increased their FLOKI holdings significantly over the past 30 days. Simultaneously, exchange reserves dropped by 4.52%, now down to 2.14 trillion tokens, suggesting a decrease in immediate sell pressure. That’s nearly 96.8 billion FLOKI tokens moved out of exchanges, a strong signal of accumulation.

Even though smart money allocations dipped slightly, this drop has been offset by the whale accumulation percentage of over 17%, showing conviction from bigger holders.

On the price chart, FLOKI is trading at $0.00010399 and has rebounded after finding support near $0.00009849. If $0.00011241 (0.236 Fib) is broken, there’s minimal resistance up to $0.00012799 and a potential revisit to $0.00015749 (local high). Beyond that, $0.00019395 could come into play if broader sentiment improves.

But then, if FLOKI takes a plunge under $0.00009849, the nearest swing low, the entire bullish view might flip into a bearish one, in the short term.

FLOKI’s setup balances whale strength and decreasing exchange pressure, giving it a real shot at upside if resistance levels flip in August.

Treasure (MAGIC)

MAGIC powers the Treasure ecosystem, a decentralized crypto gaming hub built on Arbitrum. It connects metaverse assets across games and NFT projects, acting as a liquidity layer for interoperable gaming.

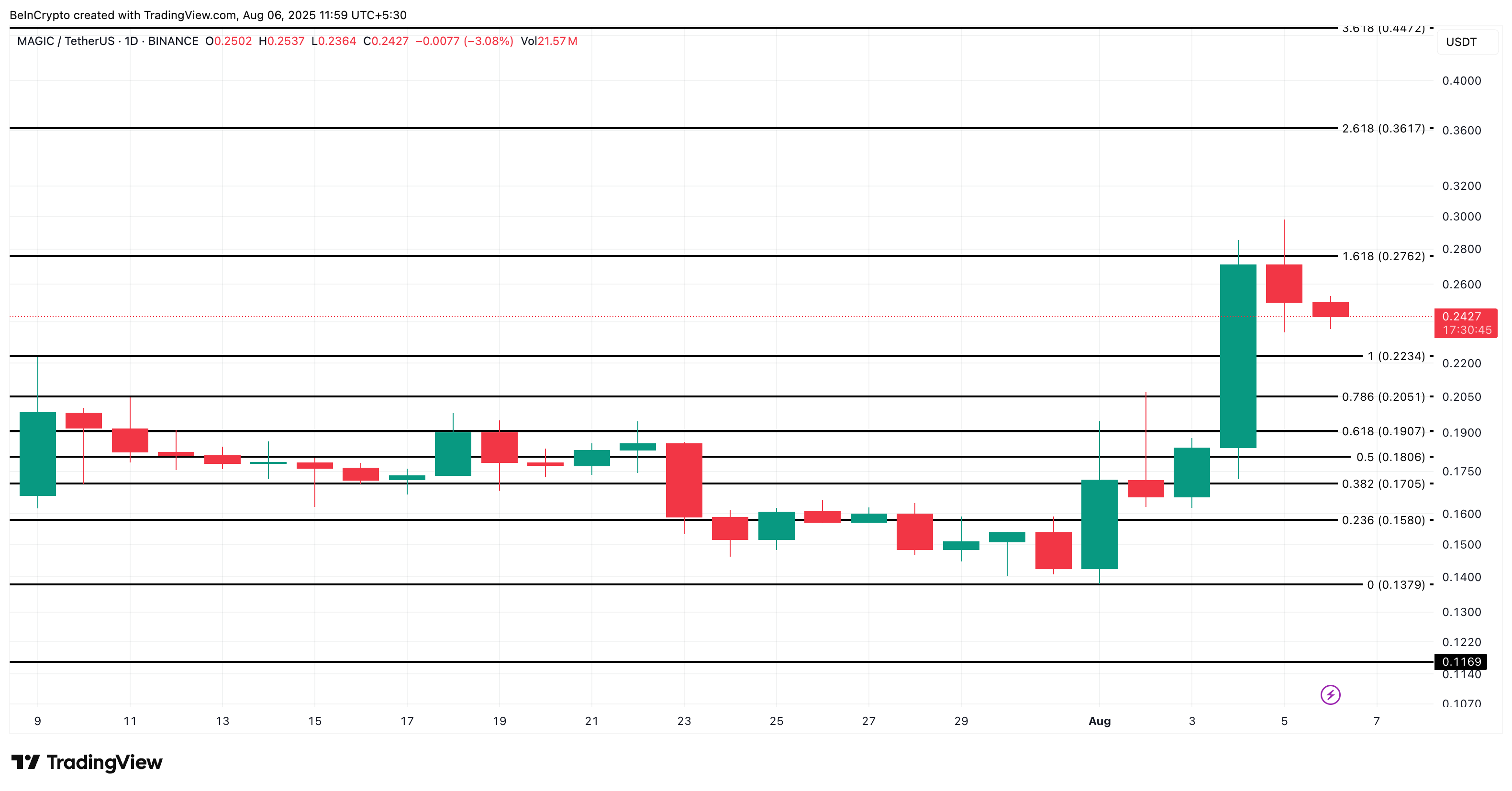

MAGIC is the only GameFi token in this list that’s up over the past 7 days — +57.4% week-on-week, showing bulls are still in control. Even though it already broke out in July, the August positioning doesn’t look weak either.

Nansen data shows exchange reserves declining. This reduction in reserves has directly aligned with the rally. This reinforces the idea that the move was driven by spot buyers, and they might still be expecting some price-related “Magic”.

