Cronos (CRO) price has extended its stunning run, trading at $0.34 at press time, up 55% in 24 hours and almost 140% in the past week.

The move has been fueled by ongoing Trump Media hype and speculative momentum, but key on-chain signals now suggest the rally may be vulnerable to profit-taking.

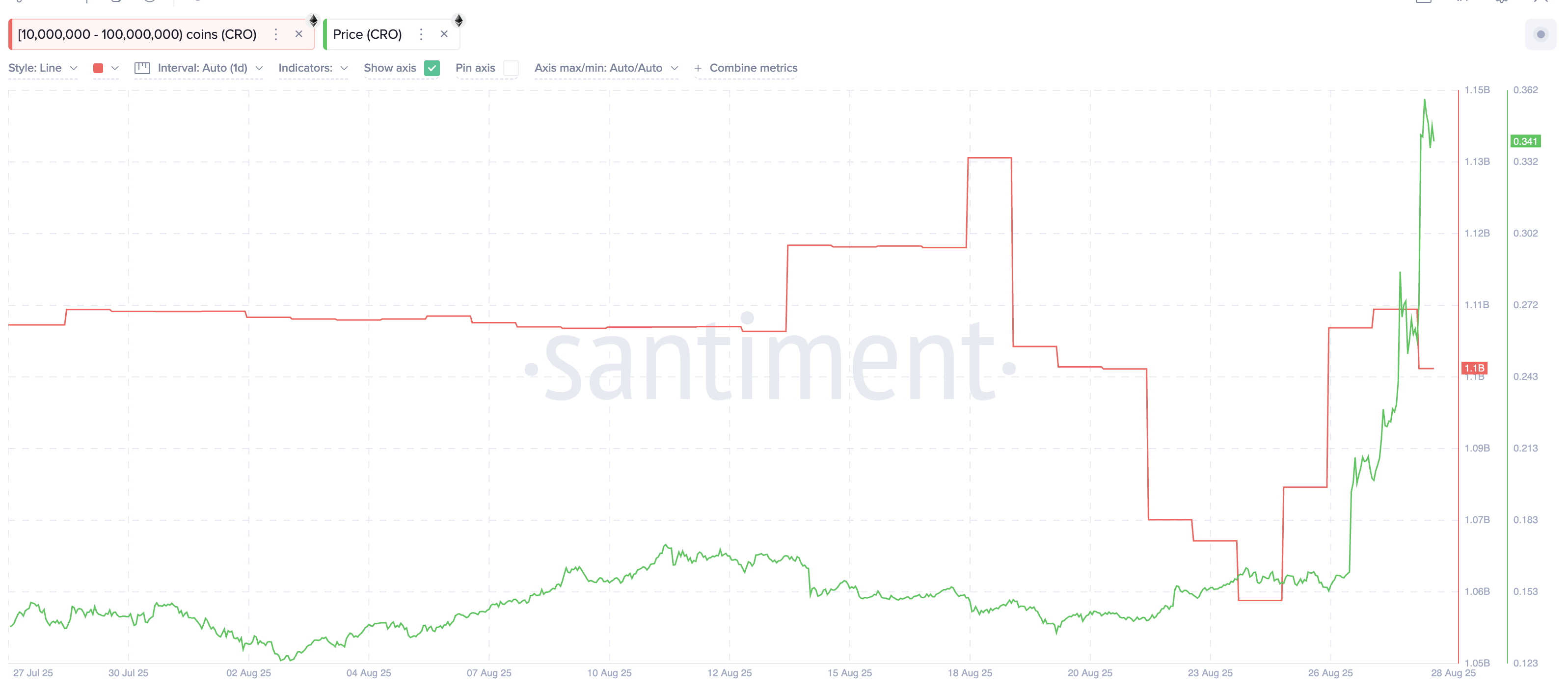

Whales Trim Holdings for the First Time Since August

For the first time in nearly two weeks, large holders in the 10 million–100 million CRO cohort have reduced their positions. Their wallets fell from 1.11 billion CRO to 1.10 billion CRO, a cut of roughly 100 million CRO worth $34 million at current prices.

While the reduction looks small compared to their total holdings, the timing is important. Until now, whales had only accumulated during the rally. Their first move to sell into strength signals a shift in sentiment that could ripple into broader market activity.

