In today’s on-chain analysis, BeInCrypto looks at the metrics of BTC addresses and so-called shrimps. In cryptocurrency slang, these are entities that hold less than 1 BTC. It turns out that currently, the growth of this group of small entities has reached a new all-time high, even surpassing the peak of the historic bull market of late 2017.

In the Bitcoin network’s equally well-known and humorous food chain, shrimps occupy almost the lowest place in the hierarchy – just above plankton. The latter species of cryptocurrency organisms holds less than 0.05 BTC. Although this classification changes with time and the preferences of the authors of different versions, it gives an idea of the size and importance of the various entities of the Bitcoin network.

BTC shrimps are growing in strength

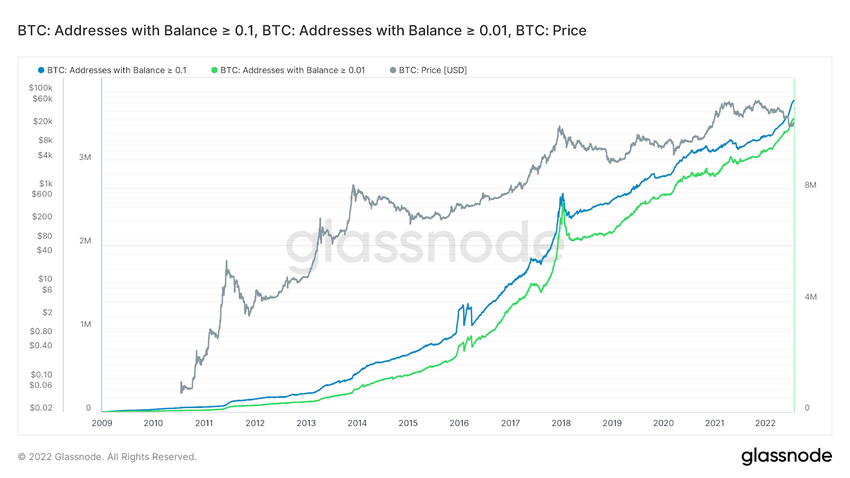

In a recent on-chain analysis, BeInCrypto noted that the number of small-sized BTC addresses has been steadily increasing, despite the deep market correction. Both the number of addresses holding more than 0.01 BTC and those with more than 0.1 BTC have been growing since early 2021.

What’s more, this growth has further accelerated since mid-June 2022. In previous market cycles, this behavior of Bitcoin network entities and addresses has been characteristic of an accelerating bull market. In contrast, during major market corrections, on-chain analysis tended to indicate a slight increase, stagnation, or even a decline in the number of addresses with less than 0.1 BTC.

In a recent tweet, well-known on-chain analyst @WClementeIII published a chart of the 90-day supply change in the hands of users holding 0.1-1 BTC (pink). The chart shows a huge spike in Bitcoin held by shrimps. Current values have surpassed levels from the end of the 2017 bull market, when Bitcoin reached a historic ATH of $20,000.

In the current market situation, BTC is retesting this level after a 70% drop from the ATH at $69,000 in November 2021. Bearish sentiment and extreme fear are creating radically different conditions from the euphoria and extreme greed of late 2017. However, shrimps are behaving almost identically. What’s more, they are scooping up Bitcoin with even more conviction that this is a good time to buy.

Why are shrimps buying BTC?

The extremely different behavior of small entities can be confusing from the perspective of the classic market truth that “the retail is always wrong.” If shrimps were buying BTC at the peak of the 2017 bull market, the big players were the sellers. They dropped their bags, exiting the market at the best possible time.

If, on the other hand, shrimps are accumulating Bitcoin at a record pace after a 70% drop from ATH, who is selling to them? Could it be that the big players are deciding irrationally to sell at the bottom? Or are they expecting further declines? A third option is a thesis that the increase in the number of entities balancing below 1 BTC is not at all indicative of an influx of a huge wave of small, individual investors. It could just as well be a huge number of small addresses that belong to the same person or institution.

