The CME opened futures trading on Solana today, with FalconX making the first block trade. This development could provide liquidity and institutional legitimacy, even potentially helping the case for a Solana ETF.

When the SEC under Gary Gensler was considering Bitcoin and Ethereum ETFs, CME futures helped determine approval. Now that Solana has this stamp of approval, too, it could improve its chances with the Commission.

CME Offers Solana Futures Contracts

In January, the CME hinted it might launch SOL and XRP futures but quickly clarified that no official decision had happened. Now, however, the CME debuted Solana futures, and FalconX made the first trade:

“FalconX is proud to execute the first block trade in CME SOL futures with StoneX. This highly anticipated launch marks a historic moment for the Solana ecosystem, allowing institutional investors to manage risk and price exposure on a regulated venue,” Josh Barkhordar, Head of US Sales at FalconX, said in a press release.

The CME is not the first market to offer Solana futures, as Coinbase began offering them in February after seeking CFTC approval.

However, the CME is much bigger. It is very much a pillar of the US TradFi ecosystem, with well over $100 billion in total assets. As Matthew Sigel, VanEck’s Head of Digital Assets Research, noted, this could be very important for a Solana ETF.

The Solana ETF recently suffered a few setbacks; the SEC delayed several applications, prompting sizable outflows from Solana spot trading.

Experts have previously noted that a sizable futures trading market helped persuade the SEC to approve ETFs for Bitcoin and Ethereum. The CME’s new Solana futures market could serve a similar function.

Besides that, the CME’s Solana futures market offers a few significant advantages. First, it provides a sense of institutional legitimacy, which may encourage institutional investment.

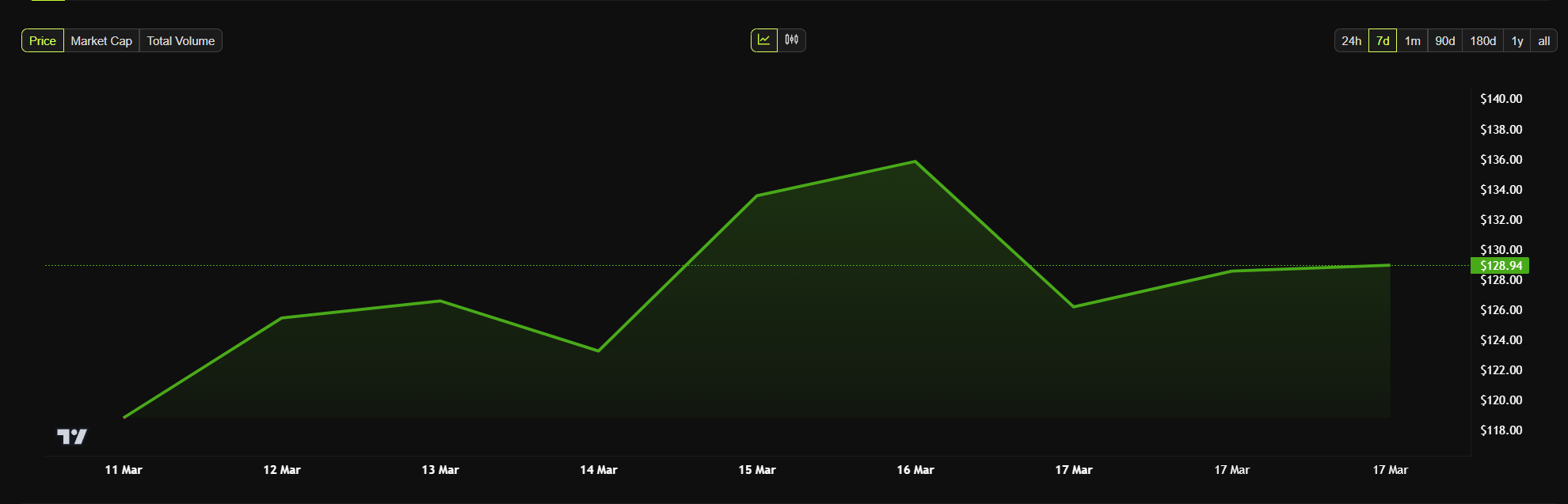

Additionally, it will greatly increase liquidity in the market. This could have a huge impact on Solana’s future market behavior, but it hasn’t changed SOL’s price in the short term.

Even if the new futures trading didn’t immediately bump Solana’s price, that’s very understandable. A development like this will hopefully set up future successes, but that doesn’t always translate to a short-term price bump.

If it encourages liquidity, institutional investment, or even a Solana ETF, then the CME could end up creating some very bullish outcomes.