Bitcoin options expiry day is here, and this Friday, we will see almost $900 million in BTC contracts expiring. Moreover, crypto markets continue to decline, with BTC dipping below $41,000 for the first time in a month, but will it fall further?

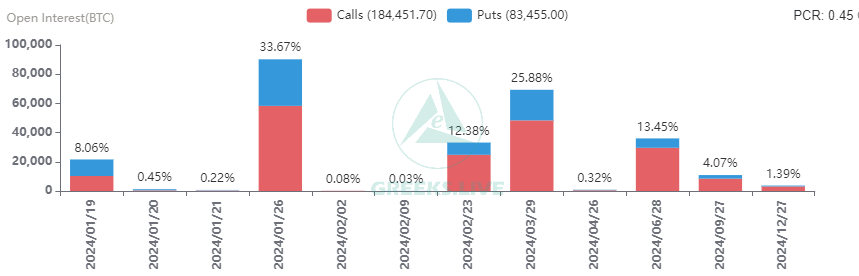

Around 22,000 Bitcoin options contracts will expire on January 19. This week’s expiry event is smaller than last week’s, which saw $1.68 billion worth of contracts expire with little impact on markets.

Bitcoin Options Notional Value Falls

The notional value for this week’s tranche of expiring Bitcoin options contracts is $890 million. Moreover, the put/call ratio is 1.1, which means the bulls and the bears are evenly matched, selling long and short contracts.

The max pain point, which refers to the price at which most losses are made, is $44,000. This is roughly $3,000 higher than the current spot market price.

Greeks Live observed that the impact of the Bitcoin spot ETF launches has dissipated. Volatility has dropped sharply, and major term implied volatility (IV) is plummeting, it added.

Moreover, the put/call ratio reached 1.1 for the first time in the bull market, “indicating that bearish forces prevailed this week.”

The crypto derivatives metric provider added that the long-term outlook is bullish:

“The passage of the Bitcoin Spot ETF looks to bring a lot of incremental capital to the crypto market in the long run, with the selloff in grayscale and support from other ETFs playing off each other, and the next big flashpoint could be a halving of the hype, which is clearly a bullish tone this year.”

In addition to the Bitcoin options, there are 211,000 Ethereum options about to expire. These derivatives have a put/call ratio of 0.55, a max pain point of $2,500, and a notional value of $520 million.

Read more: How To Trade Bitcoin Futures and Options Like a Pro

BTC Price Outlook

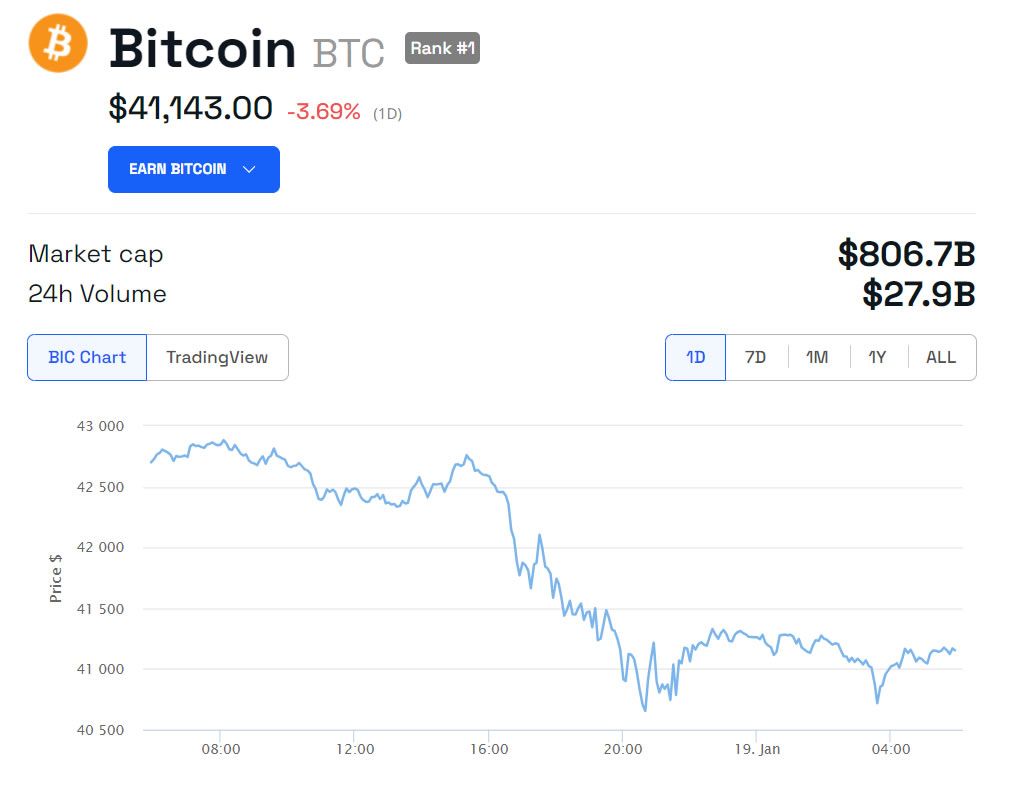

The ETF hype appears to be fading for spot markets, which have declined 3% on the day to $1.7 trillion.

Furthermore, Bitcoin has dropped more than 15% since its yearly peak on January 10. The asset is down 3.7% on the day, trading at $41,143 at press time.

Furthermore, BTC dropped below $41,000 during early trading in Asia on Friday morning. It is the first time it has dipped to this level since December 18, and is currently teetering at monthly support.

Further declines will see the asset drop below $40,000 to find support at around $38,000 in a correction that has been widely predicted.

Read more: 9 Best Crypto Options Trading Platforms