Commercial banks in China are suspending the creation of new gold and precious metal trading accounts amid massive volatility in the market.

Positive coronavirus vaccine trial news has seen a pivot from haven assets to riskier investment instruments causing a significant decline in precious metal prices.

Chinese Banks Wary of Gold Price Volatility

According to a Reuters report on Nov. 27, major Chinese banks are suspending the opening of new gold trading accounts beginning from Saturday (Nov. 30). The suspension reportedly covers both over-the-counter and mobile banking channels.

Earlier in November, some banks in the country issued warnings about impending restrictions on forex and precious metals. At the time, palpable concerns raged about the possibility of the US election fallout causing significant disruptions in the global market.

In a statement on its website, the Industrial and Commercial Bank of China declared:

Affected by the global epidemic situation and the international political and economic situation, international and domestic precious metals price continued to show volatility, market risks, and uncertainties increased.

Friday’s announcement does not affect customers with existing gold trading accounts. However, the banks are warning investors to be wary of the current volatility in the market.

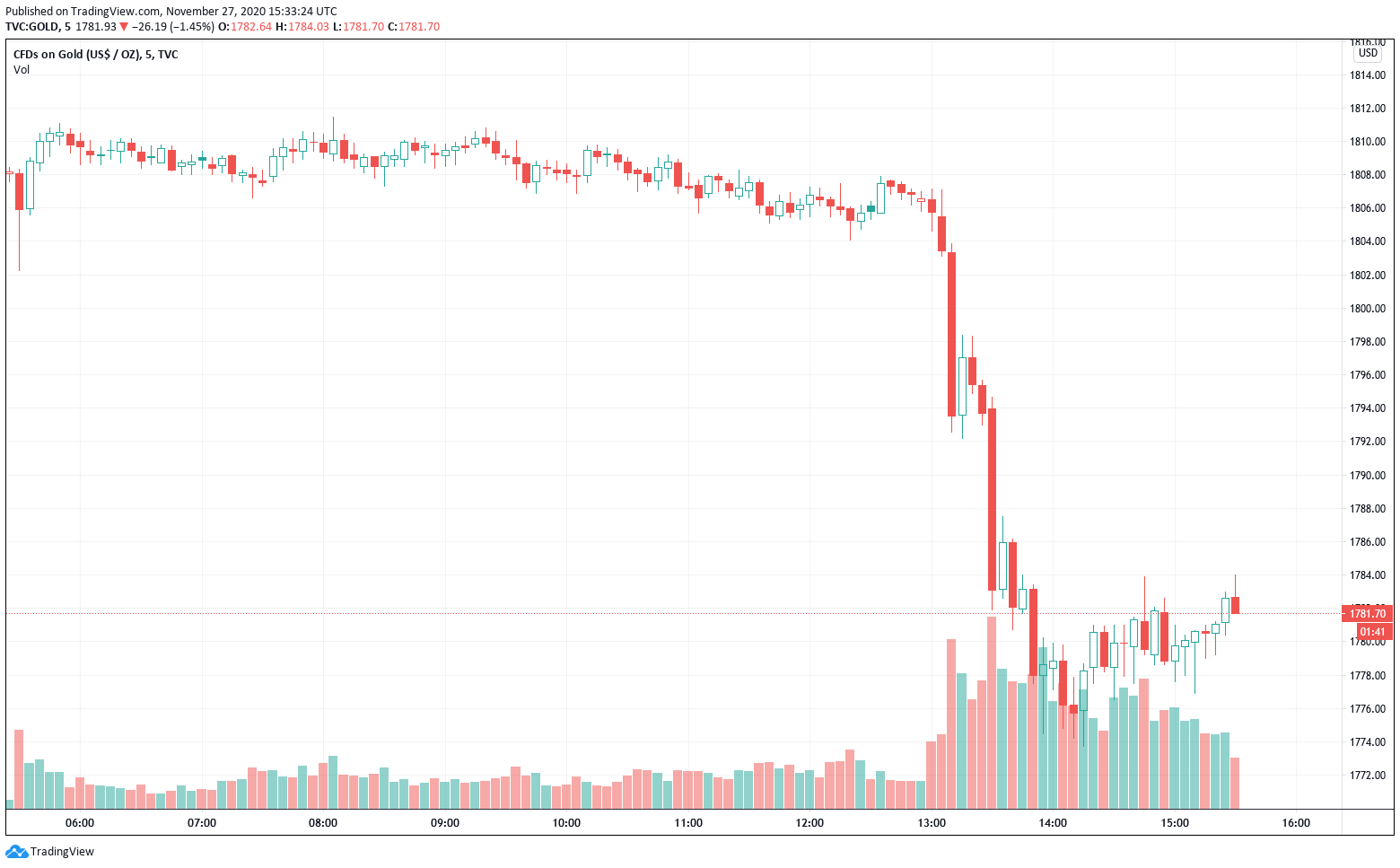

The gold price has been on the decline since the start of November, dipping by more than 8%. As of press time, gold futures are down to their lowest level in over five months with spot price dropping below the $1,800 price mark.

Back in early August, gold reached an all-time high (ATH) price of $2,060 per ounce. However, good news on coronavirus vaccines dampened investor optimism in haven assets triggering a significant price tumble.

Like gold, Bitcoin (BTC) is also experiencing price struggles after failing to break its ATH earlier in November. The largest crypto by market capitalization has seen over $3,000 shaved off its 2020 price high.

As previously reported by BeInCrypto, BTC is hunting for a support level following multiple rejections at the $17,500 price band.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.