Recent reports are showing that two independent directors of Coinbase, which is set to soon go public, have close ties to the company.

The Wall Street Journal published a report on April 5, noting that two individuals directly involved with Coinbase will become independent directors once the company goes public.

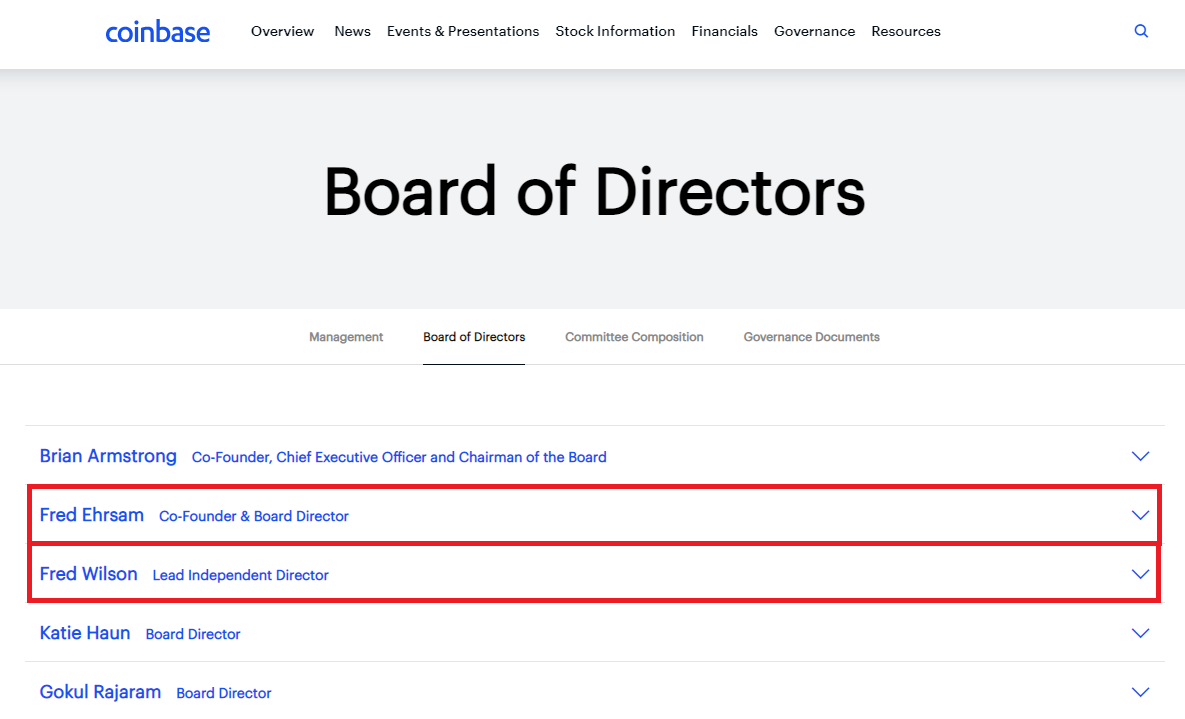

The report notes that Fred Ehrsam and Fred Wilson are classified as independent directors in the SEC filing. Coinbase will be directly listed on April 14.

Both individuals own stakes in the company and are members of the audit committee, according to the WSJ. Ehrsam is also the co-founder of Coinbase. Neither individuals have responded to requests for comments.

Coinbase itself has not revealed much with respect to its direct listing. Over the past few months, it has been offering tidbits of information. However, the majority of updates came from anonymous sources close to the company.

Last month, for instance, information on a private sale was made public. Coinbase received a $90 billion valuation following the private sale. On Coinbase’s part, it has mostly kept mum.

Coinbase’s Listing Eagerly Awaited

But the anticipation is as high as ever. Coinbase is just one of many crypto companies with aspirations of going public. The IPO has long been in the works, but for various reasons, it had been pushed back. The direct listing was expected to happen last month but was postponed.

The exchange will be capitalizing on the momentum that the crypto market currently has. There is a lot of interest from both retail and institutional interest investors at the moment. Going public should help to add another layer of legitimacy to the crypto market.

Coinbase itself is one of the most well-known exchanges, and investors are hoping that the stock market will favor its growth. At the moment, there is little reason to think that it will go the wrong way, as the exchange is proving itself to be a mainstay in the market.

This is despite the fact that it has endured damaging incidents related to politics and racial discrimination. While it may have survived a fallout, it will likely be more mindful of any such incidents once it gets listed.