Funding in crypto projects shows a direct relationship with market conditions over the years. This article shows that 2022 saw a staggering decline in project cash inflows, given the adverse conditions. However, with the start of a new year, can 2023 change the fortunes for projects within this domain?

Crypto funding is often the difference between an idea amounting to nothing and great tech innovation becoming a reality. But who are the people initiating those make-or-break words regarding crypto projects? The answer for the majority of cases is crypto venture capitalists or VCs. The job is to allocate their investors’ money into the crypto markets and make gigantic returns.

Those investors are the types of people that don’t bat an eyelid at a $100,000 investment minimum. Some big names or the top VCs have had some of their best exits and early-stage token investments. Some of the big names within the cohort are: Andreessen Horowitz or popularly known as a16z, Pantera Capital, Coinbase Ventures, and the list goes on.

This funding also comes with some conditions, considering the market behavior and sentiment. The cryptocurrency market sentiment/conditions remain fluctuating, as last year.

Yearly Crypto Funding Scenarios

Last year was one of the problematic rides for crypto operations and the participating entities, be it retail, institutions, and others. The crypto market lost around $2 trillion in value since the massive rally in 2021. Various collapses, such as the fall of the crypto exchange FTX, then the Terra crash, and the havoc caused by Three Arrows Capital (3AC), among others, directly affected the market. Even put stains on its credibility. Meanwhile, numerous hacks and illicit activities only made it worse.

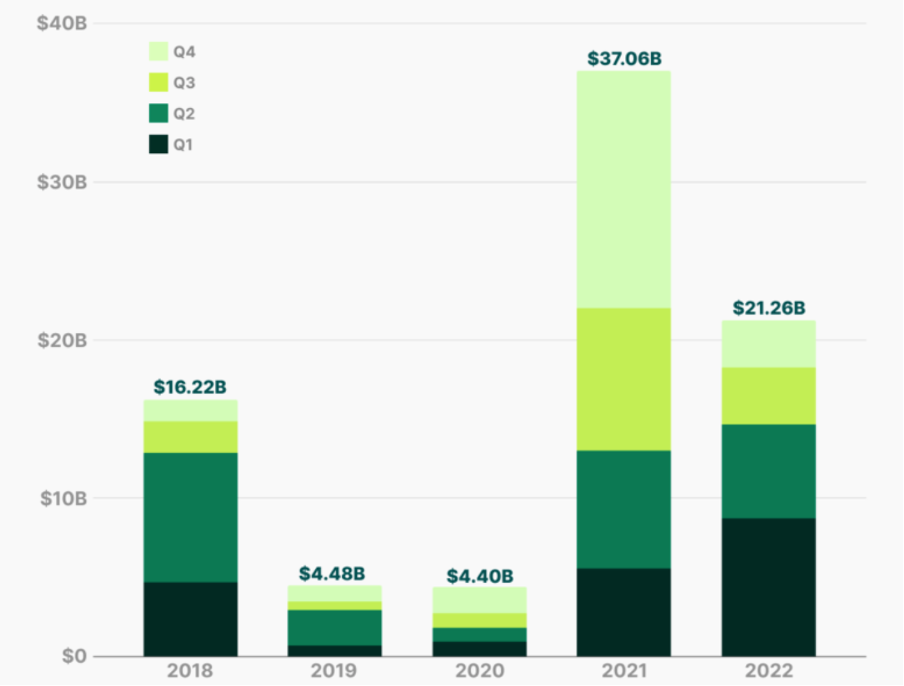

Such unfortunate events directly affected crypto projects’ funding capabilities last year. For instance, consider DeFiLlama’s graph below to visualize how last year’s events decline the funding potential for crypto projects from different investors.

The fall in crypto funding last year remains unmistakable in the plot above. Indeed, a significant loss compared to 2021. To shed more light on this discussion, a study by CoinGecko was shared with BeInCrypto via mail.

