Chainlink’s native token LINK is trading around $16 at the time of writing, with a modest 4% gain over the past 24 hours. This latest move comes on the heels of some positive technical analysis from Cryptonary, a popular crypto analytics resource.

In a deep-dive post to their 80,000 followers earlier this week, Cryptonary outlined a bullish case for LINK based on its recent chart activity:

“LINK has broken out perfectly from its pennant pattern, finding resistance at $16.40. LINK has found support at the local level of $15.30, which had acted as prior resistance.”

Essentially, LINK broke upwards through the pennant formation that had constrained its price action for the past couple of weeks. In surging past the pennant, LINK met selling pressure at $16.40, but this still marks an important technical development.

Just as critically, the $15.30 level that had previously capped LINK now serves as strong support on any pullbacks.

Cryptonary believes that as long as Bitcoin (BTC) avoids any sudden crashes, LINK looks poised to continue trending upwards in the weeks ahead. Specifically, they set an initial upside target of $17.75, which aligns with the next major horizontal resistance level on the charts.

In their report, Cryptonary also examined some on-chain metrics to gauge LINK’s current market positioning:

“Open interest has increased to new local highs of $375 million. The open interest-weighted funding rate, similar to SOL, has been very volatile.”

This data shows that market enthusiasm is expanding for LINK, demonstrated by rising open interest and fluctuating funding rates. These dynamics underline strengthening bullish momentum in the market.

Finally, Cryptonary offered their ultimate perspective on LINK:

“LINK has been and looks like it’ll continue to be a strong performer. We like that the price has recently pulled back and retested the $15.30 area as new support, having been a prior local resistance.”

With multiple technical and on-chain factors lining up positively, LINK does seem poised for additional upside. As long as Bitcoin avoids any macro shocks and drags down the broader altcoin market, LINK looks capable of rallying onwards to $17.75.

New Bitcoin ETF Token Cashes in on Spot ETF Hype

As optimism builds around a potential spot Bitcoin exchange-traded fund (ETF) in early 2024, an intriguing new token has launched to capitalize on this narrative.

Dubbed the Bitcoin ETF Token (BTCETF), this ERC-20 contract has already attracted over $2.7 million in presale interest. The project uniquely ties its tokenomics and incentive structure to the prospect of an SEC-approved, US-listed spot Bitcoin ETF.

Here are some key details on BTCETF:

- Originally sold presale tokens for $0.005, but prices have since climbed to $0.0064 amid strong demand.

- Entered stage eight of presale after crossing $2.7 million market capitalization.

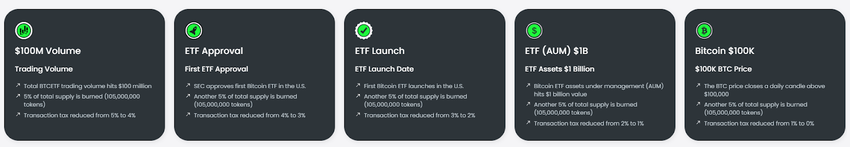

- Tokenomics include burning 25% of total supply based on 5 key Bitcoin ETF approval milestones.

- All transactions are taxed at 5% to perpetually reduce circulating supply.

The foundational idea behind BTCETF focuses squarely on the narrative momentum around the SEC approving a spot Bitcoin ETF in early 2024.

Many experts predict an approval decision within 40 days, fueling intense speculation within crypto circles. BTCETF seeks to capitalize on this swelling enthusiasm.

Unique Deflationary Approach

The project introduces deflationary tokenomics that strategically remove supply from circulation. Upon hitting certain Bitcoin ETF milestones, BTCETF executes burns to create scarcity effects.

In total, reaching all phase-based milestones will eliminate 25% of supply. A final 5% burn depends on Bitcoin reaching $100,000.

Additionally, the 5% transaction tax continually shrinks circulating supply. This dynamic tokenomics framework rewards long-term believers in the Bitcoin ETF approval narrative.

Lucrative Staking Opportunities

BTCETF also incentivizes holding via staking rewards. By locking tokens in the platform, users can earn triple-digit percentage yields. Over 10% of supply already sits in staking, showing strong commitment early on.

High staking interest allows BTCETF to reduce its tax rate from 3% down to 2%, kick-starting organic volume growth.

Between milestone-based burns, transaction taxes, and staking withdrawals, BTCETF employs several creative avenues to perpetually reduce token circulation. With intense hype building around the Bitcoin ETF narrative entering 2024, BTCETF offers a unique way to engage with this approval process while capturing deflationary gains.

Conclusion: Excitement Continues Building Ahead of ETF Decision

From Chainlink’s bullish technical breakout to over $2.7 million raised for Bitcoin ETF Token’s presale, optimism persists around two unique corners of the crypto sector.

As LINK pushes towards its next test at $17.75, positive on-chain signals suggest the rally may have further room to run if Bitcoin cooperates.

And as the Bitcoin ETF approval looms in the first quarter of 2023, BTCETF presents an intriguing option to capitalize on this narrative, with deflationary tokenomics directly reacting to key ETF events.