Money is on the move out of BitMEX, and other exchanges are lining up for the funds. Now that BitMEX and Arthur Hayes are facing charges, traders are seeing the writing on the wall and fleeing for greener pastures.

According to on-chain data provider CryptoQuant, BitMEX has experienced outflows of more than 11,250 BTC, much of which was directed to a handful of leading exchanges, including Binance, Gemini and Kraken.

11,257 $BTC flowed out from BitMEX to all other exchanges. Mostly went to #Binance, #Gemini, and #Kraken. https://t.co/S5qLsPd3wV pic.twitter.com/IZOBsZ5Fjl

— CryptoQuant.com (@cryptoquant_com) October 2, 2020

BitMEX Pain, DEX Gain?

A major reason that traders flocked to BitMEX was for the ability to trade derivatives and pile on the leverage to take high risk, high reward bets. Now that BitMEX itself has become a liability, traders could easily turn to other crypto derivatives exchanges, including those that are decentralized in nature.

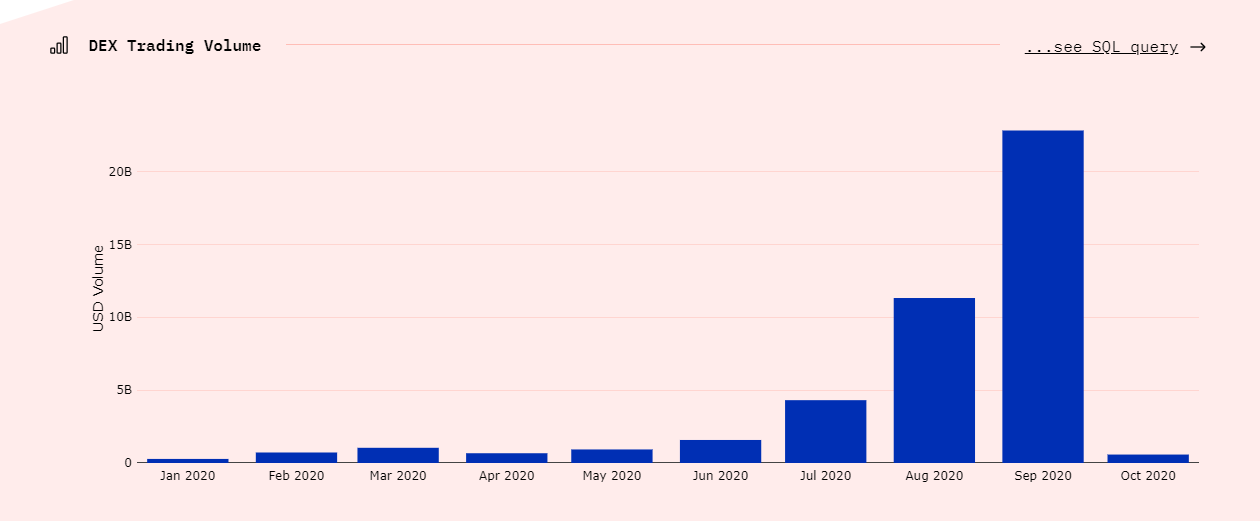

According to Dune Analytics, decentralized exchange trading volume is already on the rise, nearing an eye-popping $23 billion last month, more than double August levels.

Vega Protocol

Vega is a protocol on which cryptocurrency derivatives can be created and traded. It serves as a marketplace of sorts that matches traders and market makers across sophisticated financial products. The network is secured by proof-of-stake and it is designed to pick up where Ethereum leaves off.

BeInCrypto caught up with Vega Founder Barney Mannerings to discuss the upcoming launch of the protocol and what the BitMEX debacle means for the future of decentralized finance (DeFi).

BIC: Does what happened at centralized exchange BitMEX strengthen the argument for DEXs?

Mannerings: “The BitMEX saga highlights the mismatch between open-source, decentralized, community-led projects and the rent-seeking businesses, that exemplify the dangers of pure, unchecked capitalism, which have grown up around the periphery of the ecosystem, and suck value out of it while doing nothing for the reputation of the space. It’s clear to me that centralized exchanges are a stepping stone that has been necessary, but also something that the industry needs to move away from as quickly as possible. What’s happening with BitMEX shows that we urgently need to build and move to reputable and professional-grade decentralized solutions like Vega.”

BIC: Have you seen any of the BitMEX volume flow to your protocol?

Mannerings: “Vega isn’t live yet, so whether or not some of the BitMEX trading volume moves directly to Vega depends on how long BitMEX survives. In general, I think people are looking more cautiously at centralized derivatives exchanges, in the crypto space at least, and I think some of that volume will find its way to decentralized alternatives. When Vega launches, it will definitely be a catalyst for this, as it enables decentralized trading that’s faster, more sophisticated, and more capital efficient than any DEX today.”

Mannerings: “Vega is basically a DEX for derivatives. What we’re building is the blockchain that allows people to create and trade derivatives but we’re not launching any markets or financial products ourselves, just creating the software tools to do so. The market makers, traders, and community members who use Vega will create the products and markers they want and trade with each other using the protocol we’ve designed.”

BIC: How much margin is allowed? Are we talking about cryptocurrency futures and options?

Mannerings: “The first version of Vega will be able to be used to create futures on pretty much anything, from crypto to commodities or FX, to the weather of the Ethereum gas price. The amount of margin required and leverage allowed will vary between markets and is calculated by the Vega risk management algorithms. But to give an example, for BTC/USD futures this might be up to around 100x leverage. For less volatile markets, it could be considerably more.”

BIC: Anything else you’d like to add?

Mannerings: “I’d encourage people to visit vega.xyz if they’re interested in checking out the Vega Testnet or joining our community forums or Discord server.”