Cardano (ADA) price is currently struggling to find a clear direction. The ADX indicator shows a weakening trend, pointing to reduced momentum. This suggests that ADA is in a phase of consolidation, lacking strong bullish or bearish forces.

Whales have been accumulating ADA, hinting at potential upward movement. However, whether the price will break upwards or downwards remains uncertain as support and resistance levels come into play.

ADA ADX Shows a Weak Trend

Cardano (ADA) currently has an Average Directional Index (ADX) of 15.51, down sharply from 41 just four days ago. This decline indicates a significant weakening in ADA’s trend strength.

The ADX is a widely used technical indicator that measures the strength of a trend without indicating its direction. ADX values range from 0 to 100, with readings above 25 typically indicating a strong trend, and values below 20 suggesting a weak or nonexistent trend.

Read more: Who Is Charles Hoskinson, the Founder of Cardano?

An ADX value of 41 previously suggested strong momentum, either upward or downward, signaling a decisive price movement. However, the current value of 15.51 suggests that this momentum has dwindled, pointing towards a lack of clear directional strength, with ADA now in a phase of low volatility and reduced conviction among market participants.

Cardano Whales Are Making Moves Again

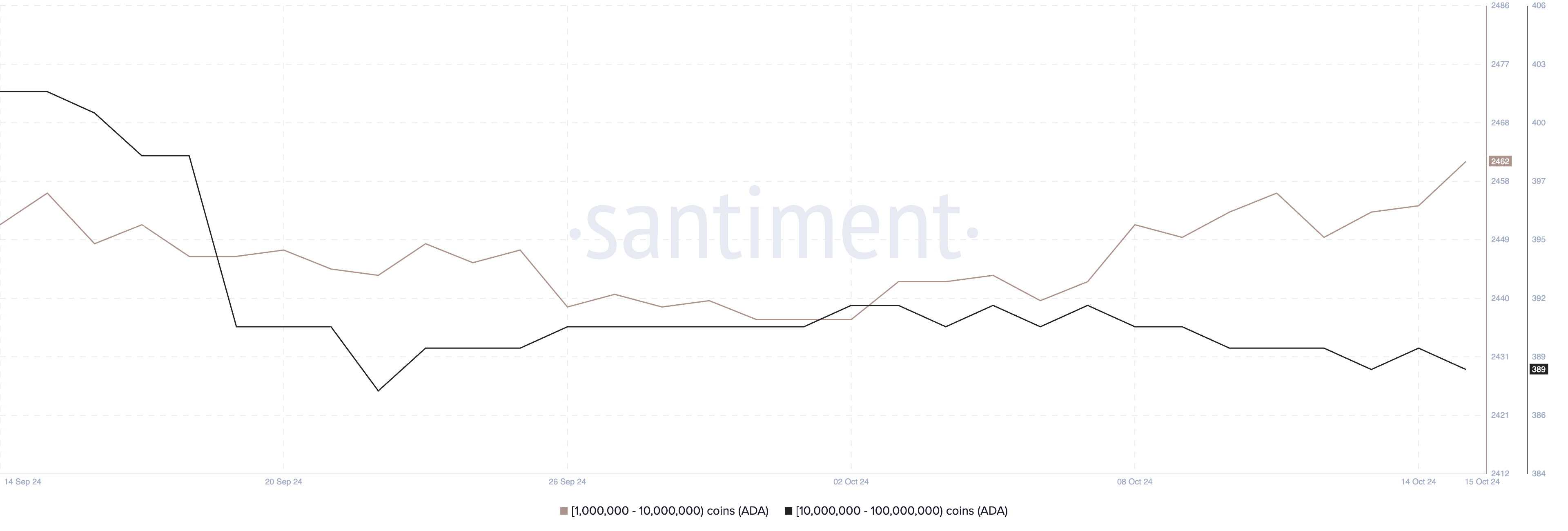

In recent weeks, the number of ADA addresses holding between 1 million and 10 million ADA remained relatively stable throughout mid-September until October 7. Similarly, addresses holding between 10 million and 100 million ADA also showed a steady trend since the end of September, following a sharp decline between September 18 and 19.

However, from October 12 to October 15, the number of addresses holding between 1 million and 10 million ADA grew from 2,450 to 2,462, suggesting renewed interest from smaller whales while the larger whale cohort remains steady. These subtle shifts in holdings can provide valuable insights into potential market trends.

Tracking the behavior of these whales — specifically, those holding millions of ADA — is crucial as they wield substantial influence over the market. When whales accumulate or divest their holdings, it often correlates with upcoming price movements due to their potential to impact liquidity and market sentiment.

Although the current trend is not particularly strong, and the direction of ADA’s price remains uncertain, the recent accumulation by addresses holding between 1 million and 10 million ADA could be viewed as a potential bullish signal.

