The Champions League final on May 31 between Paris Saint-Germain and Inter Milan marks not only the culmination of Europe’s top football competition, but also a pivotal moment for Fan Token traders. While PSG and Inter enter the final with contrasting domestic outcomes (PSG dominating Ligue 1, and Inter narrowly missing the Serie A title) their Fan Tokens, $PSG and $INTER, have both captured significant market attention in the lead-up to the match. With trading volumes rising significantly and price action increasingly tied to on-field events, this final offers a clear example of how narrative-driven assets react to moments of peak anticipation and uncertainty.

Domestic Titles Done, All Eyes on the Final

The domestic league competitions have concluded: Paris Saint-Germain (PSG) secured the Ligue 1 title decisively, finishing 19 points ahead of Marseille, while Inter Milan narrowly missed out on the Serie A title, falling just one point short of Napoli. All attention now shifts to the Champions League final on May 31, as fans and teams alike turn their focus to the season’s biggest stage.

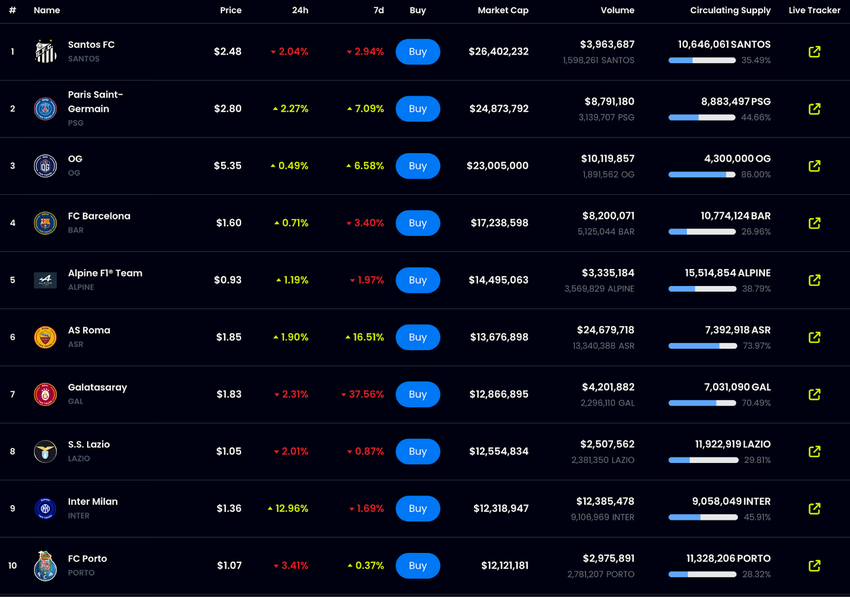

Zooming in on Fan Tokens, $PSG has a market capitalization of around $24–25 million, making it the second-largest in the category. $INTER, by comparison, stands at roughly $12 million, ranking ninth. While $PSG has a slightly larger global fanbase (118k vs. 114k), $INTER has seen comparable, and at times higher, trading activity and volatility in recent weeks. This trend likely reflects the rising anticipation and market interest surrounding the Champions League final.

Source: FanTokes.com. As of May 25, 2025

Trading volumes for both tokens have risen steadily since late April, following their progression from the quarter-finals to the final, an indication of growing interest from traders and investors. $PSG, which had seen average daily volumes of $2-5 million in previous months, reached a high of $39 million on May 3 and has consistently recorded volumes in the double-digit millions since.

Source: FanTokens

Looking at the 4-hour chart, $PSG is currently trading around $2.80, up nearly 50% since April 15, when its progression to the semi-finals over Aston Villa was confirmed. Despite that milestone, the token showed little immediate reaction, remaining around $1.90, close to its all-time low (ATL), for several days.

The trend began to shift on April 22, as both price and volume picked up, forming a series of higher highs and higher lows. A clearer trend confirmation came around April 25-26, when $PSG began consolidating above both the EMA-25 and MA-100. On April 27, the price broke out and reclaimed the $2.09 level, a significant level since October 2024.

