The Compound Finance (COMP) price has been increasing since the beginning of November and has just broken out above an important resistance area.

While COMP is expected to continue moving up until it reaches the first upcoming resistance area, it’s not yet clear if the current increase is the beginning of a new upward trend or is simply a retracement.

COMP Breaks Out Above Resistance

The COMP price has been moving upwards since it reached an all-time low of $80.62 on Nov. 3. The increase had a gradual slope until the price reached the $127 resistance area on Nov. 25 and was rejected, causing a sharp drop.

However, COMP immediately bounced and moved above this area yesterday. If it continues increasing, it’s likely to meet strong resistance between $154-$176 (the 0.382-0.5 Fib retracement levels).

Technical indicators in the daily time-frame support the possibility that the upward move will continue, especially since the RSI has moved above 50 again and the MACD has moved above the 0 line.

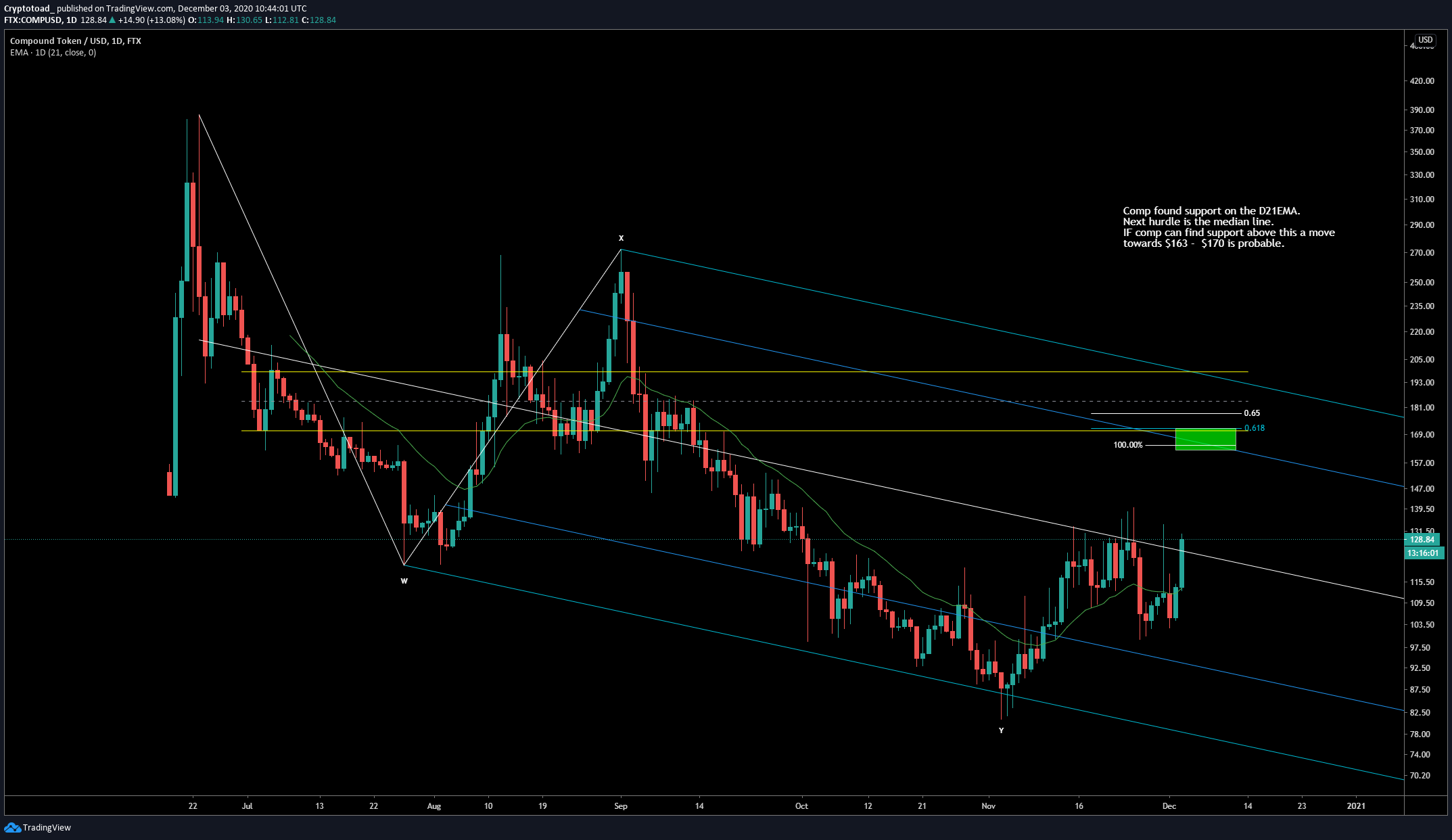

Cryptocurrency trader @Mesawine1 outlined a COMP chart and stated that if the price breaks the median line, it could increase all the way to $170.

