CityCoins, described as crypto-yielding venues to support one’s favorite cities, have drastically declined in value, sparking concern among crypto enthusiasts.

The bearish trend that struck the crypto market in late November 2021 is affecting all assets in the industry. Even some of the most popular CityCoins have crashed in market value, sending investors into “extreme fear.”

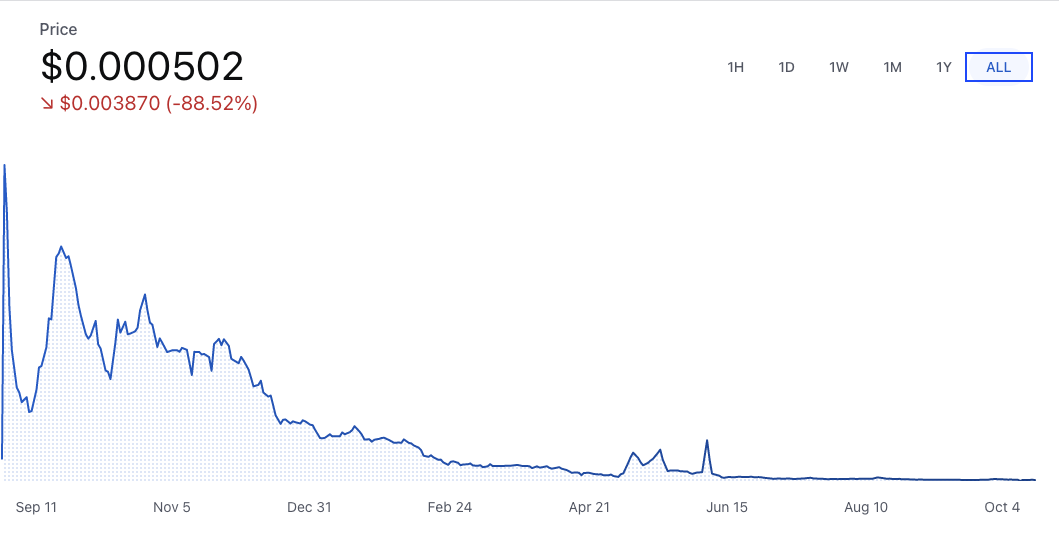

MiamiCoin Is Nearly Dead

MiamiCoin price is now down 99% from its September 2021 peak. Such an important price decline is drawing attention. MiamiCoin was not only framed as the first CityCoin to enter the crypto market but it was also been backed by Miami Mayor Francis X. Suarez himself.

Suarez has been known as someone who promoted Miami as a Bitcoin hub to solve energy optimization problems. He dismissed all environmental concerns about BTC mining and proposed laws to increase help flourish the Bitcoin mining industry in Florida.

Mayor Francis Suarez said that he was “open to exploring” Anthony Pompliano’s suggestion to allocate “1% of the city’s treasury reserves in Bitcoin.” Suarez made such claims when BTC price was trading at an all-time high of $27,500.

MiamiCoin price is now trading in a 24-hour range of $0.00049069 and$0.00054579, shows data from on CoinGecko. The CityCoin is 99.1% down against its peak of $0.055200. At the time of writing, MiamiCoin has a meager trading volume of $6,245.

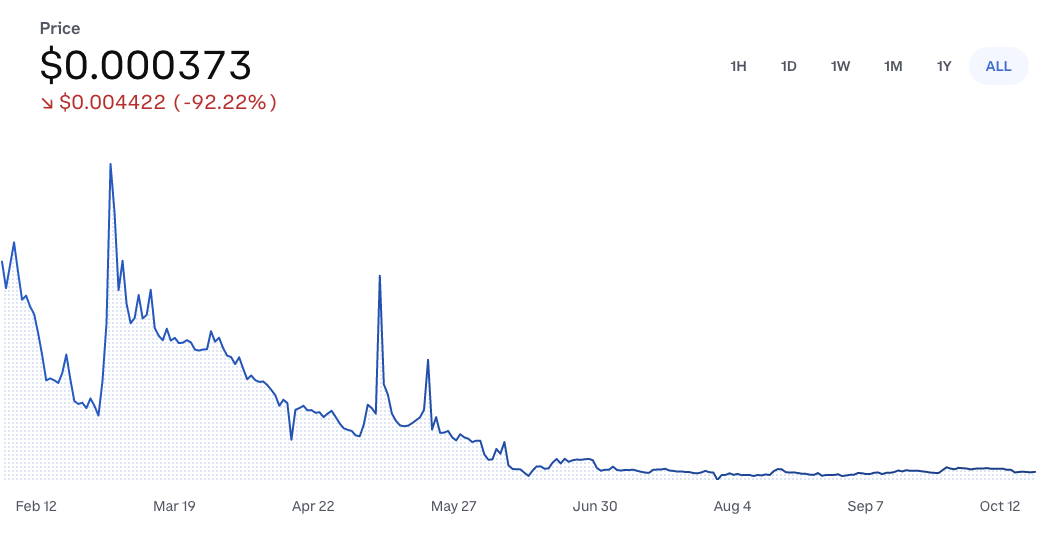

NYCCoin Price Shows Bearish Trajectory

The idea of CityCoins spread to other cities as a community-driven effort to promote development via smart contracts built on Stacks. This is often seen as Layer 1.5, used as an open-source network to create decentralized apps on Bitcoin.

Apart from Miami, Austin and New York City also promoted CityCoins to give citizens and supporters the power to improve and program these major cities.

New York City Mayor Eric Adams has come out as a Bitcoin proponent who even accepted his paycheck in crypto. Adams said he would receive his first three paychecks in Bitcoin and Ethereum, using Coinbase to convert dollars into crypto.

Despite the current crypto market weakness, Adams is still bullish on Bitcoin price. He pointed out the slump in equities this year as proof that the recent crypto crash is not unique.

On CoinGecko, NYCCoin price is down almost 95% from its all-time high of $0.006716099275, achieved in March of this year.

Is the Crypto Market and CityCoins Becoming Crowded?

It is interesting to see central banks globally racing to launch their own centrally-backed digital currency. Still, the fall of the crypto market is also under regulatory scanner following the Terra LUNA price crash. CityCoins do not derive value from the sovereign currency, making them private players.

In a 2021 blog post, IMF’s Tobias Adrian and Tommaso Mancini-Griffoli opined that private and public money could co-exist in the digital era. They argued, “How much of the private sector to rely upon, versus how much to innovate themselves? Much depends on preferences, available technology, and the efficiency of regulation.”

That said, India’s Union Minister Rajeev Chandrasekhar stated in the past that CBDC is next in the digital payments space in India. This makes one wonder if CityCoins will be able to gain traction in the future.

At press time, the global cryptocurrency market cap has fallen close to $960 billion, further hitting the valuations of CityCoins. Bitcoin price also remains under the crucial level of $20,000.