This article will deal with the price of ADA and its future movement, while XLM will be covered in a separate one.Many altcoins are showing similar signs here, through which a new level needs to be established.

— Michaël van de Poppe (@CryptoMichNL) January 19, 2020

Examples; $ADA and $XLM.

Nice rally upwards, rejection and now some consolidation before continuation is likely. pic.twitter.com/ovOAVt5LDA

Cardano is in an Ascending Triangle

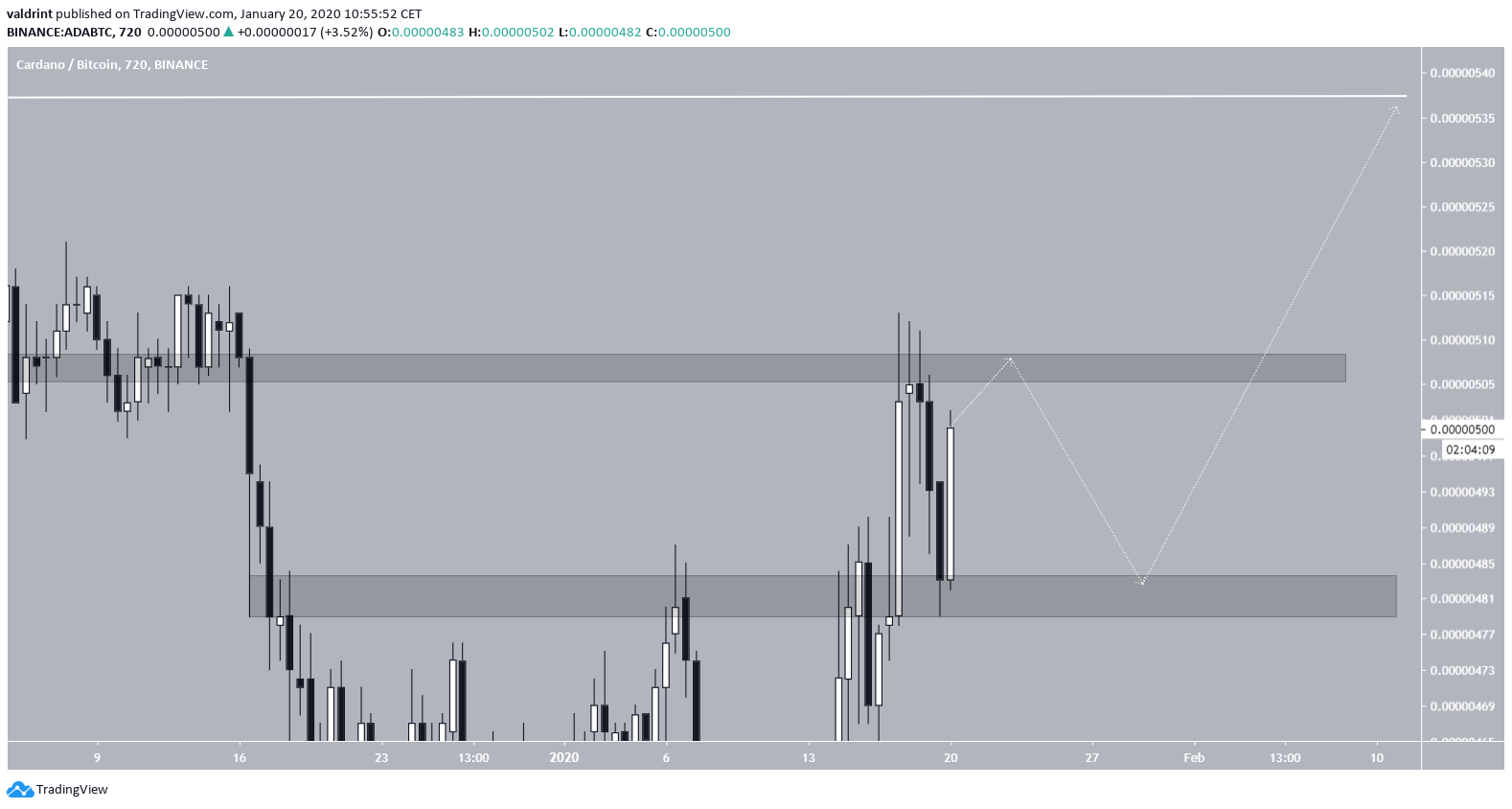

The ADA price has been trading inside a massive ascending triangle since August 10, 2019. Both the resistance and support lines have been validated several times and the price is approaching the end of the triangle. In addition, the price is trading between the 100- and 200-day moving averages (MAs), which are relatively close to making a bullish cross. If the price eventually moves above the 200-day MA, which seems likely, this would cause the MAs to make a bullish cross while the price would be above both — a major bullish price development. The resistance level outlined in the tweet is found at 480 satoshis. The Cardano price struggled to break out above this level several times before finally being successful on January 18. Afterward, the price validated it as support and began the current upward movement that is still ongoing.

The resistance level outlined in the tweet is found at 480 satoshis. The Cardano price struggled to break out above this level several times before finally being successful on January 18. Afterward, the price validated it as support and began the current upward movement that is still ongoing.

Future Movement

As for the future movement, we could definitely see some consolidation between the two areas found at 480-510 satoshis. Afterward, a price breakout would take ADA to the resistance line of the triangle at 540 satoshis. If an eventual breakout from the triangle happens, which we believe is likely, the closest target is given at 700 satoshis — which would be reached if the price travels the entire height of the pattern.

However, due to the considerably long period of time the ADA price has been trading inside this triangle, we would not be surprised if the price were to reach the previous breakdown level at 1000 satoshis — which is also the 0.5 Fib level of the entire previous decrease.

If an eventual breakout from the triangle happens, which we believe is likely, the closest target is given at 700 satoshis — which would be reached if the price travels the entire height of the pattern.

However, due to the considerably long period of time the ADA price has been trading inside this triangle, we would not be surprised if the price were to reach the previous breakdown level at 1000 satoshis — which is also the 0.5 Fib level of the entire previous decrease.

The previous consolidation phase that lasted this long lead to an upward move of 82 percent. The same movement measured from the resistance line of the triangle would take ADA to a high of 1000 satoshis, being in agreement with our long-term analysis. If the price consolidates for the same amount of time as it did in late 2018, it will break out in the second week of February.

The previous consolidation phase that lasted this long lead to an upward move of 82 percent. The same movement measured from the resistance line of the triangle would take ADA to a high of 1000 satoshis, being in agreement with our long-term analysis. If the price consolidates for the same amount of time as it did in late 2018, it will break out in the second week of February.

To conclude, the ADA price recently broke out above a short-term resistance area and validated it as resistance. It is trading inside a long-term ascending triangle. We believe it will reach the resistance line of the triangle and eventually break out.

To conclude, the ADA price recently broke out above a short-term resistance area and validated it as resistance. It is trading inside a long-term ascending triangle. We believe it will reach the resistance line of the triangle and eventually break out.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.