Momentum increased further after PSG’s first-leg win against Arsenal on April 29, which triggered a 23% move to $2.73 ahead of the second leg on May 7. That move also cleared the $2.56 resistance level. However, following PSG’s confirmation over Arsenal on May 7, the token dropped nearly 13%, likely due to profit-taking as the win had already been priced in. After a week of consolidation, buying resumed ahead of the final, pushing the price from $2.42 to $2.80, a 15% move. As of now, $PSG is approaching another key resistance zone between $2.86 and $2.94, just ahead of the final.

Source: TradingView

A similar pattern played out with $INTER, which moved well beyond the $1 million daily volume typical of previous months, reaching a peak of $32 million on May 7, the day of the semi-final against Barcelona.

Source: FanTokens

In terms of price action, $INTER followed a trajectory similar to $PSG. There was little volatility immediately after the quarter-finals, but trading volumes began to rise, likely signaling accumulation near ATLs, as traders positioned for a potential Champions League run. The token gradually shifted direction, reclaiming both the EMA-25 and MA-100, signaling the start of a new trend.

Momentum accelerated on April 30, during the first leg of the semi-final against Barcelona, which ended in a 3-3 draw. On that day, $INTER broke above the $0.87 resistance and continued climbing without major pullbacks, reaching a local peak of $1.10, a 27% move, by the second leg.

The second leg brought far more uncertainty than PSG’s semi-final, and that was clearly reflected in the charts. Both $INTER and $BAR experienced sharp intraday volatility, as the match swung back and forth: Inter went up 2-0, Barcelona came back to lead 3-2, and Inter eventually sealed the win 4-3 in extra time. The market reaction mirrored this drama.

In the days that followed, $INTER dropped nearly 13% from the May 6 close, consolidated for about a week, and then began another leg up. By May 15, it had increased nearly 50%, from $1.09 to a closing price of $1.58, breaking through a key resistance area between $1.19 and $1.23. Since then, the token has retraced part of that move but continues to hold above the former resistance, now acting as support, with the price currently trading around $1.30.

Source: TradingView

This type of price behavior highlights how fan tokens are heavily influenced by narratives and major events, particularly in the lead-up to and during key matches. Traders aware of this dynamic could have positioned themselves accordingly. The progression of Inter and PSG to the semi-finals drew attention to the Champions League catalyst, as reflected in the rise in trading volumes. From there, price movements, combined with basic technical signals like support/resistance levels and moving averages, could have been used to position in line with trend and momentum.

That said, hindsight makes these setups look more obvious than they were in real time. We now know both Inter and PSG reached the final, and the charts reflect that outcome. A more realistic strategy would have involved shorter-term positioning, actively trading the tokens of all four semi-finalists and adjusting as results unfolded. This approach, however, demands constant monitoring and quick decision-making, making it difficult to execute cleanly and increasing the likelihood of error. In the next section, we explore an alternative method that could have been used to trade the Champions League narrative more effectively.

A Framework for Navigating Fan Token Momentum During Major Competitions

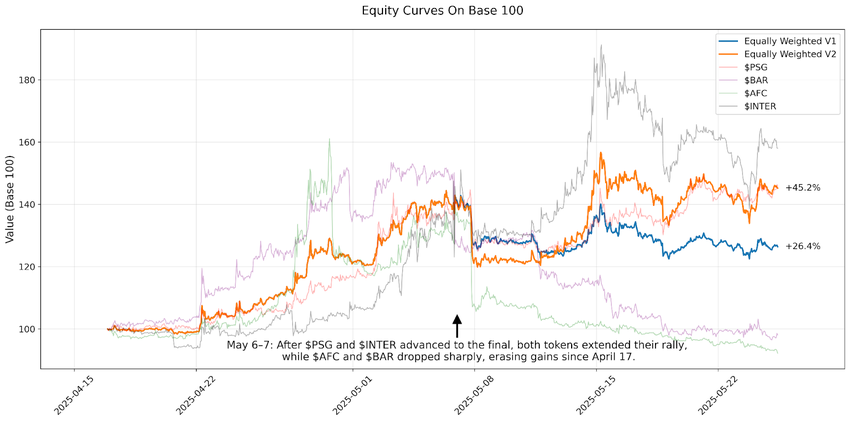

We take April 17, the day after the quarter-finals concluded, as the starting point for positioning around the Champions League narrative. As shown in the chart below, price action clearly breaks into two phases: from April 17 to May 6 (the day before the second-leg semi-finals), and from May 7 to the present.

