Following the crash of FTX, the need for crypto exchanges to regain users’ confidence is high on the list of priorities of many stakeholders, including Ethereum co-founder Vitalik Buterin who has published a blog post on the issue.

Buterin traced the history of proof of reserves, discussing the limitations of the current methods centralized exchanges use to show trustlessness, and suggested ways to improve these.

According to him, the need for exchanges to prove their solvency has been an issue since Mt Gox’s crash in 2011.

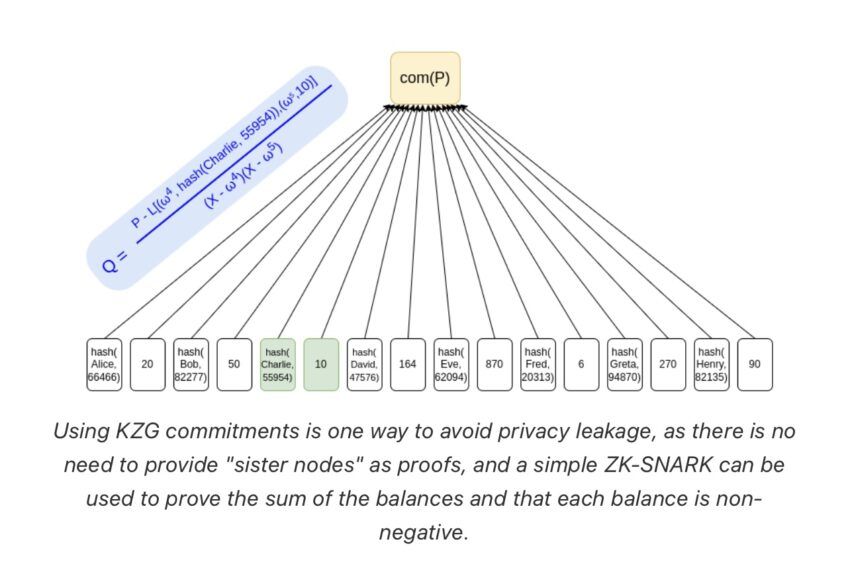

These issues led to discussions in 2013 on how exchanges can prove the total size of users’ deposits and also show they have enough assets to cover those deposits. This led to the Merkle Tree technique, which is now in use.

Buterin Says ZK-SNARKS Can Help Exchanges Prove Reserve

Buterin noted that the Merkle Tree method is not completely safe. Although it is good for proof of liabilities, he noted that it was risky for privacy.

However, technological advancements mean there are better ways for exchanges to prove reserves and liabilities, and this is through using ZK-SNARKs. He wrote:

“The simplest thing we can do is put all users’ deposits into a Merkle tree (or, even simpler, a KZG commitment), and use a ZK-SNARK to prove that all balances in the tree are non-negative and add up to some claimed value.”

Buterin also noted that while proof of assets by transferring from cold wallets to public addresses is straightforward, it is also problematic. The problems are the dual use of collateral and the cost of signing off messages to prove control of an address.

Additionally, Buterin discussed that exchanges could use Plasma and validiums to prevent misuse of users’ funds. But this also has disadvantages, such as funds getting if the operator disappears.

He concluded by saying that while decentralized exchanges have advantages, the CEXes can help recover an account if the user forgets a password.

The Future of CEXes

Buterin further predicted a future where there could be cryptographically constrained CEXes and half-custodial exchanges that will hold fiat but not crypto.

The blog post included inputs from major exchanges such as Coinbase, Binance, and Kraken.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.