The world’s largest asset manager, BlackRock Inc., has issued a $17 million loan to bankrupt Bitcoin miner Core Scientific to help it stay afloat during its bankruptcy process. The loan is part of the court-approved $37.5 million loan for the bankrupt miner.

A Dec. 22 SEC filing revealed that BlackRock, alongside other lenders, agreed to give a debtor-in-possession (DIP) facility commitment loan of about $75 million to the BTC miner.

BlackRock Loans Bankrupt Miner $17M

However, only $37.5 million of the loan was approved. According to court documents, the loan is from Creditors who already possess the company’s convertible notes. Like the other lenders, BlackRock’s credit owns a part of its $550 million Core Scientific’s convertible notes.

Reuters reported that Core Scientific plans to apply for the remaining $37.5 million DIP loan in January. Meanwhile, court filings have indicated the loan has a 10% annual interest rate.

A representative of the creditors, Kris Hansen, said the loan was a show of faith in the bankrupt firm. Hansen added that it is a belief in the system, regardless of Bitcoin’s recent challenges and plunging value.

Core Scientific is expected to use the loan to stay afloat during its bankruptcy. The firm filed for chapter 11 bankruptcy on December 21, citing unfavorable market conditions.

Bitcoin Miners Face Steep 2023

Bitcoin miners struggled considerably in 2022 because of the bear market situation alongside the rising mining difficulty of the coin. According to reports, BTC mining hashrate and profitability decreased dramatically throughout 2022.

Speaking on the situation, the founder of Capriole Fund, Charles Edward, said, “this is by far the most brutal Bitcoin miner capitulation since 2016 and possibly ever. Hash Ribbons capitulation has captured the lowest Bitcoin hash rate reading of 2022 as miners bankrupt and default under the great pressure of squeezed margins globally.”

The head analyst at Blockware, Joe Burnett, said:

“The current Bitcoin miner capitulation is looking deadly. Mining difficulty is projected to fall by more than 10%, and the price has much further downside. Hard to imagine who is still willing to hold BTC here.”

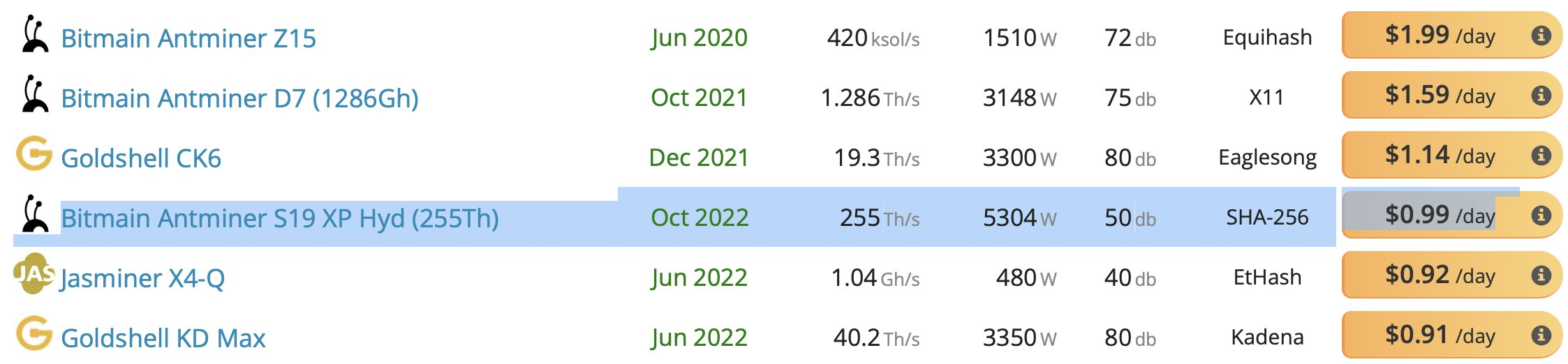

Meanwhile, another analyst, Alex McWhirter, pointed out that mining machines were also becoming unprofitable. McWhirter said, “the biggest baddest Bitcoin miner you can buy today makes about $1/day at current prices. You have to buy these as a whole shipping container, 200 miners, about $1M to buy that. $1M to mine $200 per day. Seems unsustainable, what if BTC drops lower?”