Core Scientific, a Texas-based Bitcoin mining company, has announced impressive gains in both revenue and profitability for the first quarter of 2024. It reported a revenue of $150 million from digital asset mining, marking a 46% increase in its gross margin.

The company’s success results from strategic efficiency and is a part of the broader cryptocurrency market’s recovery.

Core Scientific’s Financial Strategy Post-Bankruptcy

In this quarter, Core Scientific achieved a net income of $210.7 million. This figure starkly contrasts with its performance in the first quarter of 2023, which reported a net loss of $400,000. The improvement was largely due to a gain of $143.8 million from the extinguishment of pre-emergence obligations.

The company also reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $88 million. Moreover, Core Scientific ended the quarter with $98.1 million in cash and cash equivalents.

Core Scientific showed financial resilience by retiring $19 million in obligations. Payments due for the year on miners have been completed. These steps are essential for its operational expansion.

Read more: How Much Electricity Does Bitcoin Mining Use?

The company increased its operating income to $55.2 million, up from $7.6 million the previous year. Its total revenue rose to $179.3 million, a $58.6 million increase from the first quarter of 2023.

Meanwhile, digital asset mining contributed $150.0 million. Additionally, its mining prowess was showcased by the 2,825 Bitcoin (BTC) mined during the period. These were due to a significant increase in Bitcoin prices and improved mining efficiency.

Hosting revenue also showed healthy growth, generating $29.3 million. Both hosting and mining segments benefited from strategic cost management and efficiency gains. However, hosting revenue enjoyed a higher margin due to new client onboarding and efficient cost controls.

Core Scientific’s first quarter performance also includes operational enhancements. The company increased its hash rate and deployed new mining equipment.

It also expanded its hosting capabilities by adding 16 mega-watts of infrastructure. This was to service a high-performance computing customer ahead of schedule.

In his commentary on the results, Adam Sullivan, CEO of Core Scientific, highlighted the strategic moves underpinning these robust figures.

“We delivered outstanding results in the first quarter, […] strengthening our balance sheet by paying down debt and improving our cash position, and improving our fleet efficiency with the deployment of new generation miners,” he stated.

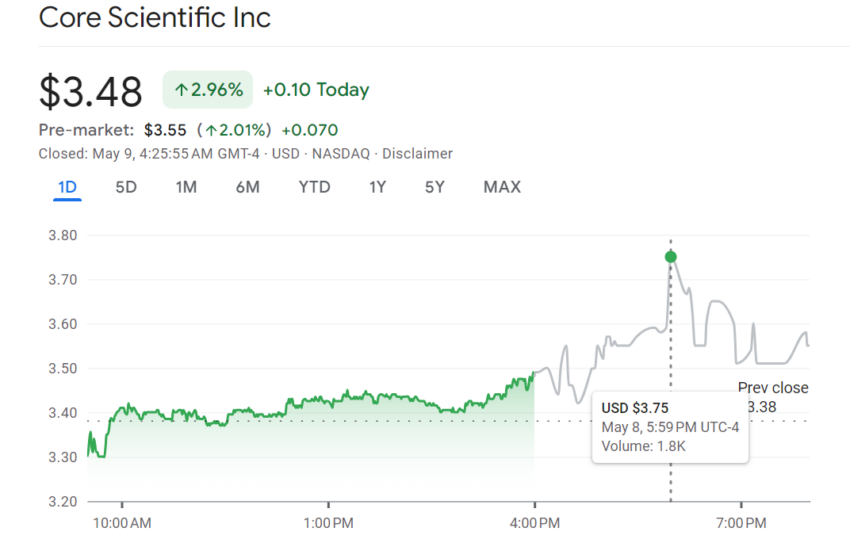

Following the report, Core Scientific (CORZ) stock surged during after-hours trading. It went from $3.42 at 16.38 ET to $3.75 at 17.59 ET.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks in 2024

Core Scientific’s achievements this quarter are notable, given its Chapter 11 bankruptcy filing in late 2022. BeInCrypto previously reported that Core Scientific regained its footing in January 2024 after the bankruptcy court approved its resolution plans.

As Core Scientific looks ahead, the strategic focus appears to be on sustaining this growth trajectory while expanding its operational scope. However, it is important to note that the post-Bitcoin halving effect presents a significant challenge.

The Bitcoin halving will reduce miner rewards. At the same time, mining costs will rise. Therefore, this condition will be crucial in determining Core Scientific’s ability to maintain impressive performance in a potentially tougher market environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.