As overall crypto market activity slows, liquidations have reached $285.48 million in the past 24 hours, affecting 97,882 traders. However, defying the broader market trend, some altcoins have surged, hitting new all-time highs today.

BeInCrypto has identified three crypto tokens that hit all-time highs today, with Dolos the Bully (BULLY) leading the pack.

Dolos the Bully (BULLY)

Solana-based meme coin Dolos the Bully (BULLY) rocketed to a new all-time high today. The meme coin briefly traded at a peak of $0.23 before witnessing a pullback. As of this writing, BULLY trades at $0.20 and continues to enjoy a significant bullish bias.

Readings from its Super Trend indicator assessed on an hourly time frame confirm this. As of this writing, BULLY’s price rests above the green line of this indicator.

The Super Trend indicator measures the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, with red indicating a downtrend and green signaling an uptrend. When the Super Trend line is below the asset’s price, it confirms an uptrend, suggesting bullish momentum is likely to continue.

If this bullish trend persists, BULLY’s price could reclaim its all-time high. However, should token selloffs commence, the meme coin’s value may drop below $0.19.

Parallel AI (PAI)

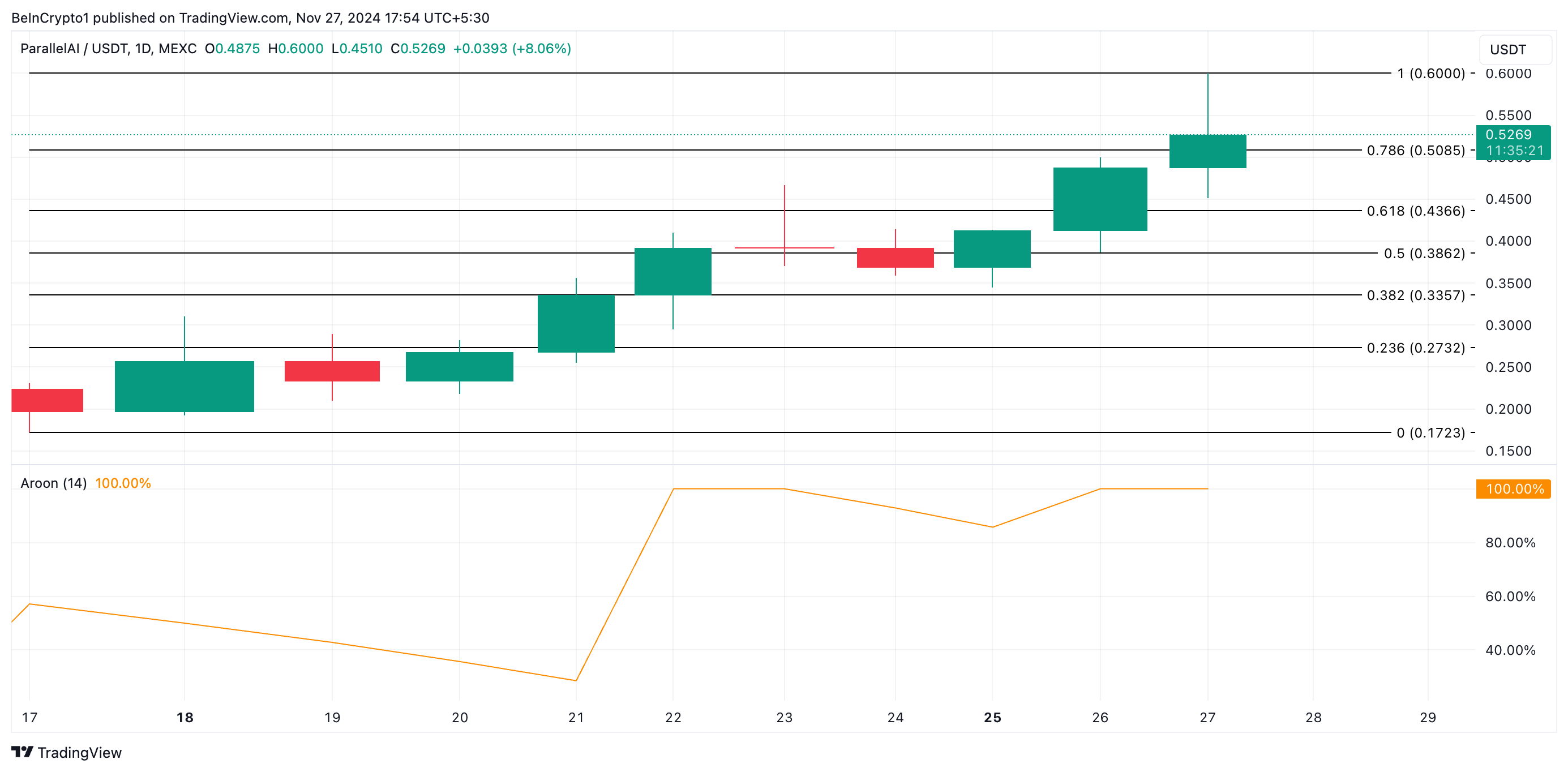

PAI currently trades at $0.52. It hit an all-time high of $0.60 today and witnessed a 14% pullback. Despite this, a rebound is possible as bullish pressure continues to strengthen. An assessment of PAI’s Aroon indicator confirms this bullish outlook. PAI’s Aroon Up Line is at 100% as of this writing.

The Aroon Indicator determines the strength and direction of an asset’s price trend by measuring the time since the asset’s highest high (Aroon Up) and lowest low (Aroon Down) within a set period. When the Aroon Up line is at 100%, a new high was recently achieved, signaling strong upward momentum and the potential continuation of a bullish trend.

If PAI witnesses a resurgence in buying pressure, its price will revisit its all-time high and attempt a rally beyond it. On the other hand, if selling activity gains momentum, the token’s price may drop toward $0.50. If the bulls fail to hold this level, PAI’s value may dip further to $0.43.

Stonks (STNK)

STNK hit an all-time high of $347.06 today but has since dropped 26%, trading at $263.67 as of this writing. The decline is attributed to a surge in profit-taking activity, which has exerted downward pressure on its price.

Analysis using the Fibonacci Retracement tool on an hourly chart shows that STNK has broken below the support at $268.01, signaling a strengthening of the downtrend. If new demand does not enter the market, its price could decline to $219.10.

On the other hand, if buying pressure increases, STNK may attempt a rally above $268.01, potentially climbing back toward its all-time high.