This resistance area corresponds with the 0.5 Fib retracement level we have outlined above.

Parallel Channel

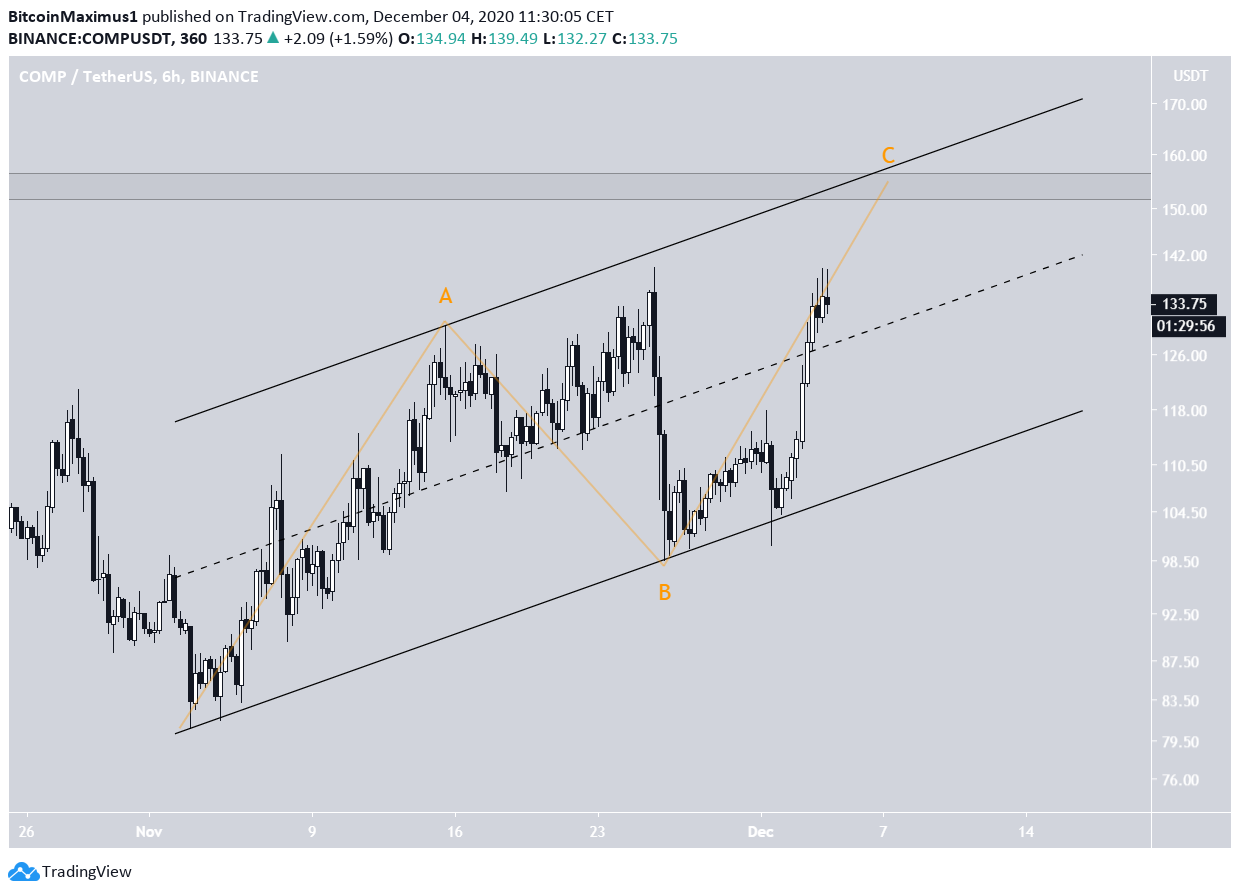

The six-hour chart shows that since reaching the aforementioned all-time low, COMP has been trading inside a parallel ascending channel.

The price has moved above the middle of the channel and is currently aiming to reach the resistance line at $155. This is an area that also coincides with the 0.382 Fib retracement level.

Both the MACD and RSI support the continuation of the upward move towards the resistance line.

COMP Wave Count

The most likely wave count for COMP is an A-B-C corrective structure (shown in orange below), which could take the price to the resistance line of the channel and the $155 resistance area.

Afterward, COMP would be expected to break down from the channel and head toward new lows.

An alternative count could transpire if COMP were to break out from the channel instead and validate it as support afterward. However, at the time of press, this scenario does not seem likely.

Whether the price breaks out above the resistance line of the channel or gets rejected will likely determine if this is a corrective structure or an impulse.

Conclusion

While COMP is expected to increase and reach the resistance line of the parallel channel, we cannot confidently predict if it will break out afterward or get rejected.

For BeInCrypto’s latest Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.