Chainlink (LINK) price has recently broken free from a three-month consolidation range, signaling a possible uptrend as it aims for $14 and potentially higher.

This breakout has sparked optimism among investors, with many eyeing the altcoin’s potential for significant gains. With bullish sentiment building, LINK appears to be on track to hit new targets.

Chainlink Supply Aims for Profits

Crypto analyst Michael van de Poppe has predicted a strong rally ahead for Chainlink, fueled by its recent breakout above $13.00. Van de Poppe highlights that LINK’s prolonged struggle to surpass this level might now be over, opening the door to a potential rise toward $17.83. Such a climb would represent a 37% increase, marking substantial gains for LINK holders.

The successful move above $13.00 is expected to bolster investor confidence in Chainlink’s trajectory, with the $17.83 target setting the stage for a new phase of growth. Van de Poppe’s forecast aligns with the current bullish sentiment, suggesting that this breakout could lead to an extended rally.

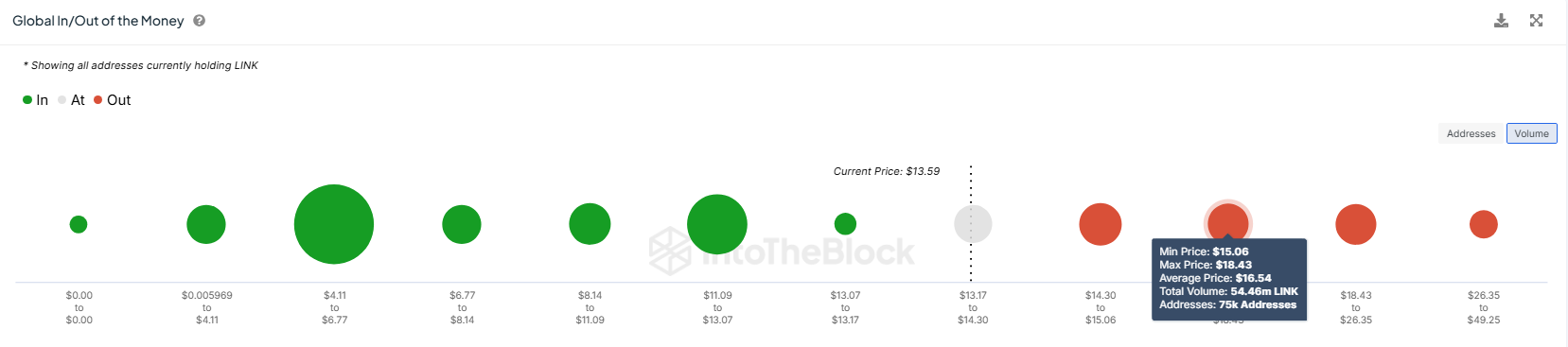

Chainlink’s macro momentum is further supported by its Global In/Out of the Money (GIOM) indicator. The GIOM data reveals that about 120 million LINK tokens, worth over $1.6 billion, were purchased between the $14 and $18.43 range. If Chainlink’s price continues to rise, this supply could become profitable, fueling even greater interest in the asset.

If van de Poppe’s prediction holds true, these holders may see substantial gains, increasing the likelihood of Chainlink surpassing its target of $17.83. The potential profitability of these tokens adds an element of anticipation among LINK investors, as further profits could encourage them to hold for even higher gains. This profitable zone could propel Chainlink toward an even stronger breakout.

LINK Price Prediction: Beating the Odds

Chainlink’s price has surged by 33.56% over the last three days, currently trading at $13.56. Should the bullish momentum continue, LINK could flip the resistance at $14.45 into a support level. Establishing this support would strengthen the rally, giving LINK the foundation needed to approach its next targets.

With support at $14.45, Chainlink could push toward $17.83 and further, reaching $18.34. Achieving these levels would make the $1.6 billion supply of LINK profitable, supporting the upward trend.

However, if Chainlink fails to break past the $14.45 resistance, it may retrace to the support level of $12.94. Losing this support would undermine the bullish outlook, potentially bringing LINK down to $11.64. This move would caution investors and could signal a shift in market sentiment.