Bankrupt crypto lender Celsius has withdrawn 6,521 staked Ethereum — worth over $13 million — since the network-enabled withdrawals through the Shapella upgrade.

On-chain investigator Lookonchain reported on April 14 that 239,882 ETH — worth $504.5 million — had been withdrawn. The top three addresses withdrawing their assets were the bankrupt lender, liquid staking protocol Lido, and Figment.

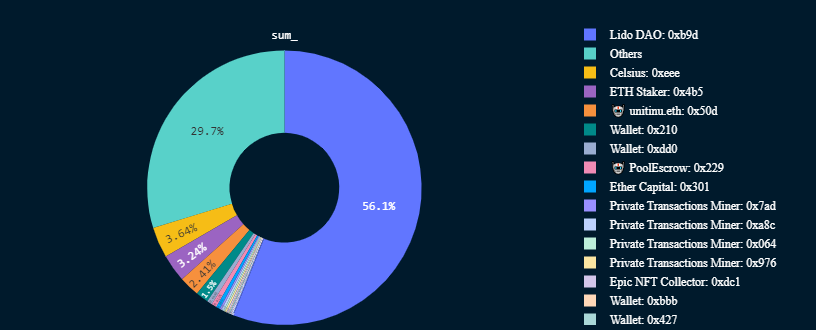

Data from blockchain analytical firm Nansen corroborated that the bankrupt lender was withdrawing its asset. According to its dashboard, Celsius has withdrawn 4,991 ETH as of April 13, equating to 3.64%.

According to the Arkham Intelligence dashboard, the lender holds 410,378 staked ETH worth $862.45 million.

Meanwhile, Lookonchain noted that Lido had withdrawn 152,780 ETH, equating to 64% of all withdrawals. Staking solution provider Figment processed the second-largest withdrawal with 7,135 ETH.

Crypto Exchanges Are Withdrawing Staked ETH

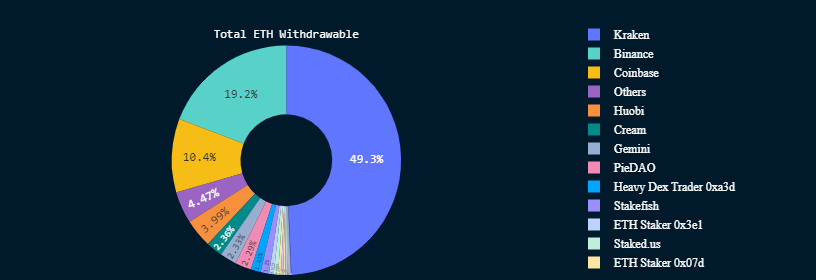

Besides the bankrupt lender, centralized crypto exchanges — Kraken, Binance, Coinbase, Gemini, and Huobi — account for around 85% of entities waiting to withdraw their staked assets. According to Nansen data, 1.117 million ETH are currently in the queue for withdrawal.

Per Nansen’s data, Kraken accounts for most of the pending withdrawals with 556,321 ETH. Binance is second with 216,208 ETH, while Coinbase is third with 117,239. Huobi and Gemini want to withdraw 71,377 ETH.

The recent regulatory actions in the United States could be forcing firms in the region to withdraw their staked ETH. In February, the SEC fined Kraken $30 million for failing to register its staking services. The regulator has also filed charges against Gemini and has issued a Wells notice to Coinbase.

Celsius Wants to Sue Creditor For Leaking Confidential Information

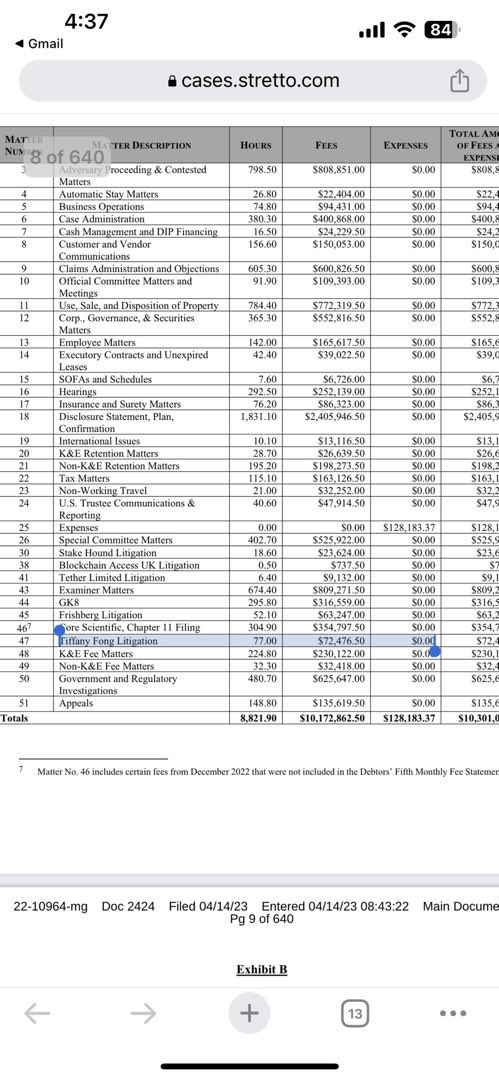

Crypto blogger Tiffany Fong suggested that Celsius wants to sue her in an April 14 tweet. Fong shared a screenshot of the bankrupt lender’s monthly fee statement, including a $72,000 invoice titled “Tiffany Fong litigation.”

Fong is a Celsius creditor with about $119,000 locked in the firm. She has been actively reporting on the Celsius bankruptcy case while sharing leaked internal information. The blogger also got the broader market attention when she interviewed the founder of the now defunct crypto exchange, FTX, Sam Bankman-Fried.