BeInCrypto takes a look at five tokens from the decentralized finance (DeFi) sector that have interesting developments lined up for the month of November.

Aave (AAVE)

- Current Price: $339.88

- Market Cap: $4.483 Billion

- Market Cap Rank: #42

Aave is a fully decentralized liquidity protocol, which means that it allows users to build third-party applications and services on it. Participants in the protocol have the choice of becoming either borrowers or depositors.

The native token, which is used for voting and governance rights is AAVE.

On Nov 5 and 6, the Cosmosverse conference will take place in Lisbon. Ajit Tripathi, the head of institutional business for AAVE will be one of the main speakers.

AAVE has been decreasing alongside a descending resistance line since Aug 17. On Oct 27, AAVE made an attempt at breaking out above this line. However, it was unsuccessful and created a long upper wick with a magnitude of 27%. This is a sign of selling pressure since the breakout could not be sustained and sellers pushed the price down instead.

Until AAVE manages to break out from this line, the trend cannot be considered bullish.

Secret (SCRT)

- Current Price: $9.15

- Market Cap: $1.388 Billion

- Market Cap Rank: #92

Secret Network is a blockchain whose main focus is data privacy. Its users are able to build applications that specialize in maintaining privacy.

The native token for the blockchain is SCRT. By using it, users face lower costs on the network. Furthermore, those who stake the token earn rewards and are able to participate in decisions relating to governance.

Supernova, which is its most comprehensive mainnet upgrade up to this point, will launch on Nov 9.