This early whale action ties directly into the profit-taking behavior reflected across the wider network.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

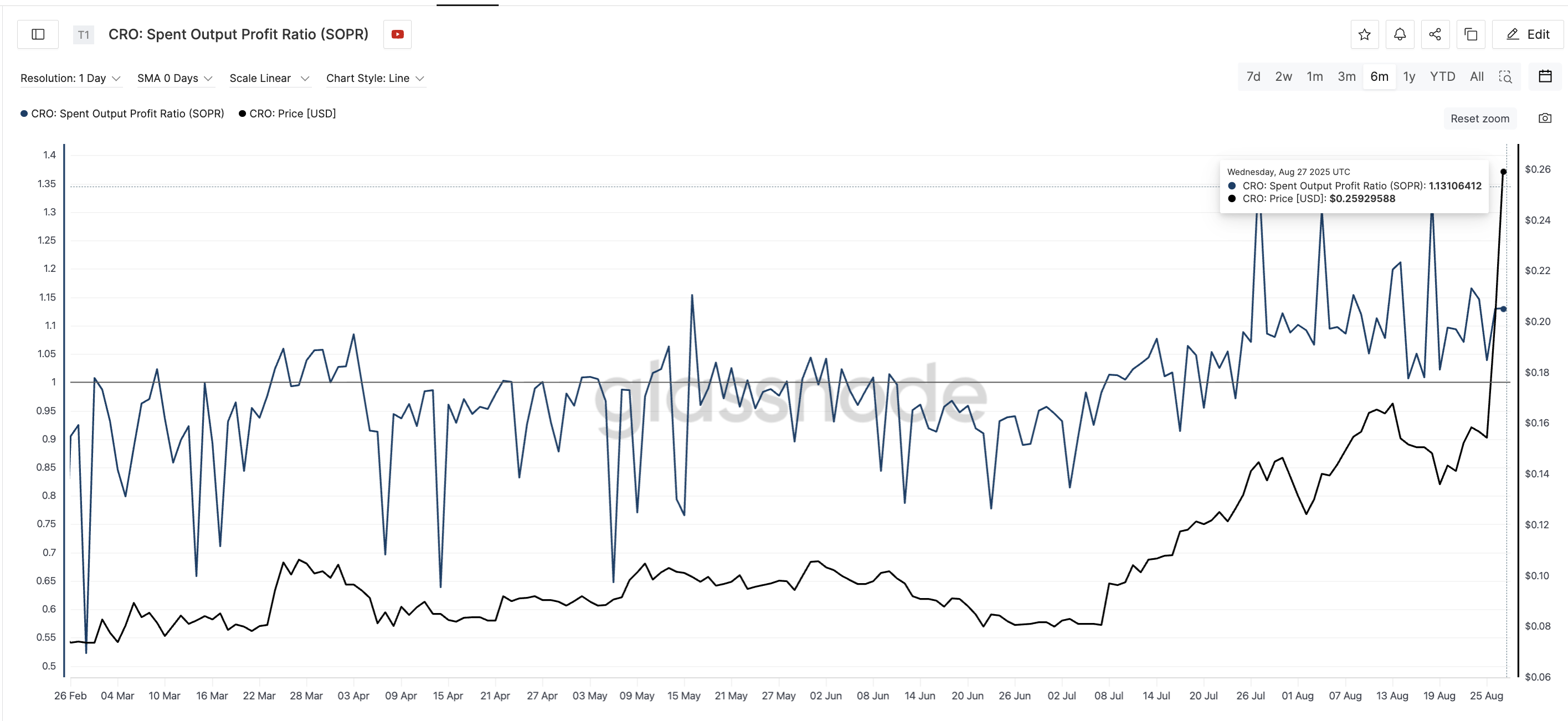

SOPR Peaks, Confirming Profit-Taking Signals

The profit-taking signal becomes clearer when looking at Cronos’ Spent Output Profit Ratio (SOPR), which climbed to 1.13 this week — its second-highest reading in six months. An SOPR above 1 means most coins being moved are being sold at a profit.

The Spent Output Profit Ratio (SOPR) tracks whether coins are being sold at a profit or a loss. Rising SOPR alongside rising prices often signals heavy profit-taking, which can slow or reverse rallies.

The last time SOPR hit such elevated levels in July, the Cronos price corrected from $0.14 to $0.12. This marked a pullback of 14%. If a similar 14% correction were to unfold from today’s price of $0.34, it would bring the CRO price back around $0.28. This level coincides with the $0.28–$0.32 support zone.

This overlap strengthens the case that current profit-taking could test those supports. And it could potentially flip the short-term bias if they fail.

With whales now trimming and SOPR flashing similar warnings, history suggests that a cooling phase could follow even amid bullish momentum.

Cronos Price Levels to Watch

Amid these warning signs, the structure for the Cronos (CRO) price remains bullish. The token has cleared the $0.28 and $0.32 resistances and is now testing $0.34. The immediate upside target is $0.38, which the Cronos price must break convincingly for the rally to continue.

On the downside, support lies at $0.32 and $0.28, with a deeper reversal likely only if CRO dips below $0.25, led by the profit booking pressure. Importantly, Cronos is still 64.5% below its all-time high of $0.96, leaving significant room for upside if momentum sustains.

At present, if the CRO price manages to hold above $0.32, it might just be able to survive the profit-booking pressure. And then it could validate the bearish outlook, attempting a rally continuation.