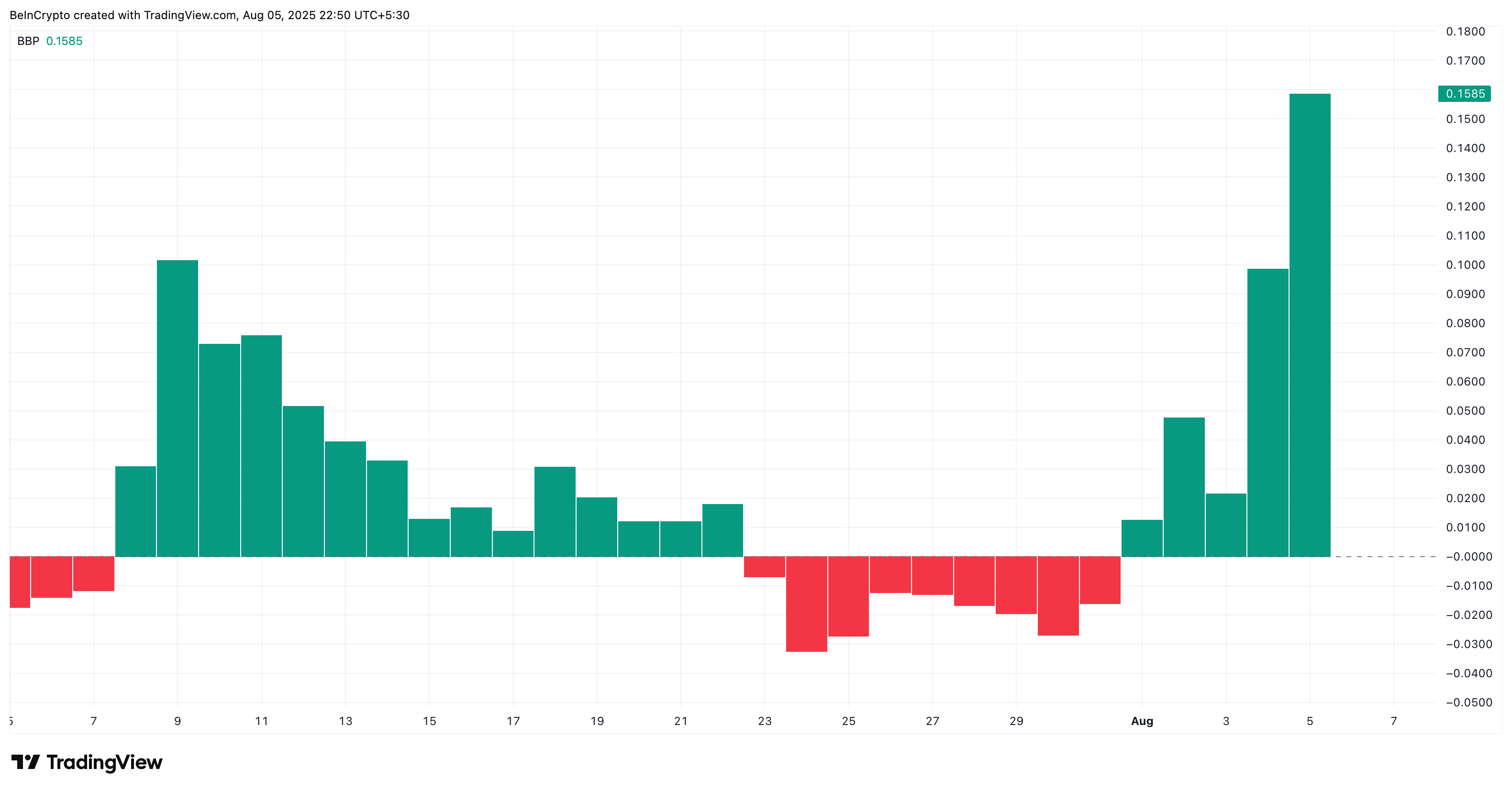

Momentum has also shifted sharply. The Bull-Bear Power (BBP) index is at +0.1585, surging after a long stretch of negative readings. This suggests increasing demand strength even amid short-term corrections. What’s interesting is that despite the price consolidating post-rally, the bulls have intensified their control.

Technically, MAGIC just cleared the 1.618 Fibonacci level at $0.27 but faced resistance immediately after. A clean move above this zone could open up a run to $0.36 or higher, per the Fibonacci retracement levels. On the downside, $0.22 (Fib start or the last swing high ) acts as a strong short-term support, and the structure remains bullish as long as $0.17 holds.

Momentum is clearly in favor of bulls, and MAGIC’s on-chain activity supports the rally, making this a strong candidate for continued upside in the crypto gaming token space.

Render (RNDR)

Render Network allows users to contribute unused GPU power for rendering tasks, making it a cornerstone of AI, metaverse, and GameFi applications. The RNDR token is used for payments and governance across the platform.

Despite an 11.42% decline over the past 7 days (current price $3.52), RNDR shows signs of a potential breakout in August.

Here’s why: whale wallet holdings have grown significantly, not just among top holders, but across the board. Meanwhile, exchange reserves are declining, which helps reduce downward pressure and indicates accumulation from off-exchange buyers.

