Commodities on the blockchain: Up until now, traditional commodities trading has hinged largely on the use of vast paper trails in order to execute, authenticate, and process individual transactions. However, with the rise of blockchain technology, there now exists a plethora of digital options that can help streamline these operations. This potentially disrupts many long-established business models that have been in place globally for a long time.

What are commodities?

In their simplest sense, commodities can be thought of as basic goods that are fungible in nature, i.e. exchangeable in lieu of other items of a similar nature. As far as examples of commodities go, we can take into consideration items like cattle, corn, dairy, crops, wheat, oil, precious metals, etc.

On a technical front, it should be noted that commodities are required in the creation of various essential goods and services. And, while their quality may vary a bit from one producer to another, when it comes to their trade/exchange, they need to meet certain international standards – referred to as a ‘basis grade’.

How are commodities traded?

By far, the most common means of trading commodities is via the exchange (i.e. buying/selling) of futures contracts. Futures are financial offerings representing legal agreements designed to facilitate the trade of assets at a predetermined price at a specified time in the future. However, commodities can also be traded via a number of other routes including options and exchange-traded funds (ETFs), even though these avenues are not as popular as futures.

When being traded, commodities are typically divided into five broad categories: i.e. metal, energy, livestock and meat, and agricultural. While, on paper, commodities can serve as an excellent means of diversifying an investor’s portfolio, they come packed with a host of inherent financial risks since their supply/demand is subject to various external factors that are hard to predict (seasonal swings, epidemics, natural disasters).

Blockchain and commodities – An overview and benefits involved

Straight off the bat, the core proposition put forth by blockchain is its use of a distributed ledger that allows for the maintenance of voluminous data records in a highly transparent, decentralized fashion. To elaborate, the technology works by verifying and recording information that can be shared with trusted counterparties without the interference of any centralized entity such as a bank, broker or other similar intermediary.

Within the context of commodities trading, blockchain has the potential to transform this massive market by making many of its native processes cheaper, transparent and more efficient. In this regard, some of the key benefits of using blockchain in relation to commodities include:

- Overhead cost reduction: The mitigation of post-trade processing charges is by far the most important advantage here, with conservatives estimates suggesting that blockchain technology can help reduce costs related to daily operations, accounting, settlements and IT by a whopping 40%.

- Seamless peer-to-peer (P2P) trading: Another underrated application is the facilitation of large-scale commodity exchanges that allow massive wholesale markets to gain seamless access to smaller regional ones.

- Elimination of fraud: The technology can help eliminate issues related to financial irregularities since it utilizes a decentralized ledger that makes it extremely easy to detect and identify invoice irregularities, carousel transactions, etc.

- Easier stock maintenance: Using blockchain, it can become easier to keep track of key supply-and-demand data, making the global commodities ecosystem more efficient while allowing for an extremely high level of commercial confidentiality, if required.

- Improved privacy and safety: Commodities-related trade data stored on a blockchain platform is safe from any sort of third-party interference since a copy of the info is available with each node operating within the network. Therefore, if any transactional irregularities are identified, relevant actions can be taken immediately.

Blockchain Commodity Projects Worth Following:

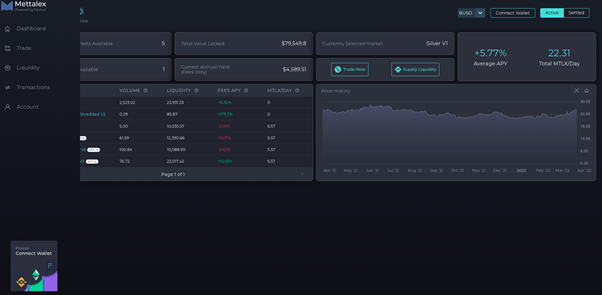

Mettalex

Mettalex is a blockchain-based commodity derivatives exchange (DEX) that seeks to bring the massive commodities sector touted to be worth more than $20 trillion on-chain while offering small and medium-sized enterprises (SMEs) with a future ready hedging tool.

The exchange seeks to correct many of the market inefficiencies plaguing the ferrous commodities market. On a technical front, the platform offers a decentralized capital-efficient solution while employing an advanced tokenomics framework, industry-grade pricing data, as well as a novel liquidity mechanism.

Lastly, since making its market debut, Mettalex has entered into licensing agreements with a whole host of industry-grade data providers such as S&P Global Platts, Javelin Commodities, and Davis Index allowing the platform to access accurate price feeds relating to commodity markets such as (but not limited to) Uranium, Lithium, Zinc, Aluminum, Copper, Brent Crude, Natural Gas, Iron Ore, amongst others.

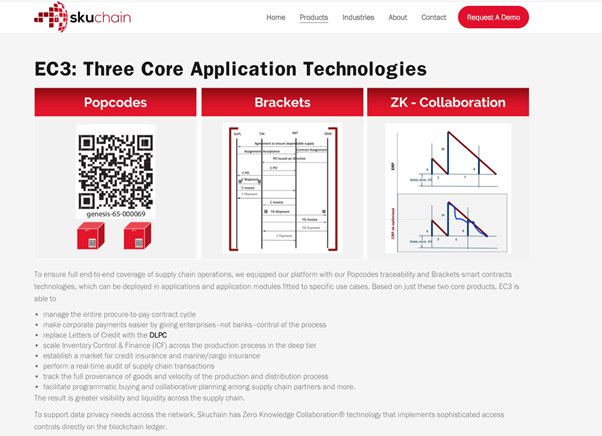

Skuchain EC3

Short for ‘Enterprise Collaborative Commerce Cloud’, Skuchain’s EC3 is a blockchain-based platform allowing users to gain access to an end-to-end solution for commodity-centric supply chains. To elaborate on the utility of this project, EC3 allows commodities trading houses to process “physical deals” in which they are the financiers of their inventories (and not using some futures contracts).

As a result, the ecosystem can facilitate transactions at scale while employing a post shipment invoice-accepted model where the financier doles out 80%-90% of the due sum while the remaining amount is processed by the buyer (minus a discount fee).

DCX

Digital Commodity Exchange (DCX) is a commodity trading platform that deals primarily with the buying/selling of agriculture-based assets. Design wise, the platform employs a highly secure framework along with an integrated online ecosystem allowing users to trade commodities on a global scale.

Functionally speaking, every transaction associated with DCX is fully traceable and can be accessed by relevant counterparties with the touch of a button. Lastly, the project has partnered with a number of prominent market entities working within the commodities sector, thereby providing users with improved access as well as price discovery in relation to a host of assets ranging from fertilizers to rice to grains.

Covantis

Covantis is a blockchain platform streamlining many expensive post-trade processes related to the agricultural shipping domain. On a design front, it can track transactions associated with bulk shipments of commodities — including (but not confined to) corn, soybeans, kidney beans — on a global scale. Furthermore, the ecosystem is capable of connecting shippers, traders and charterers involved with the aforementioned trade flows in a highly seamless manner.

By eliminating the need for paper-based post-trade processes, Covantis is not only able to enhance the efficiency for bulk shipments of agricultural goods but also mitigate many of the operational risks associated with these transactions.

Cerealia

Cerealia is a professional online marketplace designed to facilitate physical agri-trades with a high degree of certainty. Over the last couple of years, the project has conducted a number of community-building efforts targeting the trade of grains such as wheat, sorghum, etc in and around the Black / Mediterranean seas.

Furthermore, since its inception, Cerealia has identified (as well as signed agreements) with a number of companies active within the agri-commodities’ trade sector.

Got something to say about commodities on the blockchain or anything else? Write to us or join the discussion in our Telegram channel.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.