Input Output Global (IOG), the firm behind Cardano, has responded to the Security and Exchange Commission’s claim that ADA is a security.

On June 7, IOG responded to the SEC’s latest enforcement actions against Binance and Coinbase.

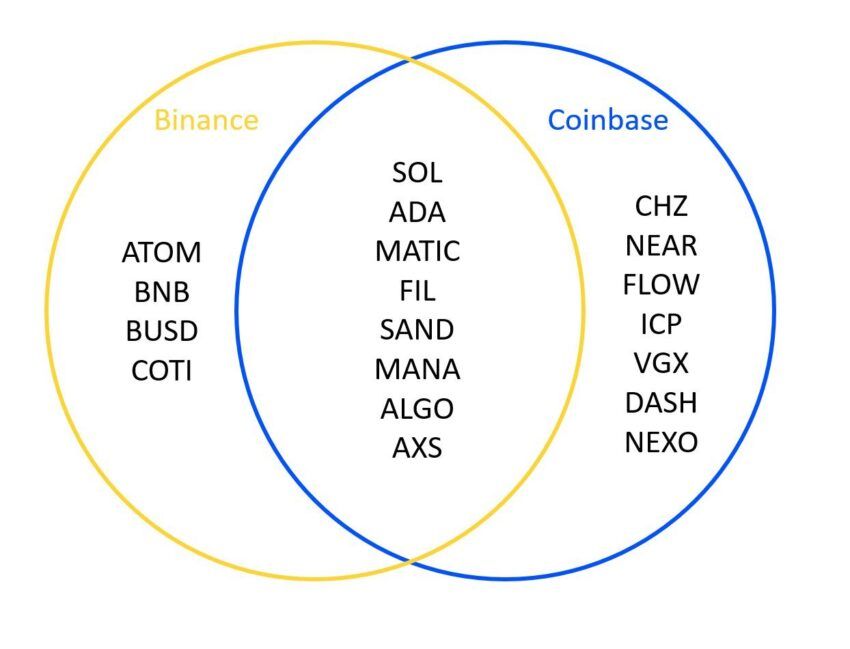

In the filings, the regulator listed a large number of crypto assets that it deemed were securities. Among them was the Cardano native token ADA.

Cardano Says No to ADA Security Claim

The firm stated that the SEC filing “contains numerous factual inaccuracies” and will not impact its operations in any way.

“Under no circumstances is ADA a security under U.S. securities laws. It never has been.”

It noted that in order to create responsible legislation, regulators need to understand how decentralized blockchains operate.

Like the two targeted crypto exchanges, IOG said it was willing to work with regulators to help develop a regulatory framework. However, it said that stifling innovation only does more harm to the industry and communities involved.

“This latest filing from the SEC demonstrates that we still have a long way to go in this regard. Regulation through enforcement action does not provide either the clarity or certainty to which both the blockchain industry and consumers are entitled.”

Blockchain and crypto need regulations that recognize the “transparent, auditable, immutable, and fair,” design aspects of networks.

Investors had already begun selling off Cardano’s ADA with the asset dumping 15% since the SEC filings earlier this week.

The SEC named 19 tokens as securities throughout the Binance and Coinbase filings. ADA was labeled a security in both of them.

On June 8, industry analyst Miles Deutscher said that these tokens had several things in common.

They all had an initial sale and or fundraising event. Each project pledged to improve the protocol via ongoing development, and social media was utilized to express the protocol’s features and advantages, he said.

Outdated Securities Laws Applied

The SEC argues that these common factors satisfy the requirements of the Howey Test and the determination of an “investment contract.”

Get more clarity and find out what the Howey Test means for crypto:

What Is the Howey Test and How Does It Impact Crypto?

He added that there could be severe implications, like getting delisted from U.S. exchanges. However, the Howey Test is more than 75 years old. It’s outdated and has a relatively limited framework.

“Applying a precedent established in 1946 to an entirely new digital asset class creates challenges.”

The SEC appears to have its own agenda, however. Chair Gary Gensler has said this week that America doesn’t need cryptocurrencies because it has the dollar. This implies that bigger players in the traditional finance sector control or back the agency. Many of these view crypto as a threat to their businesses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.