Technically, RNDR is trading within a symmetrical wedge, having bounced off support near $3.34. The next key level is $3.83 (0.236 Fib), and if broken, RNDR could surge toward $4.39–$4.62. A breakout from the wedge pattern would validate this move, opening up extension levels of $4.98, $5.43, and even $6.72.

A breakdown under $3.34 would flip the structure bearish, defeating the bullish outlook.

While Bear-Bull Power (BBP) is still slightly negative (-0.353), it’s improving. If this trend continues, RNDR could quickly turn into a breakout candidate this month.

Honorary Crypto Gaming Token: Beam (BEAM)

Beam is a modular crypto gaming chain in the Merit Circle ecosystem, focused on onboarding developers and powering in-game economies. When it comes to the holding patterns, whales have increased their stash by 2.94% over the past three months. This puts BEAM as one of the key beneficiaries of the growing altcoin season-led attention.

Both Smart Money and the top 100 wallets have added to their holdings in the said time period. And yes, exchanges have been emptied by almost 9%, which should contribute towards reduced sell pressure.

Price-wise, BEAM is sitting at $0.0067, down 12% week-on-week, but holding above its recent low of $0.0063.

The token is now attempting to reclaim $0.0070 (Fib 0.236), and if successful, could climb toward $0.0081 or $0.0092. There’s very little technical resistance beyond that range in the short term. However, if the BEAM price dips under $0.0063, the bullish hypothesis would cease to exist.

While not as strong as the others in terms of whale inflows, BEAM’s recent price action and pattern recovery make it one to keep on the watchlist, especially if the crypto gaming sector rotates back into favor.