Following weeks of subdued momentum, Bitcoin faces a key test with Friday’s US inflation data on deck. The September CPI report arrives today, October 24, 2025, at 8:30 a.m. ET (12:30 PM UTC) and is likely to influence the market’s short-term risk appetite.

Consensus estimates call for a 0.4% rise in headline inflation and 0.3% in core prices month over month.

Current Bitcoin Market Overview

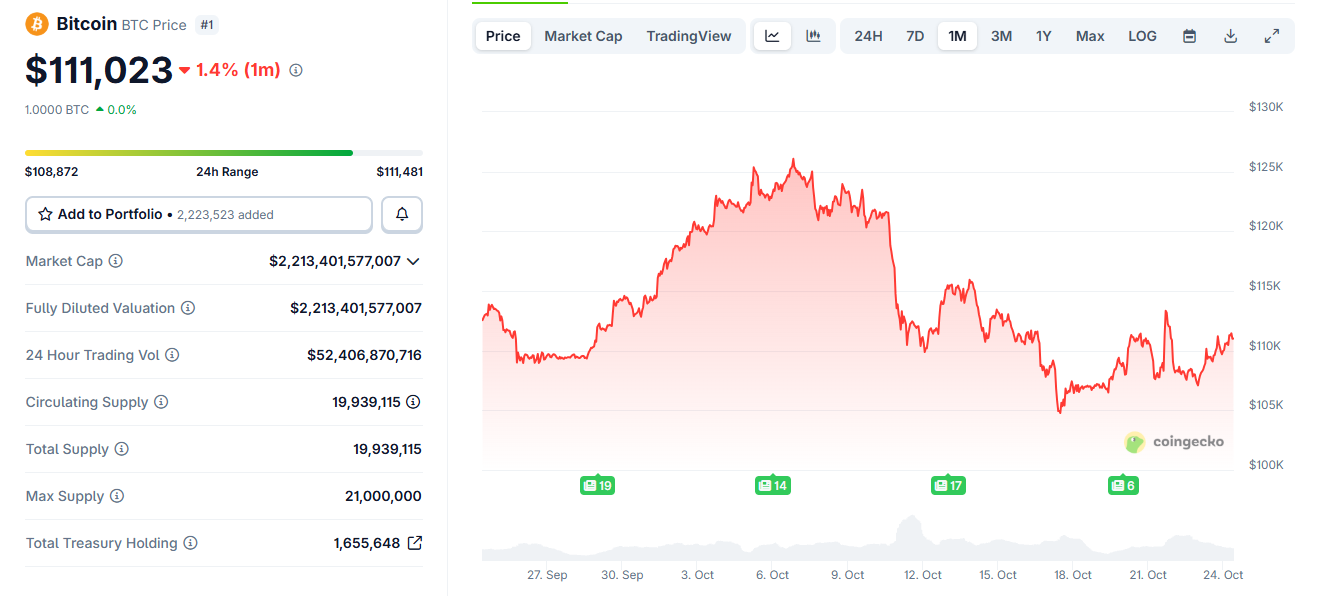

Bitcoin has hovered around the $107,000 to $111,000 range after pulling back from early-October highs near $126,000. Short-term option volatility has climbed back into the 30s, which indicates that traders are positioning for movement but not bracing for major stress.

Meanwhile, funding rates across major exchanges remain near neutral, which suggests limited directional conviction ahead of the data.

Overall, the setup looks balanced on paper. But then, positioning often flips fast when macro data lands.

Considering all possibilities, we asked ChatGPT how it would handle Bitcoin in the lead-up to Friday’s CPI release to gain a data-driven perspective. Here’s what came out of that exchange:

Pre-print Game Plan

ChatGPT recommends cutting leverage before the release. And it makes sense too, considering how CPI data can flip markets in seconds (and slippage widens right at the print).

If you must stay exposed, one safe way to go about it would be to hedge with short-dated puts (1–7 days). In other words, it’s best to prepare your “stop” before the number hits. Once the data is out, reassess positioning only after volatility settles.

When the Number Lands

The CPI hits at 12:30 PM UTC, and that’s when chaos usually kicks in. The first candle often traps both longs and shorts before direction becomes clear. You will see spreads widen and liquidity vanish for a few seconds.

So, the smarter move under these circumstances would be to wait it out and let the dust settle. Only then trade, once order books normalize.

After the Print: Three Possible Paths

- Hot CPI (above 0.4 %): ChatGPT expects a stronger USD, higher yields, and short-term Bitcoin weakness. In case support breaks, you will probably be better off staying defensive or tightening your stops.

- In-line CPI: Volatility likely collapses; option sellers benefit. In this case, keep position sizes light until direction becomes clear.

- Cool CPI (below expectations): Bitcoin could rebound if DXY and two-year yields drop. Wait for a clean reclaim of resistance before going long.

Keep an eye on the pre-print high and low, along with VWAP. A decisive reclaim or breakdown usually confirms bias for the next 12 to 24 hours. Option premiums remain expensive, so stick to defined-risk setups like spreads rather than naked options.

According to ChatGPT, even if inflation softens a bit, the annual rate should stay near 3%, which would keep the “higher-for-longer” debate alive. That means BTC will likely mirror shifts in yield expectations more than anything else.

The Bottom Line

So, to cut a long story short, you are walking into this CPI with sentiment tilted, not settled.

Bitcoin already priced part of the inflation risk, so a neutral print could trigger a quick rally as traders unwind hedges. A hotter-than-expected number, however, favors a short-term pullback before any recovery attempt.

Given the setup, the smarter play here is balance. Overall, you might want to consider scaling down risk before the release. Hedge if you must, and react to what the data shows instead of guessing it.

If yields start to cool and Bitcoin climbs back above resistance, the upside looks cleaner. If not, expect price swings to flatten fast once volatility drains out of the system.