The Oracle of Omaha, whose opinion many regards as an economic health barometer, suggests that businesses’ performance could decline, leading to a short-term stock decrease. This decline could spur a crypto price correction because of the Nasdaq’s correlation with cryptos.

Speaking at a Berkshire Hathaway shareholder meeting in Nebraska, Buffet said many firms would report lower earnings caused by discounts after their COVID-19 inventory build-up.

Oracle of Omaha Predicts Lower Earnings After Dumping $13 Billion in Stocks

The Oracle of Omaha surmised:

“In the general economy, the feedback we get is that, I would say, perhaps the majority of our businesses will actually report lower earnings this year than last year.”

Apple Inc. saw declines in iPad, Mac, and wearables revenue in Q2, despite iPhone revenue growing 2% year-over-year. The iPhone maker comprises almost half of the Berkshire empire’s stock portfolio.

Services, Apple’s second-largest segment after the iPhone, experienced a third straight quarter of mid-single-digit growth. As a result, Apple’s total revenue declined 3% annually, marking two consecutive quarters of revenue decline.

Q1 profits of Berkshire investment Chevron Corp were down 40% from quarterly profits last year. Analysts expect quarterly earnings of Occidental Petroleum to fall 38% to $1.30 per share when it reports earnings later Tuesday.

Berkshire increased its stake in the firm earlier this year.

Berkshire Hathaway is sitting on $130.6 billion in cash after selling $13.3 billion in shares in Q1. It repurchased some of its own stock and invested $2.9 billion in other companies.

Interest rates boosted returns from Treasury bills and bank deposits from $164 million last year to $1.1 billion this year.

Despite earlier investments in Goldman Sachs and Bank of America, Buffet did not reveal any intentions to help alleviate the current U.S. banking crisis.

Nasdaq Correlation Could See Cryptos Trend Downward

Buffet’s business partner Charlie Munger said last month that investors should brace for lower stock market returns amid higher interest rates.

Earlier this month, the Federal Reserve (Fed) increased interest rates by 25 basis points to 5-5.25%, but hinted at a future pause.

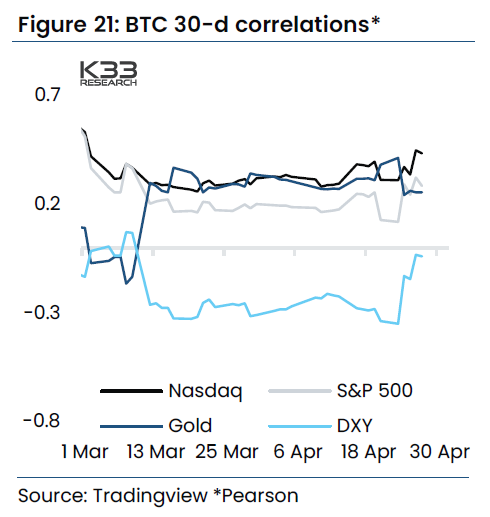

The 30-day correlation between Bitcoin and the Nasdaq rose to around 0.5 at the end of April. This tracking implies that Buffet’s and Munger’s prediction of an economic slowdown could accompany a crypto slide.

A correlation coefficient closer to one means that the Nasdaq and Bitcoin performances dovetail almost perfectly.

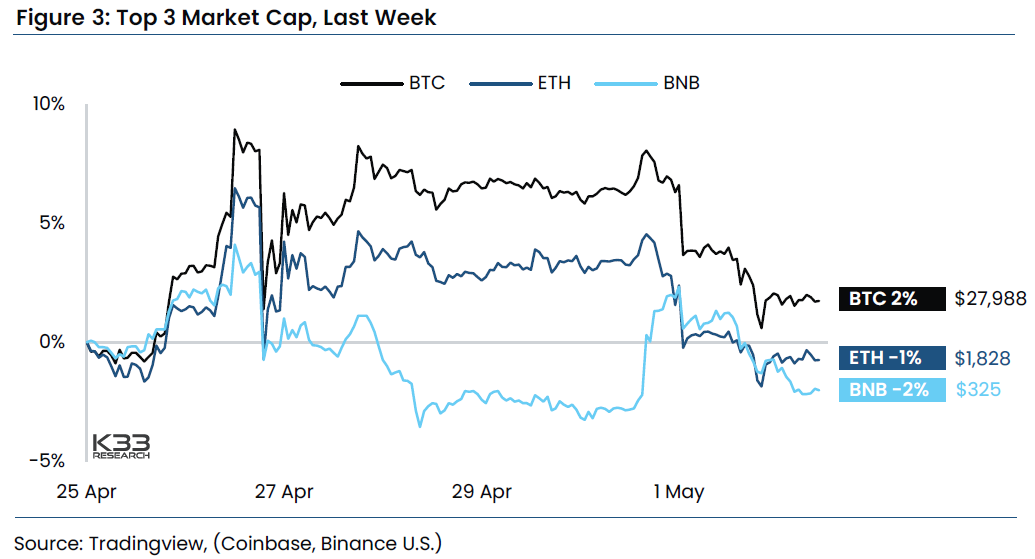

Furthermore, a larger stock market decline will impact the performances of larger-cap cryptos tracking Bitcoin.

Other macro pressures could depress crypto prices, such as U.S. regulatory uncertainty discouraging institutional investment.

Despite getting a boost from the collapse of several U.S. banks earlier this year, Bitcoin needs this investment to break out beyond its current trading range, according to Kevin O’Leary.

Bitcoin lost substantial liquidity after the collapse of FTX and Alameda Research last year.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.