Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as we continue to examine what Bitcoin (BTC) could be for Ireland amid global economic uncertainty. For the island in Europe, El Salvador’s achievements under President Nayib Bukele continue to serve as an example to emulate, at least according to MMA star Conor McGregor.

Crypto News of the Day: Conor McGregor’s Bitcoin Blueprint for a Sovereign Ireland

In a recent US Crypto News publication, BeInCrypto reported McGregor’s interest in having Ireland create a Bitcoin strategic reserve.

Specifically, he wants the country to adopt El Salvador’s successful adoption of Bitcoin, replicating Bukele’s Bitcoin strategy. McGregor sees this as an enabler to eliminate financial corruption in Ireland and secure long-term stability.

“An Irish Bitcoin strategic reserve will give power to the people’s money,” McGregor said on X.

In the latest development, the Irish presidential hopeful has proposed using Bitcoin to establish a decentralized blueprint for Ireland’s sovereignty.

The former UFC champion lauded El Salvador’s Bukele for his transformative achievements, particularly his adoption of Bitcoin as legal tender.

McGregor aims to mirror Bukele’s success, slashing El Salvador’s crime and corruption rates. To do this, he seeks to leverage Bitcoin to empower the Irish people and reclaim national autonomy.

McGregor, who announced his presidential bid in March 2025, invited Bukele for a discussion.

However, McGregor’s use of “crypto” instead of “Bitcoin” drew sharp feedback from supporters on X (Twitter).

Meanwhile, as the presidential hopeful eyes Bitcoin in Ireland, elsewhere, Panama and El Salvador advocate for Bitcoin adoption in Latin America.

Speaking at the Bitcoin Conference, Panama City mayor Mayer Mizrachi called for a Panama–El Salvador alliance to lead global financial freedom using Bitcoin.

“Panama and El Salvador are pushing Bitcoin adoption in latin america,” Mizrachi shared on X.

US Bank Earnings Tick Up, But FDIC Warns of CRE Weakness—What It Means for Bitcoin

Elsewhere, the FDIC (Federal Deposit Insurance Corporation) report shows the US banking sector posted a modest earnings rebound in Q1 2025.

FDIC-insured institutions reported a net income of $70.6 billion and a return on assets (ROA) of 1.16%, up from 1.11% in Q4 2024.

However, beneath the surface, growing stress in commercial real estate (CRE) portfolios has caught the attention of regulators and crypto investors alike.

The FDIC’s Quarterly Banking Profile flagged continued weakness in non-owner-occupied CRE loans. Past-due and nonaccrual (PDNA) rates are climbing sharply.

Large banks with over $250 billion in assets reported a CRE PDNA rate of 4.65%, far above the pre-pandemic average of 0.59%.

Although these banks are less exposed to CRE than their total assets, mid-sized institutions with higher CRE concentrations are increasingly vulnerable.

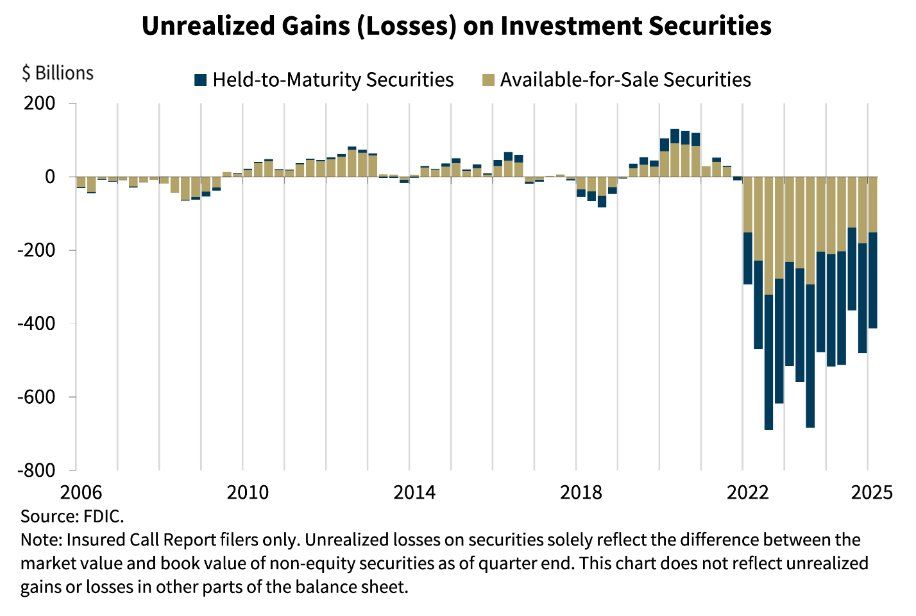

This structural pressure comes amid tight credit conditions, high interest rates, and elevated unrealized losses on securities portfolios. If broader economic stress escalates, these factors risk constraining lending and liquidity.

