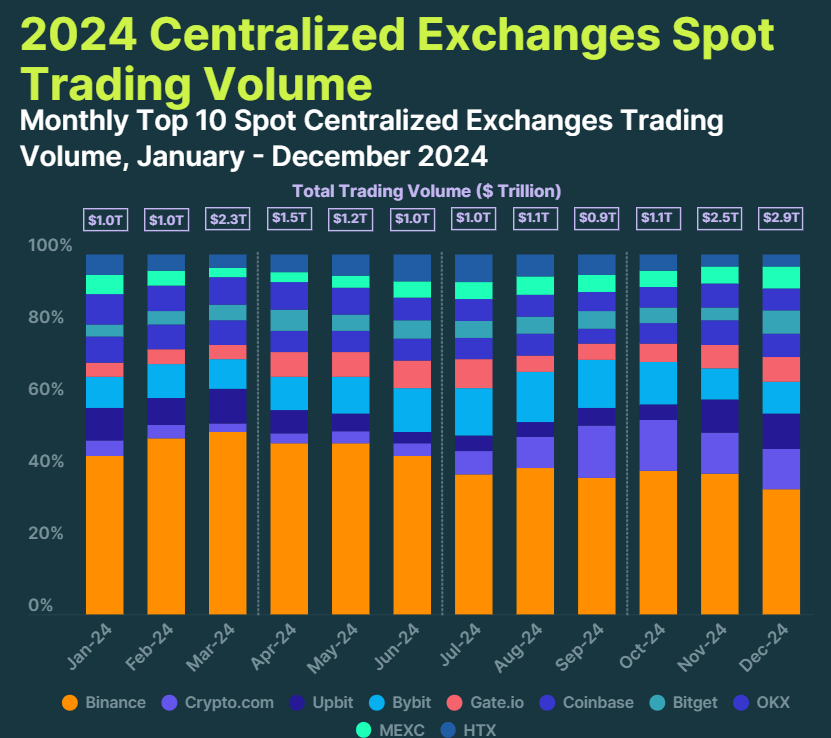

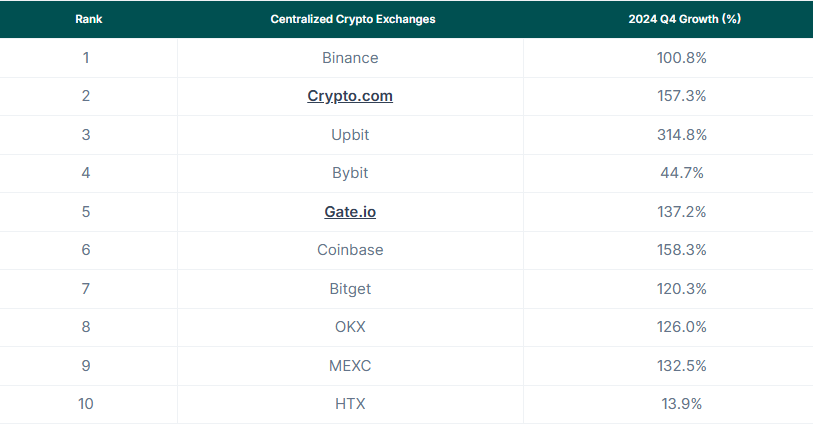

According to a CoinGecko report, in Q4 2024, the overall trading volume of the top 10 crypto centralized exchanges (CEX) surged, with eight of them recording triple-digit percentage growth.

It was also found that the total trading volume for the top 10 exchanges in Q4 was $6.4 trillion, a 111.7% increase from the previous quarter.

Binance Maintains Dominance as Top CEX, Despite Declining Market Share

At the close of 2024, Binance remained the clear leader in the market, maintaining a dominant market share of 34.7%.

The CoinGecko report showed that in December alone, the exchange recorded a substantial spot trading volume of $1.0 trillion. This marked a slight increase of 2.3% from November’s $979.1 billion.

The achievement marked Binance’s second $1 trillion volume month in 2024. Over the course of the year, Binance’s dominance was even more pronounced, capturing 42.4% of the total volume among the top 10 exchanges, with $7.4 trillion traded compared to the $17.4 trillion in total volume for the group.

Despite its dominance, Binance has experienced a gradual loss of market share in 2024. Starting the year with a 44.1% share, it has seen a decline in its portion of the market since September, dipping below 40%.

“However, it is still the largest exchange by a large margin. For comparison, it had more trading volume than the next five largest exchanges combined in 2024 ($7.4 trillion vs. $6.6 trillion),” CoinGecko said.

Crypto.com’s Q4 Surge Powers It to Strong Second Place

Crypto.com emerged as the second-largest exchange by trading volume in December. It had an 11.2% market share and $322.3 billion in trading volume. This represents a significant increase of 12.7% from the previous month.

In Q4 2024, Crypto.com saw a sharp increase in volume. The volumes rose from $539.8 billion in the first three quarters of the year to $757.8 billion in the final quarter.

Upbit, which reclaimed its spot as the third-largest exchange in November 2024, continued its upward trajectory into December. The exchange recorded $282.7 billion in spot trading volume for the month, a notable 22% growth from November.

Upbit’s performance in Q4 was driven by a dramatic surge in volume following the declaration of martial law in South Korea on December 3. This led to a six-fold increase in daily volumes, reaching an average of $21 billion per day.