In the first phase, all four semi-finalist fan tokens ($PSG, $INTER, $BAR, and $AFC) moved in the same direction, trending upward following their respective quarter-final victories. By May 6, just before the decisive semi-final matches, $PSG was up 37%, $INTER +29%, $BAR +50%, and $AFC +29%, all comfortably outperforming $BTC (+12.4%, orange line).

However, after the semi-finals concluded with PSG and Inter advancing, the market began to clearly differentiate between winners and losers. While $PSG and $INTER continued to trend upward (now up approximately 45% and 56% since April 17), $BAR and $AFC retraced their entire gains and more, currently down about 3% and 8%, respectively.

Source: TradingView

This divergence was not only sharp but also fairly predictable. One straightforward way to position for it would have been through an Equally Weighted (EW) portfolio of all four semi-finalist tokens. The chart below illustrates two versions of such a portfolio:

- Variant 1 (blue line): an equal allocation to all four tokens held from April 17 through today.

- Variant 2 (orange line): the same equal allocation at first, but with $BAR removed and the portfolio rebalanced on May 7 (after Inter’s second-leg win over Barcelona), and $AFC removed and rebalanced again on May 8 (following PSG’s win over Arsenal). From that point, only $PSG and $INTER are held.

While both portfolios would have ended in profit, the second variant clearly outperformed, returning +45% compared to +26% from the static four-token portfolio, an improvement of roughly 1.7x.

Source: TradingView (price data), author’s analysis (portfolio construction). As of May 25, 2025.

It’s also worth noting that both strategies achieved this outcome with significantly lower volatility than holding any single token, while still capturing most of the upside. For example, the second variant delivered performance only slightly below $INTER’s solo return of ~60%, while matching $PSG’s performance over the same period.

In practice, this simple rebalancing strategy would have been easier to implement than actively trading individual match outcomes, while still allowing traders to follow the Champions League narrative and participate in its momentum.

Final Moves Before the Final Match

Looking ahead to the final, the most practical way to manage a portfolio based on the approach just discussed would likely be to close all remaining positions before the match begins. Most of the move appears to have already played out, and as past high-stakes matches have shown, volatility during the game can spike sharply in either direction (making it less meaningful to hold positions through the event itself).

A clear example of this was the Champions League semi-final between Inter Milan and Barcelona, where traders reacted in real time to every shift in momentum.

Source: X

The 3-minute chart below shows price action for both $INTER (solid candles) and $BAR (hollow candles). Even without watching the game, the market’s direction was readable through the chart: as Inter took a 2–0 lead, $INTER climbed over 17%. When the match reached a 3–3 draw, the token dropped by around 21%. Finally, as Inter secured the win in extra time, $INTER jumped again, this time by nearly 35% at peak.

Source: TradingView

Importantly, price action after the match tends to remain uncertain. It’s not unusual to see strong “anticipation rallies” ahead of major games, followed by sell-offs regardless of the result. That’s what happened in the recent Europa League final between Tottenham and Manchester United: $SPURS peaked the day before the match, then began to decline in the days that followed, even though Tottenham won the competition.

Source: TradingView

In general, the pattern around major fixtures tends to be characterized by pre-match momentum and sharp intraday swings, often followed by an unclear post-match phase where price depends more on profit-taking and shifting sentiment than the result itself.

Conclusion

As the Champions League final approaches, both $PSG and $INTER fan tokens have already seen meaningful price moves, driven by growing interest, rising volumes, and a clear connection to on-field events. While their domestic campaigns followed different trajectories, their tokens have followed a similar pattern, becoming tools for short to medium-term positioning around high-profile competitions. This highlights how fan tokens are increasingly treated as tradable assets influenced by match outcomes and market sentiment.

Whether the final continues the recent trends or brings a change in direction, one point remains consistent: the period before major matches tends to be the most active and directional for fan token markets. For traders, the most effective strategies are often those that focus on this pre-match momentum while limiting exposure to the uncertainty that typically follows once the match is decided.

References

Inter ($INTER) v Barca ($BAR): A Tale of Two Tokens. FanTokens | Link

Goals To Gains. FanTokens | Link

FanTokens Website | Link

UEFA.com | Link