A look at On-Chain metrics for Bitcoin (BTC), specifically Coin Days Destroyed (CDD), to determine the long-term holders’ behavior.

CDD suggests that long-term holders took profit near the $40,000 high of Dec. 2020. After that, they have stayed relatively dormant.

Coin Days Destroyed – CDD

CDD is a measure of liveliness as it pertains to transactions. Unlike simple transaction volume, it places more importance on coins that have not been spent for a long period of time.

Therefore, coins held for long periods are believed to be more important than those that are not. This is because their spending signals a change in the behavior of long-term holders.

The indicator is calculated in this manner:

- Each day that a coin remains unspent, it accumulates one ”coin day”.

- Afterward, these accumulated ”coin days” are ”destroyed” when the coin is spent, hence the name ”Coin Days Destroyed”.

For example, one BTC that is not spent for 100 days has accumulated 100 coin days. Similarly, 0.5 BTC that is not spent for 200 days also accumulated 100 coin days.

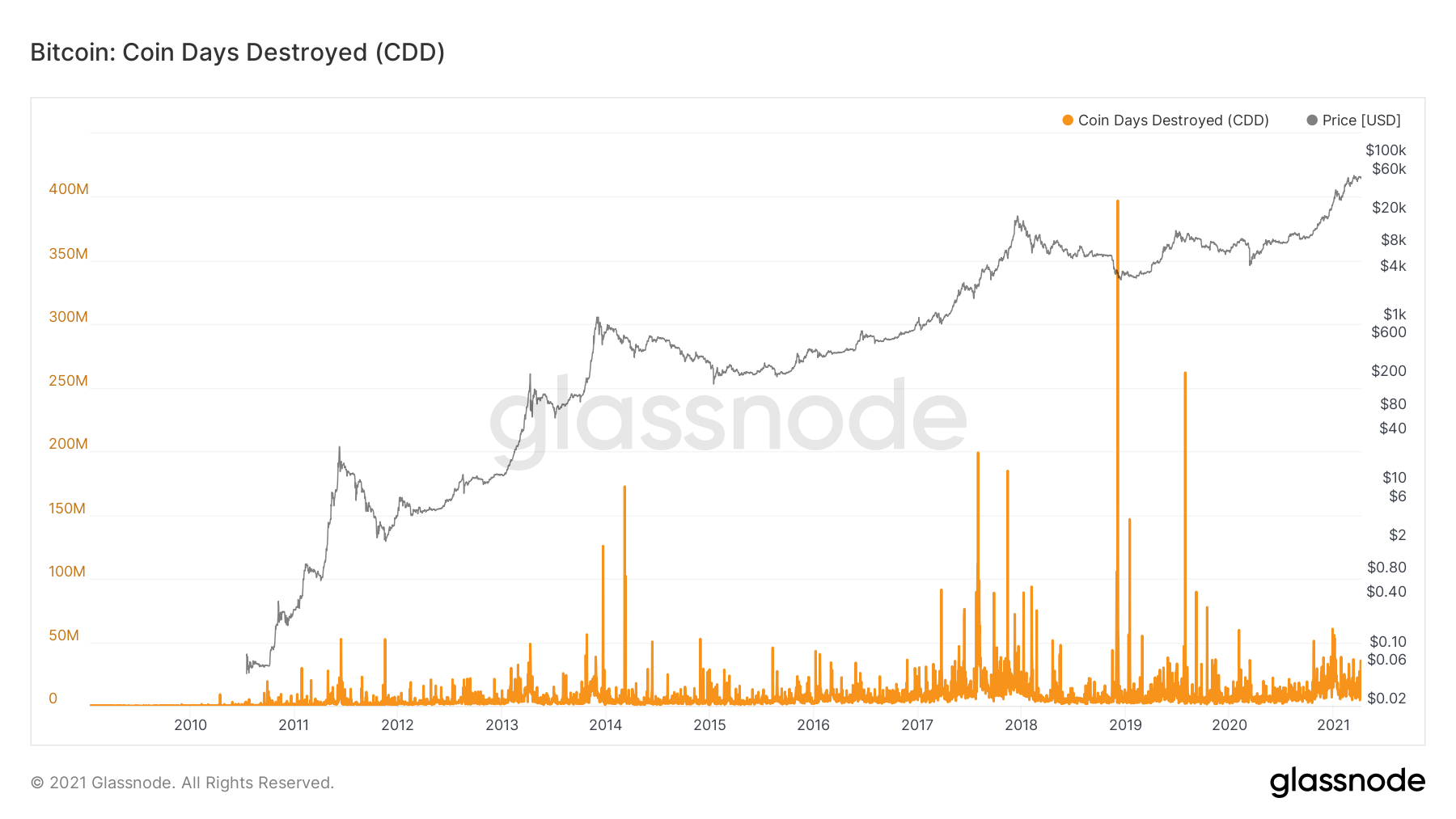

A look at CDD throughout the price history of BTC shows two distinct peaks.

- Dec. 4, 2018 – 397 million CDD

- Jul 29, 2019 – 261 million CDD

The Dec. 4 peak seems to be more akin to capitulation since the BTC price was trading at $4000 at the time. On the other hand, the Jul. 29 peak seems to be holders taking profit after a significant upward movement that took BTC to $9500.

