The last couple weeks in DeFi have been an absolute bloodbath.

— Ryan Watkins (@RyanWatkins_) September 22, 2020

But keep in mind bull markets never go up in a straight line.

In the 2017 ICO boom ETH pulled back 20%+ seven times before it peaked in January 2018.

So far in this bull market we’ve only experienced one.

1/ pic.twitter.com/EXqhmm2MkM

That Was Then, This Is DeFi

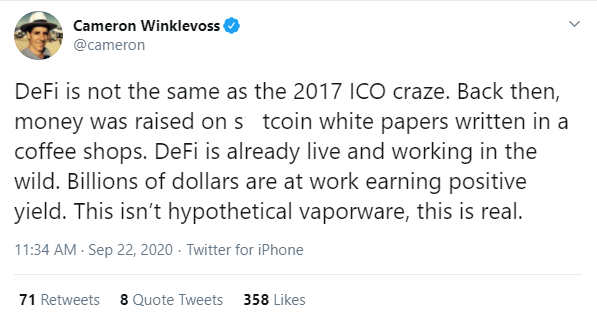

Gemini Co-Founder Cameron Winklevoss says not so fast. In a tweet, he points out the differences rather than the similarities between DeFi and ICOs. He notes that unlike many failed ICO projects, whose white papers were thrown together, DeFi has a real use case in which “billions of dollars are at work earning positive yield.”

DeFi Hype

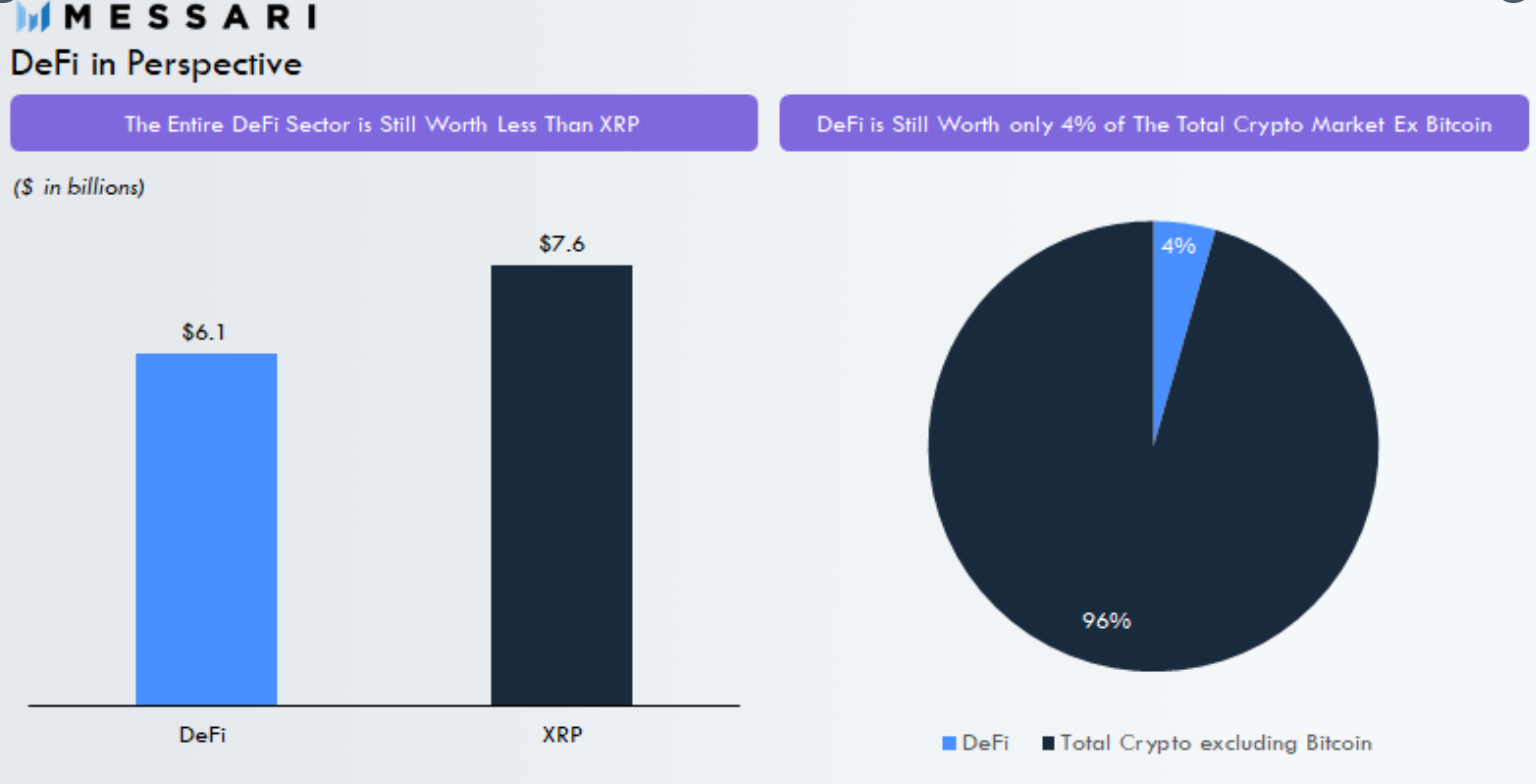

For all of its hype, you would think that the DeFi market segment is as big as bitcoin. But it’s not. According to Messari, the total DeFi sector is worth $6 billion, which falls below the total value of No. 4 cryptocurrency XRP. For even more perspective, Messari compares to the DeFi market to the broader crypto market excluding bitcoin, which still results in only a sliver of the total pie at 4%.

“In other words, DeFi hype is strong, but not strong enough to make a dent in broader crypto asset markets.”

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.