PancakeSwap’s native token (CAKE) is gaining momentum. The platform is now the second-largest Decentralized Exchange (DEX) by trading volume, according to CoinGecko.

This means that PancakeSwap has outperformed rival DEX Sushiswap (SUSHI) on this indicator with over $500 million passing through the platform per day. Interestingly, the exchange started off replicating much of its closest competitor’s features including governance and yield farming.

Currently, PancakeSwap ranks immediately below Uniswap, which has the largest daily volume of around $1.2 billion.

Boasting Low-Fee Transactions

PancakeSwap, launched in late 2020, is likely to flourish as it has become the most viable option for users to avoid the high cost of developing Ethereum-based smart contracts.

BeInCrypto previously reported that gas fees surged drastically following the recent ethereum (ETH) bull run. Now, average transaction fees appear to be enormous and are trading above $20, according to ycharts.

Thus, instead of building their DEX on the Ethereum network, the team behind PancakeSwap chose to run it on the Binance Smart Chain (BSC). While the BSC enables smart contracts and Binance Coin (BNB) staking, transaction fees for its native BEP-20 standard are much lower.

The rise in popularity of this project is impressive, as crypto analyst Nicholas Merten explains. However, he warns investors that the spectacular increase in the token’s value may be a temporary phenomenon.

“The one thing I will say overall is, again, not to get too caught up in the hype here – we want to see if it’s going to sustain. We want to see more liquidity coming in.”

He also added that all the fuss around BSC has become a “really big boost” for Binance Coin as a “potential reserve asset.”

CAKE Journeys to the Moon

CAKE token, which is the native governance token of PancakeSwap, has rocketed since the beginning of 2021.

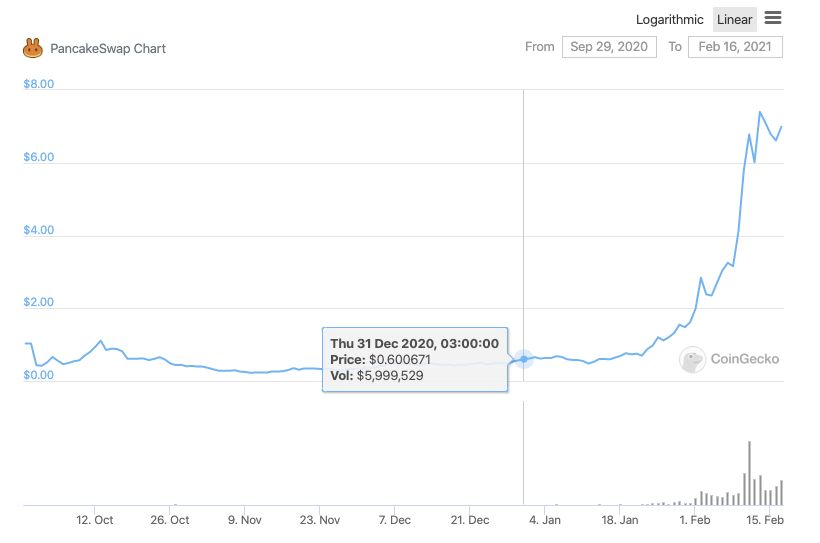

Starting at an offering price of $1.03 in September 2020, it saw a further drop and closed the year at a low price of around $0.6.

A spike in trading volumes on PancakeSwap has triggered the demand for its governance token. CAKE started to break record after record consistently climbing to a new all-time high (ATH) of $7.4 per token. In percentage terms, that’s a groundbreaking 1,200% increase.

Despite the asset having slightly lost its value recently, it managed to maintain much of its previous gains. At press time on Pancake Day, CAKE trades over $7 per token, while its total market capitalization is approaching $800 million.

By now, the future of PancakeSwap and its native token heavily depends on Binance and its BSC. The question is whether CAKE will mimic the price trajectory of SUSHI, reaching at least $16 per token.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.