In today’s on-chain analysis, BeInCrypto looks at indicators that compare the current market situation of short- and long-term Bitcoin (BTC) holders. The goal is to try to determine what stage of a bear market BTC is in.

Historical on-chain analysis shows a constant tension between the two types of holders, for which the demarcation line is 155 days. During bull markets, long-term holders (LTHs) systematically sell their BTC in favor of short-term ones. They realize profits, reduce risk, and usually get rid of most of their assets at the peak of the bull market.

Conversely, short-term holders (STHs). They sell off their BTC during a bear market in favor of long-term holders who accumulate throughout this period. In contrast, they are happy to buy when the price is rising, as they assume the uptrend will continue. At the peak of the bull market, they are left with expensive bags of coins that lose value dramatically. In contrast, at the bottom of a bear market, they are left with almost no funds.

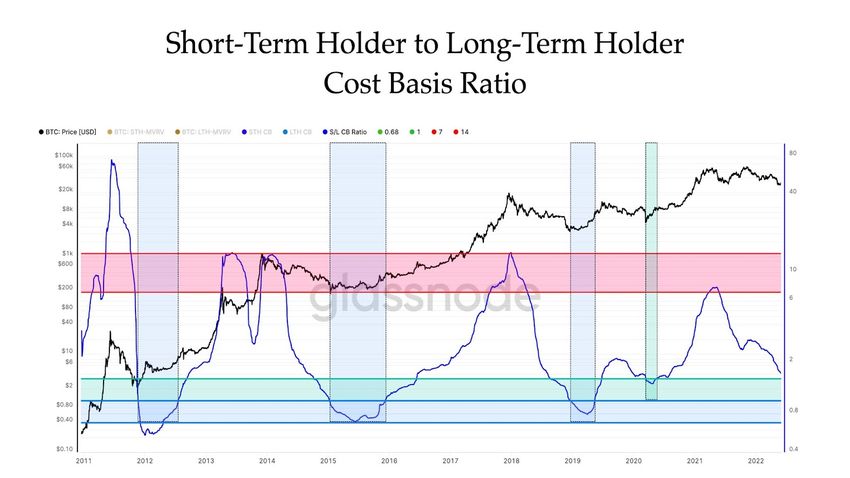

The ratio between short-term and long-term holders

The historical relationship outlined above is illustrated by a chart of the ratio between short and long-term holders. It is a chart of the amount of circulating supply held by long and short holders in profit or loss.

In the previous bear markets of 2014-2015 and 2018 and the crash of 2020, reaching the green area was associated with the process of BTC hitting the bottom. The green area is in the range of 0.25-0.28 and indicates a situation where most of Bitcoin’s supply (more than 70%) remains in the hands of long-term holders.

Bitcoin analyst and enthusiast @StackSmartly wrote in a comment to this chart that “short-term holders are essentially dead.” He then added, “Only smart money survived. Healthy sign for #Bitcoin.”

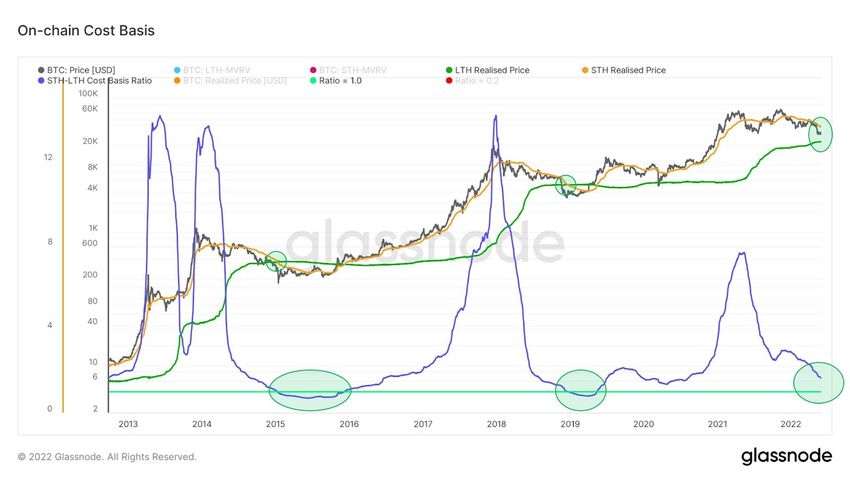

Cost basis

Another indicator that helps estimate the stage of a bear market for Bitcoin is the so-called cost basis for two types of holders. In financial jargon, cost basis is used for determining whether an investment was profitable or not. Cost basis helps to calculate capital gains or losses, which is the difference between the sale price and the purchase price.

Looking at the on-chain indicators that calculate the cost basis for two types of BTC holders, we see two different values. For long-term hodlers, the current cost basis (green line) is around $22,000. This means that despite the ongoing declines, long-term holders are still making profits in the market.

In contrast, for short-term holders, the cost basis (orange line) is just below $40,000 today. This implies that they are recording a loss, as the coins they hold are below the purchase price.

STH-LTH cost basis ratio

An additional indicator of the overall health of the BTC market is the so-called STH-LTH cost basis ratio (blue line). It is calculated as the ratio of the realized LTH and STH price. Historically, when the orange STH line crossed below the green LTH line, the STH-LTH cost basis ratio determined the best opportunities to buy Bitcoin (green and blue areas).

In the current market situation, with the BTC price near $30,000, the two lines have not yet crossed and the STH-LTH cost basis ratio has not fallen to a historical low. This indicates that the BTC price needs to potentially fall to lower levels in order to repeat conditions from the end of previous bear markets.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.