Bulls and Bears: The bronze sculpture of a bull has long become a symbol of Wall Street – the historic center of New York’s financial district. Alternating between bull and bear markets is commonplace for traditional stock markets. So how do you know when a bull or bear market is going to appear? Vladyslav Zadorozhniy of CryptoCrew shows us the signs.

For the cryptocurrency market, these concepts are of particular importance due to the specifics of this field. Understanding the characteristics of bull and bear markets in crypto will allow you to better pass periods of decline and maximize profits against the background of growth.

Bulls and bears: Origins of the terms

A bull market is usually a market in which prices have been rising for a considerable period of time. At the same time, a bear market characterizes a period of prolonged decline in prices.

There are several versions of how the trends in the stock markets obtained these names. According to one of them, the names of bear and bull markets come from the way these animals attack.

The bull raises the victim on its horns upwards, so the bull market is a growth market. And the bear attacks from top to bottom, therefore symbolizing the fall in prices.

According to another version, dealers of bear skins in the USA often signed contracts for the sale of these skins in advance. Therefore, when buying them from hunters, they tried to lower the purchase price in order to earn more from the sale. In general, the terms “bullish” and “bearish” are quite firmly rooted in the English language and are used in everyday life.

Bulls and Bears in financial markets

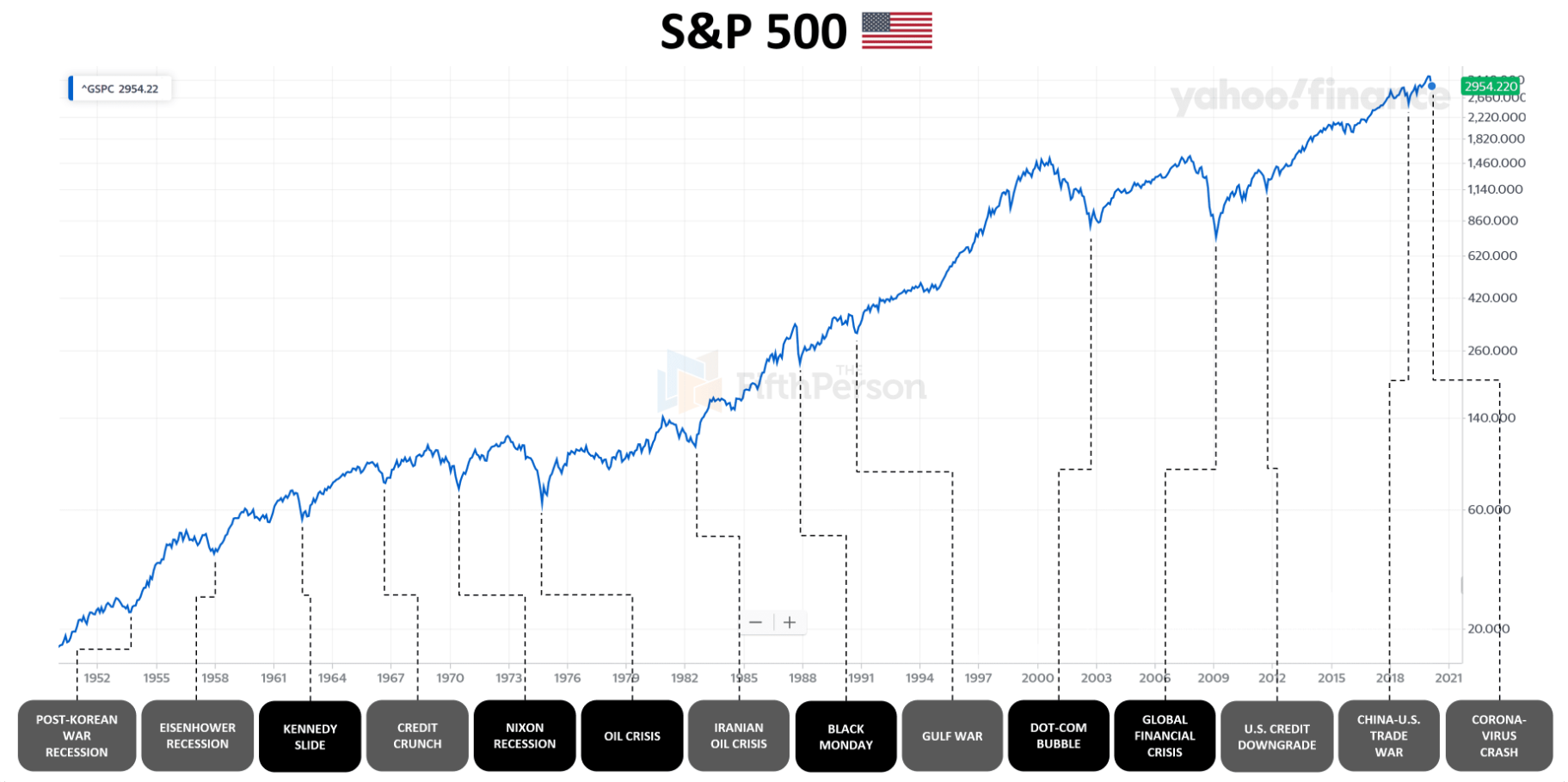

In traditional equity markets, long-term bull markets are suddenly replaced by bear markets. Usually, this is preceded by a significant negative event in the economy or other areas. For example, the bear market of 2008 began after the bankruptcy of one of the largest US banks, Lehman Brothers.

Before 2008, the bear market was triggered by the Dot.com bubble – when the shares of overvalued internet companies began to fall. Pandemics, such as Covid-19, or large-scale war, such as the Russian invasion of Ukraine, can cause a bear market.

Bear and bull markets can vary in length over time. For example, the bear market caused by the coronavirus lasted about a month between late February and late March 2020. After that, it immediately changed to bullish. At the same time, the bear market against the background of Nixon’s economic crisis in the USA lasted for almost a year (between 1972 and 1973). The state of the economies of the world’s most developed countries is usually the best indicator of what the financial market will be like.

Although the causes of bear and bull markets are easy to explain after the fact, predicting them in advance is difficult. The reason for this is the human factor. It is not clear at what exact moment the supply will exceed the demand in the market and cause the first wave of falling prices.

Bulls and bears in crypto markets

The cryptocurrency market is quite young. Cryptocurrencies only appeared at the end of the “zeroes” (if the publication of the Bitcoin whitepaper in 2008 is considered as a reference point).