Such accumulation during a period of low trend strength could indicate that larger players are positioning themselves for a future upward movement in ADA’s price, hinting at optimism for positive momentum in the coming days.

ADA Price Prediction: Can It Jump 17% In The Next Few Days?

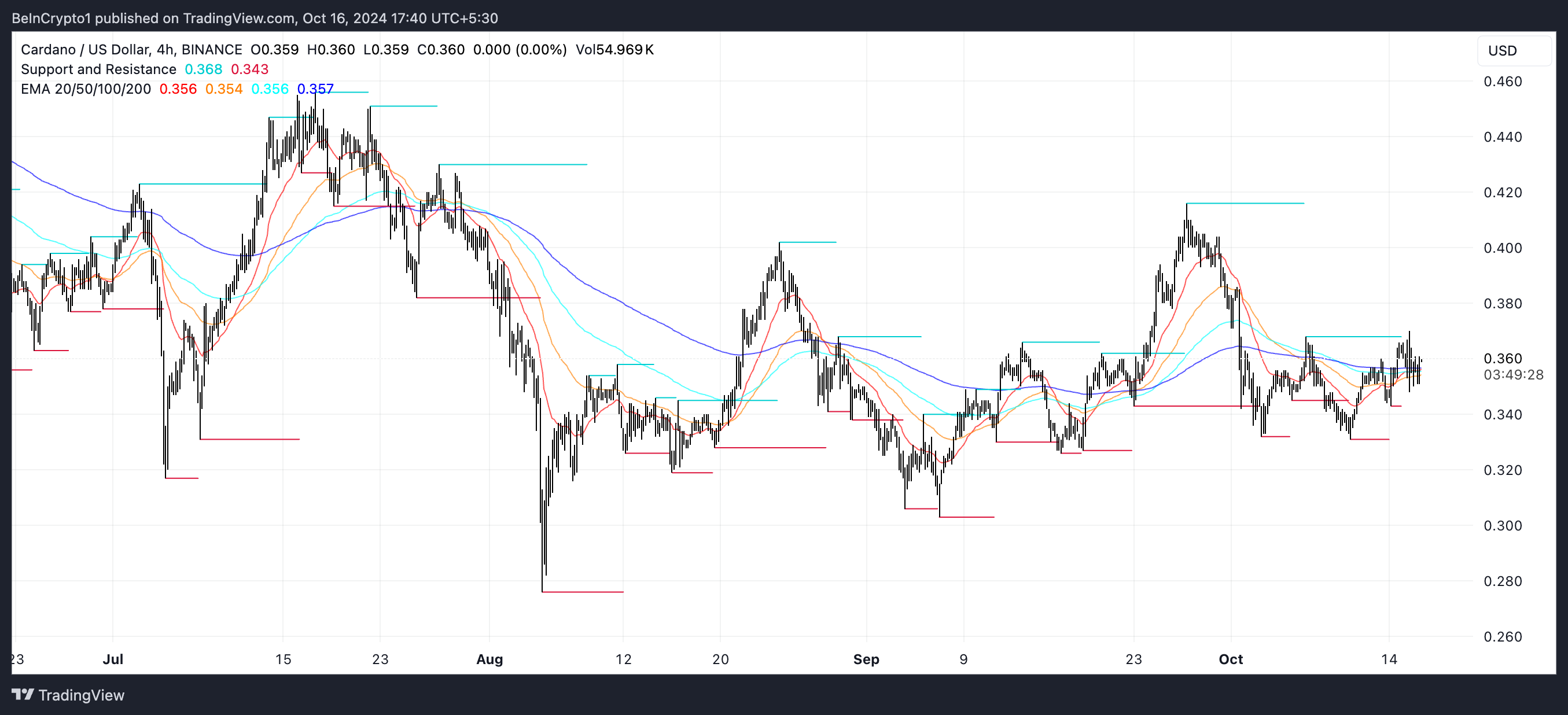

ADA EMA (Exponential Moving Average) lines are currently very close together, indicating that there is no clear trend direction at the moment. This often suggests that ADA’s price is in a consolidation phase, where the market lacks strong bullish or bearish momentum.

EMA lines are moving averages that place greater weight on more recent price data, making them more responsive to short-term price movements compared to a simple moving average.

When EMA lines converge and move tightly in sync, it typically implies that neither buyers nor sellers are dominating, resulting in a period of sideway movement, where the price fluctuates within a narrow range without breaking out in either direction.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

Despite this consolidation phase, the recent increase in whale accumulation, as observed in the number of large ADA addresses, suggests that a potential uptrend may be on the horizon. If an upward movement emerges, ADA may test resistance levels at $0.40 and $0.416, presenting an opportunity for approximately 17% growth from its current levels.

However, if a downtrend takes hold instead, ADA’s price could fall to support levels around $0.328 or even $0.303, suggesting a risk of further price depreciation if selling pressure intensifies.