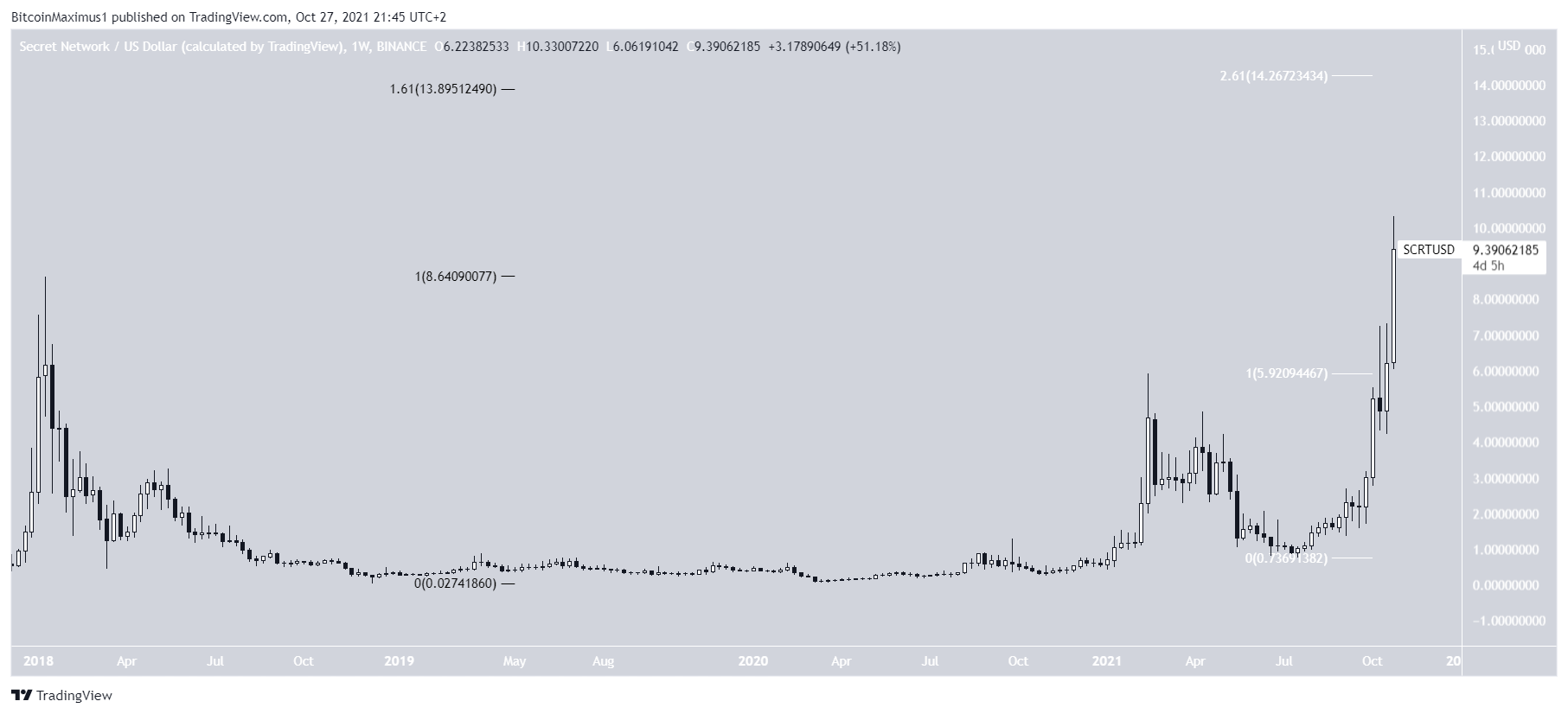

SCRT reached a new all-time high price on Oct 7. The upward movement has become completely parabolic, which is usually unsustainable in the long run.

The next closest resistance area is found between $13.90 and $14.25. This is the 1.61 external Fib retracement (black) when measuring the previous drop, and the 2.61 external Fib retracement when measuring the most recent dip (white). The confluence of these two levels increases its significance as a resistance area.

COTI (COTI)

- Current Price: $0.469

- Market Cap: $414Million

- Market Cap Rank: #185

COTI is a blockchain platform specializing in financial technology. It aims to provide similar services as traditional payments systems, but with the security and cost-effectiveness of blockchain systems. The platform is able to process more than 100,000 transactions per second.

Mainnet 2.0 for COTI will fully roll out by the end of the month.

COTI has been increasing alongside an ascending support line since July 20. This led to an all-time high price of $0.68 on Sept 29.

While COTI has been moving downwards since making a new high, it’s potentially validating the $0.48 area and the ascending line as support (green icon). Doing so would be a very bullish development that is often followed by the continuation of the upward movement.

Therefore, as long as it’s trading above this level, the trend is considered bullish.

Compound (COMP)

- Current Price: $309.46

- Market Cap: $1.89 Billion

- Market Cap Rank: #76

Similar to Aave, Compound is a decentralized lending protocol. By depositing tokens into the pools offered by the platform, users are able to accrue interest.

The native token is COMP, which is mainly used for governance issues.

The Ripple Swell conference will take place on Nov 9-10. Robert Leshner, the founder of COMP will be one of the main speakers there.

COMP has been trading inside a descending parallel channel since July 6.

Since the beginning of October, it’s been holding on above the $305 support area and the support line of the channel.

Despite the lack of bullish signs, this is a strong support level that is likely to initiate a rebound.

Axie Infinity (AXS)

- Current Price: $122.64

- Market Cap: $7.53 Billion

- Market Cap Rank: #27

Axie Infinity is a blockchain battling game. It’s turn-based and allows its players to collect, upgrade, trade, and battle non-fungible creatures that are known as “Axies.”

The governance token for the game is AXS and has uses in both governance voting and staking.

NFT.NYC, the leading annual non-fungible token (NFT) event will take place on Nov 1-4. Jeffrey Zirlin, one of the co-founders of Axie Infinity will be one of the main speakers.

AXS has been trading inside a symmetrical triangle since reaching an all-time high price on Oct 4. While the symmetrical triangle is often considered a neutral pattern, it’s transpiring after an upward movement. Therefore, a breakout from it would be the most likely scenario.

The first Fib resistance area is found at $186.50, and the second is at $227.50. These levels are found by projecting the length of the previous upward movements.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here.