Implications for Crypto

CRE stress may signal both risk and opportunity for Bitcoin and digital assets. Should CRE-linked defaults ripple through mid-sized banks, investor confidence in the traditional financial (TradFi) system could weaken.

Such an outcome could catalyze a flight to decentralized alternatives like Bitcoin, similar to the March 2023 banking turmoil.

Moreover, persistent stress in banks’ long-duration assets may revive speculation around rate cuts or liquidity backstops. These macro shifts are historically bullish for crypto markets.

With unrealized losses on securities still hovering near $413 billion, any future sell-off could accelerate a policy pivot.

In short, while headline bank earnings suggest resilience, mounting CRE risks could reopen the playbook for Bitcoin’s “safe haven” narrative, especially if financial cracks widen.

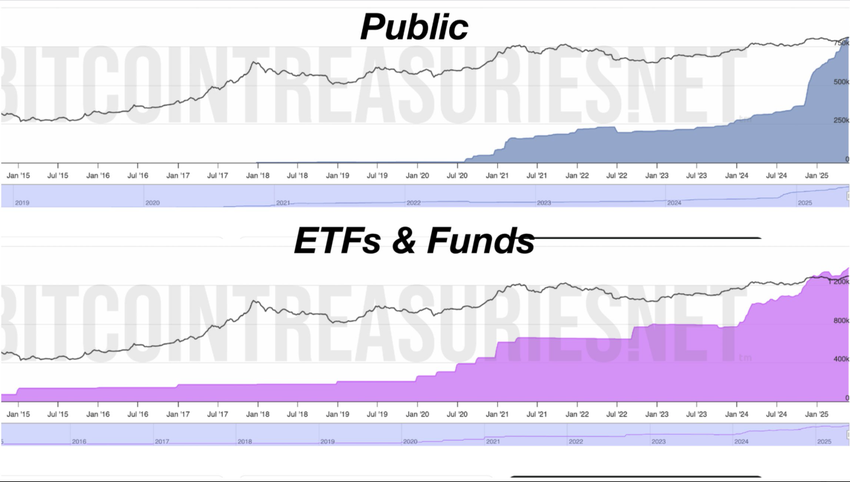

Signs are already manifesting, with Bitcoin held by ETFs (exchange-traded funds) and public companies going parabolic.

Specifically, Bitcoin’s institutional stack is soaring, with BlackRock’s ETF holding over 663,000 BTC. In the same way, MicroStrategy is also stacking.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- SEC clarifies that certain Proof-of-Stake blockchain staking activities are not securities transactions under federal regulations.

- Arkham reveals 97% of Michael Saylor’s Bitcoin holdings, raising centralization and market collapse fears over his crypto influence.

- Technical analysts spot multiple bearish divergence signals, hinting Bitcoin’s rally may reverse as early as June 2025.

- Chinese AI company Webus International plans to invest up to $300 million in XRP to improve cross-border payment systems.

- Solana saw only $0.5 million in institutional inflows during May, falling behind rivals like SUI ($23.9 million), Cardano, and Chainlink.

- PancakeSwap dominates the DeFi space with 66.9% trading share and $149 billion monthly volume, outpacing Uniswap and Pump.fun.

- Thailand’s SEC will block access to five unlicensed crypto exchanges starting June 28, 2025, to curb money laundering and protect investors.

- After months of negotiations, Binance and the SEC filed a joint motion today to resolve their ongoing legal battle.

Crypto Equities Pre-Market Overview

| Company | At the Close of May 29 | Pre-Market Overview |

| Strategy (MSTR) | $370.63 | $368.46 (-0.59%) |

| Coinbase Global (COIN) | $248.84 | $247.25 (-0.64%) |

| Galaxy Digital Holdings (GLXY.TO) | $27.05 | $26.79 (-0.95%) |

| MARA Holdings (MARA) | $14.61 | $14.47 (-0.96%) |

| Riot Platforms (RIOT) | $8.18 | $8.13 (-0.61%) |

| Core Scientific (CORZ) | $10.69 | $10.71 (+0.19%) |