Sometimes the lack of understanding of the nature of cryptocurrencies by people who trade on exchanges adds to the volatility and instability of this market. Crypto usually follows a similar trend to equity markets in terms of when bear markets are replaced by bull markets. The main difference is the depth of falls and the height of price growth.

For comparison, take the bear market of 2022. The bear market in cryptocurrencies started back in November 2021 and continues now. The bear market in the stock market began a few months later – in January 2022.

From the peak values in February 2022 to the lowest point in June 2022, the S&P 500 index decreased from $4,504 to $3,667, or by 18.6%. At the same time, Bitcoin’s peak price fell from $69,000 to $19,018, or 72.4%.

It is important to note that we are comparing the most stable cryptocurrency to an index that includes 500 companies. If compared to other cryptocurrencies and assets, the difference will be more striking.

Such fluctuations of the crypto market could often be observed since 2017, when various coins and tokens began to gain popularity. Therefore, bearish and bullish cryptocurrency markets are more pronounced in terms of ups and downs.

How to survive bull and bear markets?

Investments are always associated with risks. Investing in stock markets is considered one of the riskiest ways to invest. And the cryptocurrency market has an even greater level of risk due to sharper fluctuations in bearish and bullish stages. The investment strategy depends on the goals, capabilities, and risk tolerance of each investor. At the same time, it is a good idea to limit risks by investing part of the funds in various assets.

An analogy with baskets and eggs is appropriate here: you should never put all the eggs in one basket, because if it falls, all the eggs will break. The same philosophy should apply to investments – it is necessary to invest in different assets. The basic rule is: the greater the risk, the smaller the amount invested.

For example, only 10% of the total amount of investments can be invested in shares and 5% in cryptocurrencies. Other funds are better off buying fixed-guaranteed income instruments like bonds.

This approach makes it easy to pass through bear markets. If there is only a small amount of funds in the crypto, it does not make sense to sell it in a falling market. It is better to wait for the change to the bullish market and then take the profit.

It is important to be patient and not make hasty decisions. By the way, buying in a bear market, when everyone is panicking and selling, is considered the pinnacle of skill.

About the author

Vladyslav Zadorozhniy is the founder of CryptoCrew, the fast-growing educational community on crypto. The team’s main goal is to explain to users that cryptocurrencies are not about “easy and fast money”, but about knowledge, skills, and abilities. They have 103,000 active subscribers in Telegram and 19,000 subscribers on YouTube.

Got something to say about bulls and bears or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.