In 2023, Tether made waves in the financial sector by generating an astonishing $6.2 billion in net income. According to Teddy Fusaro, president at Bitwise, this figure closely competes with banking giants like Goldman Sachs and Morgan Stanley.

Remarkably, Tether achieved this with approximately 100 employees, showcasing an unprecedented level of efficiency.

Will Traditional Finance (TradFi) Institutions Rush Towards Crypto?

The company’s performance is particularly striking when compared to traditional banking behemoths. For instance, Tether’s income per employee is at least 380 times more than that of JPMorgan, one of the world’s largest banks by market cap.

This disparity highlights the crypto firms’ technological leverage to maximize profitability.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

| Institution Name | Total Deposits as of December 31, 2023 (in millions) | FY 2023 Net Income | Total Workforce | Net Income per Employee |

| JPMorgan | $2,400,688 | $47,760 | 293,723 | $162,602 |

| Goldman Sachs | $428,000 | $7,907 | 48,500 | $163,031 |

| Morgan Stanley | $346,000 | $8,530 | 82,000 | $104,024 |

| Tether | $97,020,395 | $6,180 | 100 | $61,800,000 |

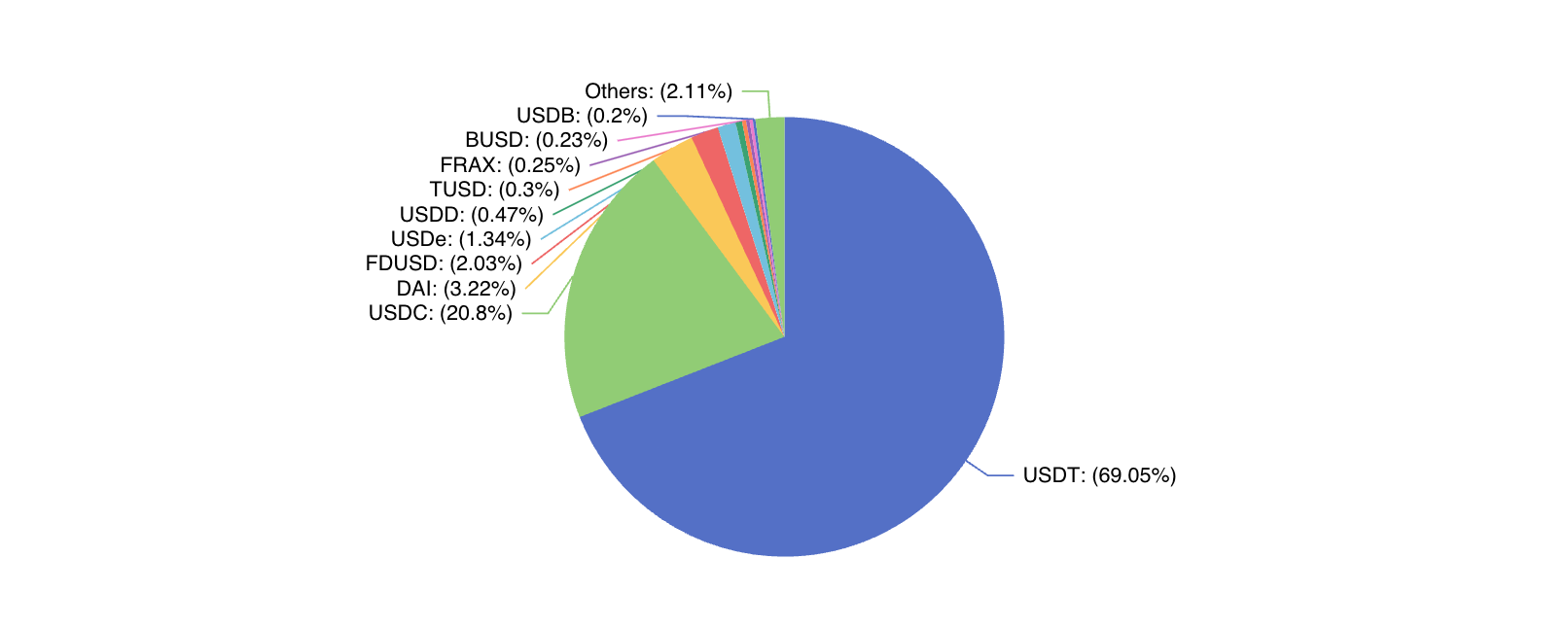

However, Tether’s success has sparked discussions within the financial ecosystem. Some community members believe that its ascendancy, especially in the stablecoin market, with USDT surpassing $100 billion in circulation, could prompt legacy financial entities to explore cryptocurrency more seriously.

Conversely, JPMorgan has expressed concerns about Tether’s rapid growth and the regulatory challenges it faces. The bank highlighted the potential risks to the wider crypto ecosystem, citing Tether’s ongoing issues with regulatory compliance and transparency.

Nevertheless, Tether’s management remains optimistic. CEO Paolo Ardoino views the company’s market dominance as beneficial, particularly for sectors that rely on stablecoins.

He stresses Tether’s proactive approach to engaging with global regulators to ensure a comprehensive understanding of the technology.

“Tether’s market domination may be a ‘negative’ for competitors including those in the banking industry wishing for similar success but it’s never been a negative for the markets that need us the most,” Ardoino said.

Read more: A Guide to the Best Stablecoins in 2024

Moreover, Tether is branching into Artificial Intelligence (AI), aiming to make AI technologies more accessible and efficient. By investing in sectors like renewable energy and Bitcoin mining, Tether is positioning itself as a leader in AI, advocating for open-source and transparent practices.

This strategic move comes as discussions around the centralization of AI technologies gain momentum. Through its commitment to open AI models, Tether aims to promote innovation and prevent monopolistic practices in the industry.

However, not everyone views Tether’s activities positively. The X account Bitfinex’d accuses Tether and Bitfinex of engaging in fraudulent activities, including money laundering.

“It’s money laundering. Criminal activity is very profitable for a while,” Bitfinex’d said.

These allegations, along with past regulatory penalties, including a settlement with the New York Attorney General and a $41 million fine from the US Commodity Futures Trading Commission, add a layer of controversy to Tether’s narrative.