The market cap of top USD-pegged stablecoins has fallen significantly over the past two weeks following FTX’s implosion, according to available data.

Crypto investors are massively redeeming their stablecoin holdings for fiat following the recent market conditions that have eroded trust in centralized exchanges.

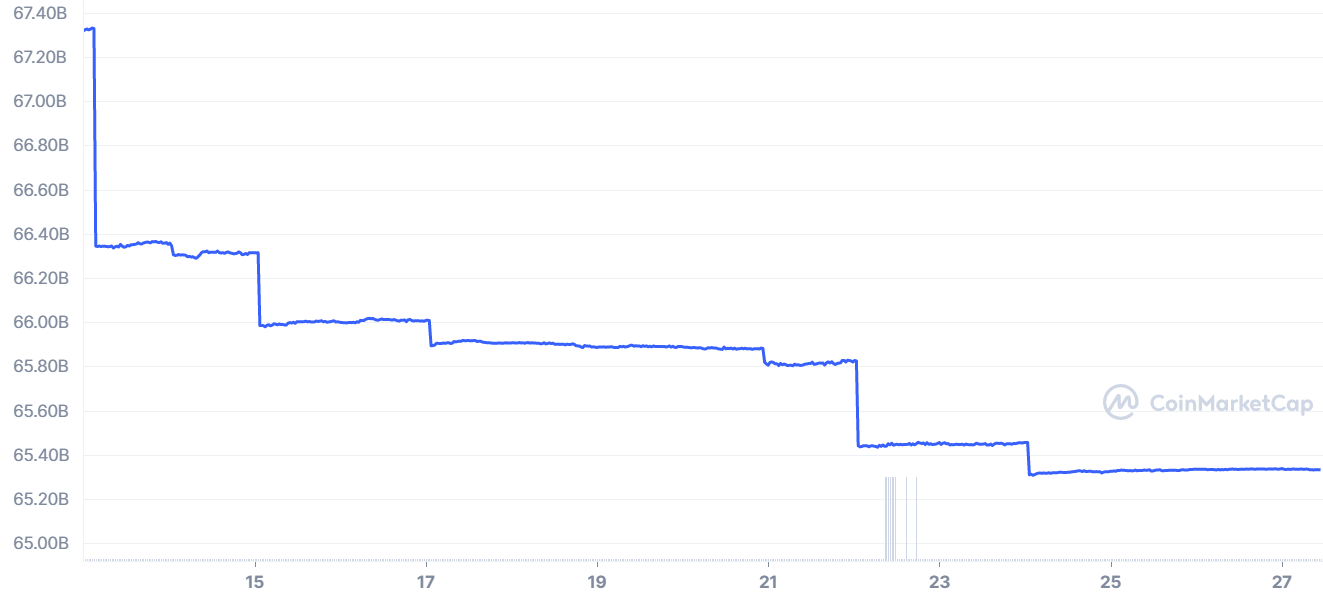

According to CoinMarketCap data, Tether’s USDT supply fell from over $67 billion in the last two weeks to $65 billion. This means that investors have redeemed roughly $2 billion USDT since FTX’s implosion.

With previous concerns about the USDT peg and whether the asset was fully backed, many traders are redeeming their USDT or converting it to USDC. Tether, however, has insisted that it has no material exposure to FTX.

This is not the first time that USDT volume will drop after a major meltdown in the crypto market. Following the Terra Luna crash, there was a redemption of $10 billion USDT within two weeks.

Fear Spreads to BUSD, DAI

The fear was also spread to Binance-backed BUSD, which has been on an upward trend all year round. According to CoinMarketCap data, its supply has fallen from over $23 billion to around $22.5 billion, losing $500 million.

Even DAI was affected as its supply dropped to $5.2 billion from $5.7 billion.

USDC Stablecoin is an Exception

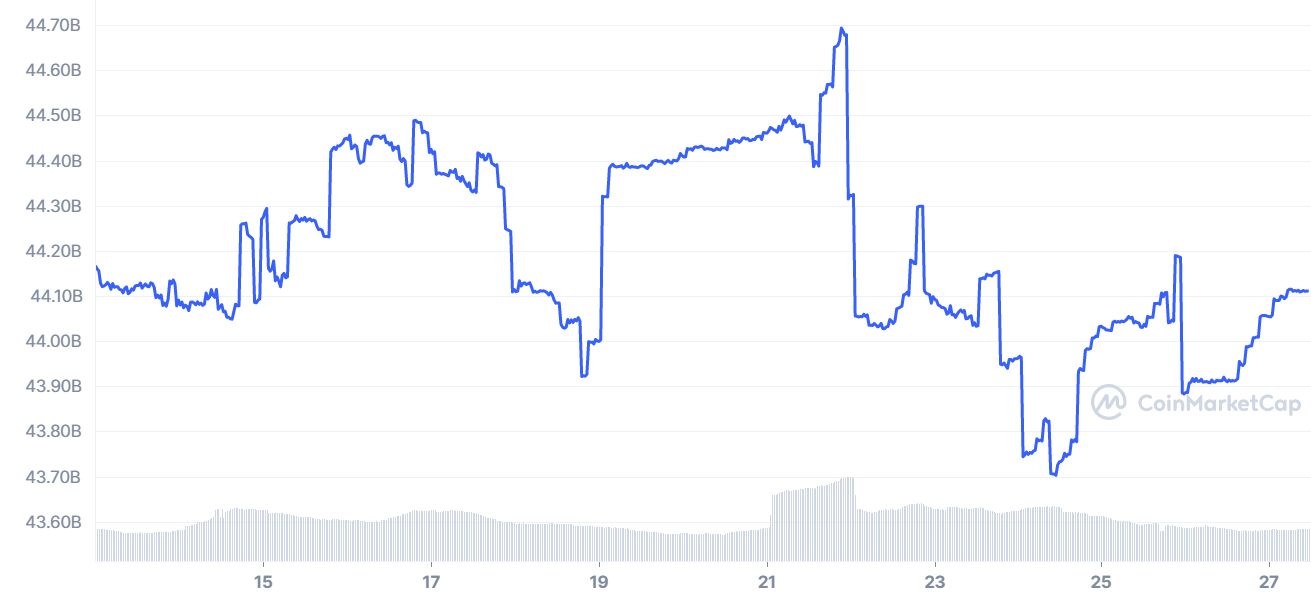

Meanwhile, some stablecoins like Pax Dollar and USDC have seen their supply grow amidst this chaos.

In the last two weeks, USDC has seen its supply grow to as high as $44.70 billion; though it dropped to $43.70 billion on Nov. 24, it has risen to $44.11 billion as of press time.

There are many speculations as to what could have been responsible. Pentoshi tweeted that it could be due to the 4%+ yield on USDC at treasury and possibly the conversion of some USDT to USDC.

Overall, there was a redemption of about $3.5 billion worth of stablecoins over the last 14 days, coinciding with the collapse of FTX.

FTX’s Collapse Dampens Investors’ Confidence

The crypto exchange crash has generally dampened investors’ confidence in cryptocurrencies, leading to a massive price crash.

But there are also concerns about the contagion effect of the collapse and how it could affect other crypto companies. This has already led to many retail traders favoring self-custody instead of leaving their assets on centralized exchanges.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.