The latter possibility was suggested by the famous on-chain analyst, @woonomic in a comment on a tweet by his younger colleague. He wrote:

“Nice, but be aware entities data like this drifts and is over-optimistic towards recent time frames. Takes about 2 years for the drift to stabilize. E.g. small txs are assumed to be a new person then later is found to cluster to an existing person who has more than 1 BTC.”

Cryptocurrency podcast host @VentureCoinist, on the other hand, in his comment under the same tweet, seems to suggest the real possibility of the second option. In his view, shrimps buying BTC is a signal of coming declines:

“I’m going to pretend I don’t see the last time it spiked this high.”

Is the retail right after all?

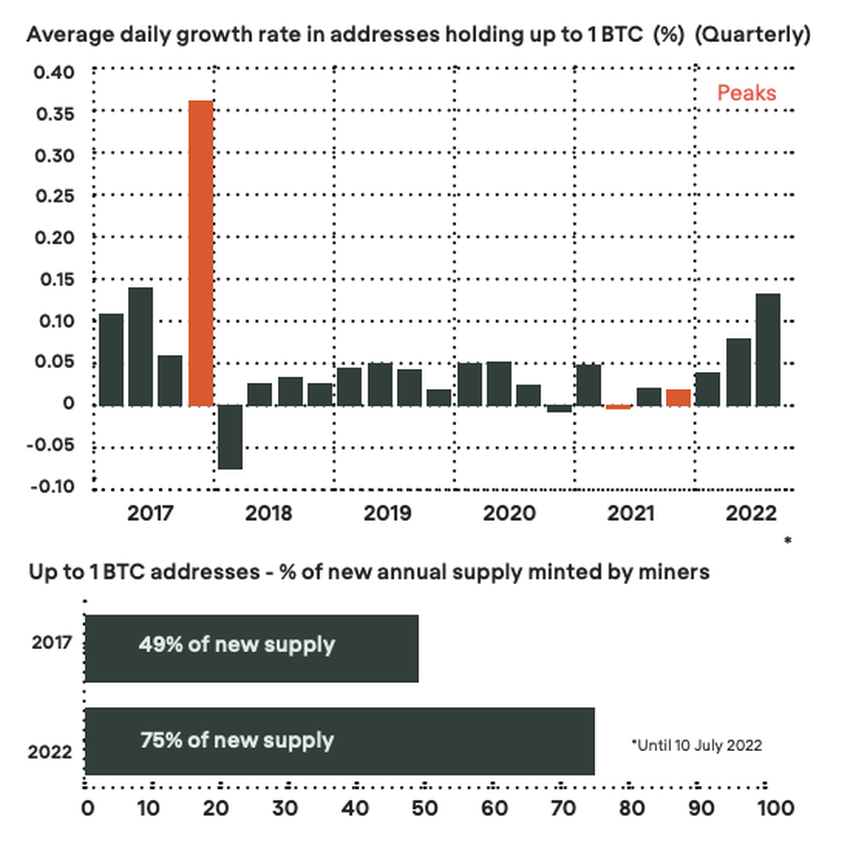

Finally, yet another user @fusillifadi posted data that seems to confirm Clemente’s suggested organic growth in shrimps. Referring to data from Cooper.co, he presented a graph of the average daily growth rate of entities holding less than 1 BTC.

Since the end of 2021, we have seen a clear upward trend in shrimp numbers, which can only be compared to 2017. Despite the fact that the last period of 2017 is characterized here by a much larger increase, this year’s growth surpasses anything from 2018-2021.

It is worth mentioning that according to this data, the main source of Bitcoin acquisition by shrimps are BTC miners. In 2017, 49% of the supply provided by miners was accumulated by entities up to 1 BTC. In 2022, it’s up to 75%. We know from other on-chain data that the capitulation of miners is currently underway. Thus, we get an answer to the question of where shrimps get their Bitcoins from.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.