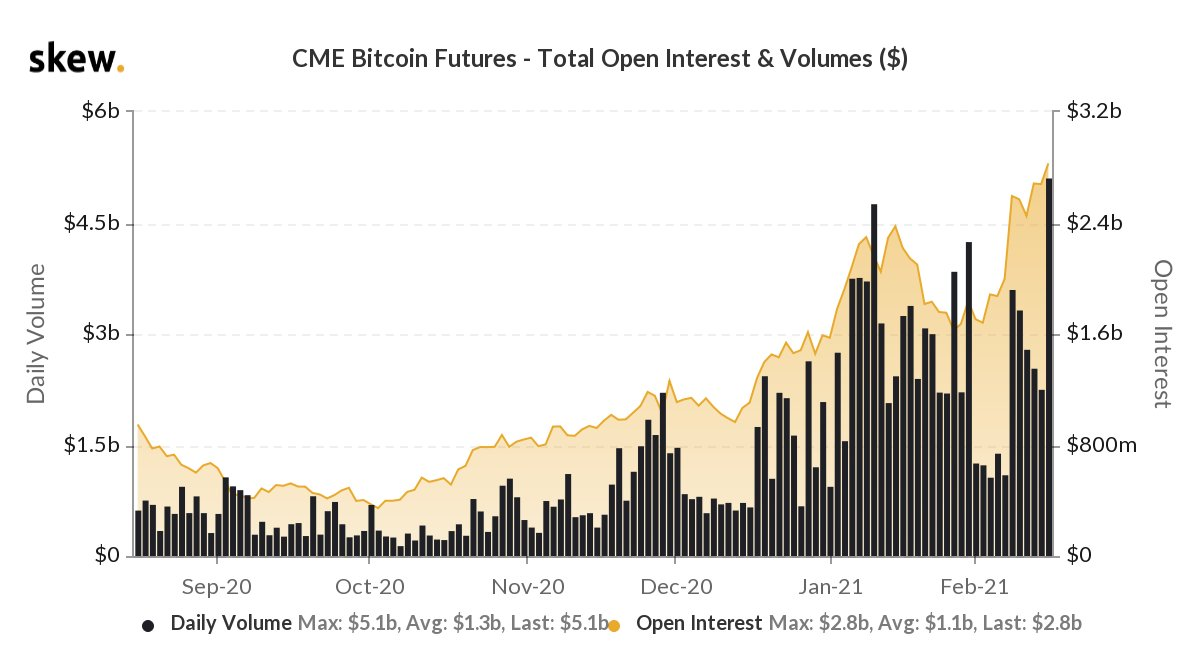

According to the analytics platform skew, the daily volume of Bitcoin (BTC) futures offered by the Chicago Mercantile Exchange (CME) hit a new all-time high (ATH) of over $5 billion on Feb. 16.

This spike appears to come after bitcoin finally soars past $50,000 for the first time in history. In light of BTC’s astronomical rally, Bitcoin futures worldwide have already aggregated an unprecedented $14 billion in value.

Bitcoin Enhancing Its Store of Value Status

Earlier, skew reported that the CME, one of the largest global markets for BTC futures, was among the top three exchanges by aggregate trading volume. Rival platforms Binance and OKEx held first and second spots relatively, with the former accounting for almost half the volume.

As bitcoin continues its journey to dizzying heights, it comes as no surprise that traders rush to capitalize on crypto derivatives. A futures contract allows traders to buy the given asset at a pre-set price at some specified time in the future.

Thus, futures may be extremely capital-efficient, which causes traders to flock to derivatives platforms to maximize their BTC returns. At press time, bitcoin sits at over $51,000, a price level much-anticipated during the past week, according to CoinGecko.

BTC and ETH Futures to Explode Further

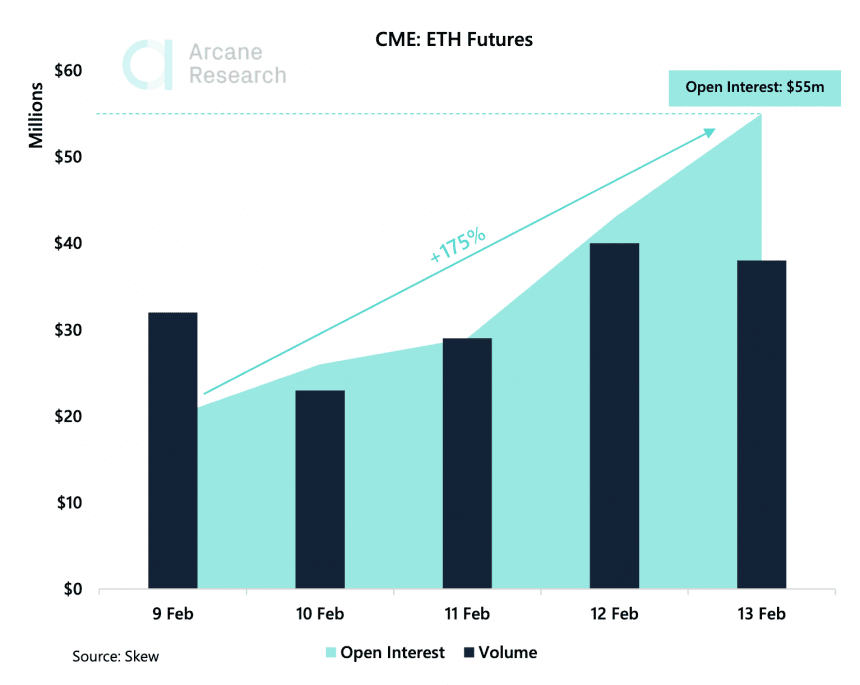

On Feb. 8, the CME added Ether (ETH) futures following ethereum’s consistent bull run. The introduction of ETH futures contracts to empower institutional investors likely made the second-ranked cryptocurrency stronger. Now, it trades slightly above $1,800 after initially breaking out to $1,750 on Feb. 5.

During the first few days of trading, ETH futures open interest reached $55 million. Meanwhile, the trading volume itself remained relatively stable at about $35 million.

At the same time, the CME is trading almost 200 contracts, most of which will expire in February.

Most market experts felt optimistic about the launch of Ether futures. Their common belief was that ETH is unlikely to collapse as it previously did with BTC.

As soon as the CME rolled out Bitcoin futures in 2017, the BTC price hit $20,000 and then crashed. This time appears to be different. ETH prices are rising, and the greater bullish trend is only gaining momentum.

As most measures indicate, bitcoin’s strong rally is far from being exhausted. And considering the strike price of a December ETH option, it may just reach $10,000 and above before the end of 2021.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.