2022 vs. 2021: Crypto Funding Tale

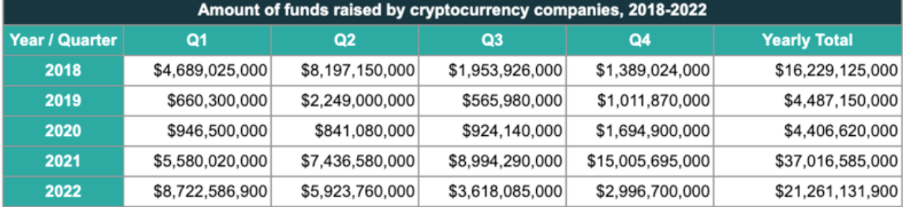

Last year stopped or hindered expansion plans for various crypto projects due to the need for more funding drives. Per the report shared, last year raised over $21 billion, $21,261,131,900, to be precise. While this may sound a lot, the stated number was less than $16 billion than the funding statistics in 2021. This amounted to a massive 42% decline in funding initiatives between the two years.

Zooming further, 2022’s funding declined significantly every quarter. The first quarter saw around $8.70 billion, -41.8% QoQ after a solid fundraising performance in the last quarter of 2021. The following quarters saw a relatively slow fund inflow into cryptocurrency companies.

Per the chart below, companies raised progressively less at $6 billion in the second quarter (-32.0% QoQ) and $3.61 billion in the third quarter (-38.9% QoQ). Lastly, ~$3 billion in the fourth quarter (-17.1% QoQ).

There were some positives, especially compared to the fundraising activities in 2020 and 2019. This is evident in the charts added above. As Lim Yu Qian, a member of the Growth team at CoinGecko, stated:

“The relatively better funding performance in 2022 points to the cryptocurrency industry’s growth over the last five years, supported by more projects securing financial backing and increasing interest from institutional investors.”

Even the web3 projects saw the light at the end of the tunnel despite the sufferings of crypto projects in 2022. BeInCrypto reported that, amidst the bear market, web3 projects raised more than $7 billion, up by more than $4 billion. Investors are beginning to see the potential in web3, which explained the fundraising events last year.

Keeping the positive momentum in mind, can the current year inject some certainty amidst the chaotic market sentiments from the last year?

Can 2023 Deliver?

The ongoing year just kick-started carrying the load from the past. But the hype around web3 and the related companies can see some milestones. Alex Thorn, head of research at crypto investment firm Galaxy Digital, reiterated the rise of funding and even focus on web3 platforms. In an interview on Jan. 10, the veteran opined that last year’s trend could continue in the current year.

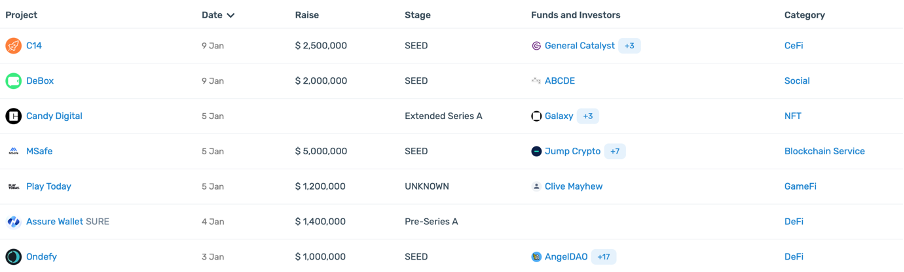

Nonetheless, a few projects did manage to kick-start the year after securing some funds.

Yes, the start of the ongoing year could have been faster; a few firms did see some much-needed cash inflow to carry out the operation. But illicit activities can curb those incoming cash flows. Apart from this, another area of concern is regulation. A few countries, such as France and Hong Kong, have already started the year by taking steps toward regulating the market. Others, too, would follow.

Different narratives have emerged following these steps. While it can flush out bad actors within the blockchain space. There are also rising concerns about the fading decentralized aspect of this space, which may or may not impact investors’ betting on a specific project.