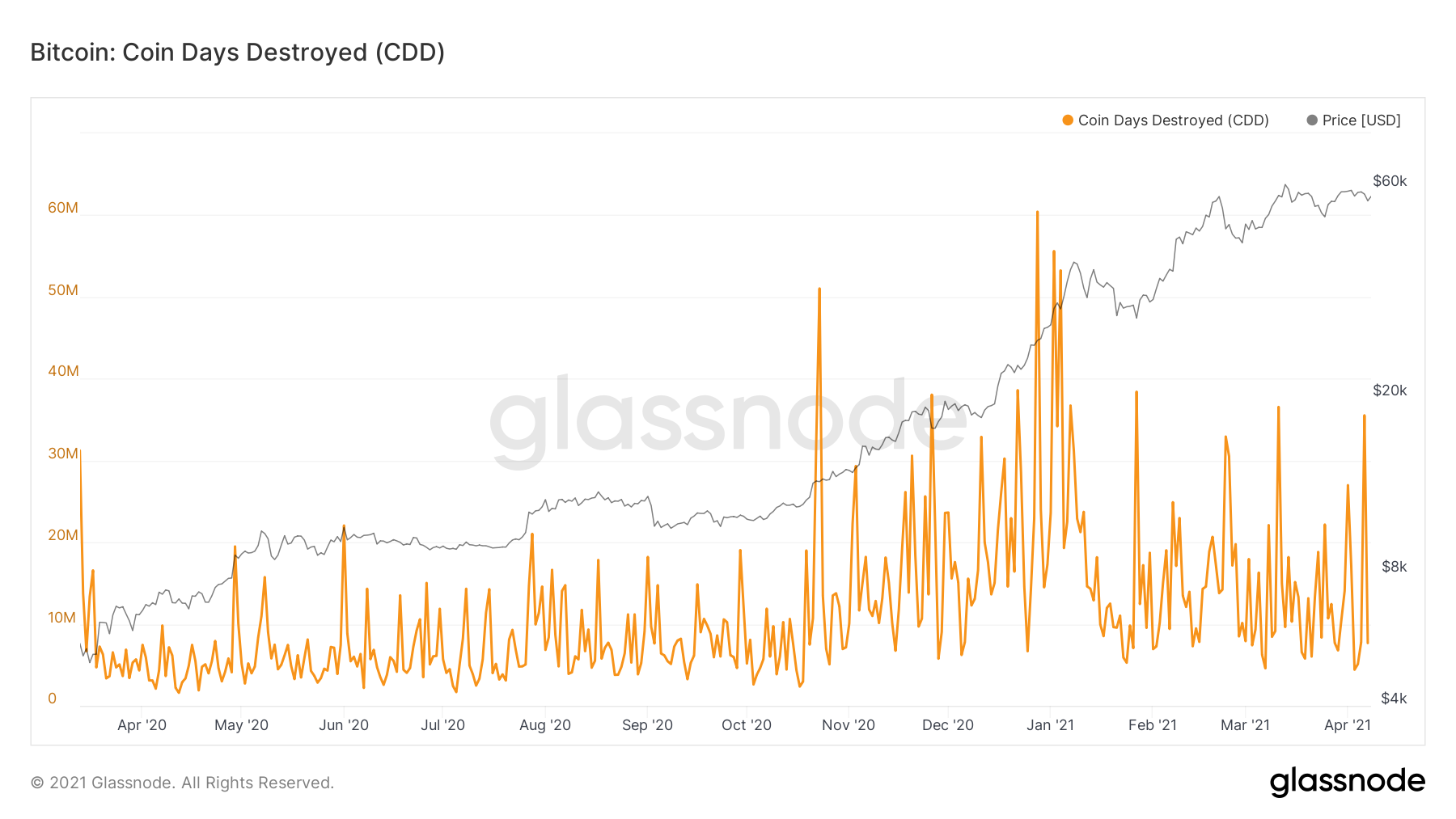

2020 CDD

A closer look at the indicators since the upward movement began in 2020 shows that even the current CDD is relatively low.

Three distinct peaks were reached at the end of Dec. 2020 beginning of Jan. 2021, with highs of 60, 55, and 53 million CDD. However, it has decreased afterward.

This is interesting since it shows that long-term hollers took profit near the $40,000 top but have been holding since. The $61,000 all-time high was not combined with profit taking by long-term holders.

Coin Years Destroyed – CYD

Coin Years Destroyed (CYD) is simply a 365 days rolling sum of CDD.

It reached a peak of $6.728 billion on Feb. 22, 2018. Since it is a one-year rolling sum, this measured all the profit-taking done throughout the bull run, leading to the 2018 peak.

An interesting observation is that it has decreased considerably afterwards.

It reached a bottom on Aug – Sept. 2020. At the same time, it has been increasing since it has yet to reach the 2019 peaks.

Therefore, when looking at this long-term indicator, we can determine that the current amount of selling significantly lags behind that in the 2018 bull run.

Conclusion

To conclude, both CDD and CYD suggest that long-term holders’ current behavior is very unlike that near the peak of the previous bull markets.

Therefore, judging by these two indicators, the top is not yet in.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.