In this article, BeInCrypto looks at on-chain indicators, more specifically the number of addresses holding different quantities of BTC, in an attempt to isolate patterns of prior bull cycles.

The number of addresses holding bitcoin (BTC) has been increasing steadily since December 2018. The behavior of addresses holding a small number of BTC and those holding large numbers have differed considerably throughout the May correction.

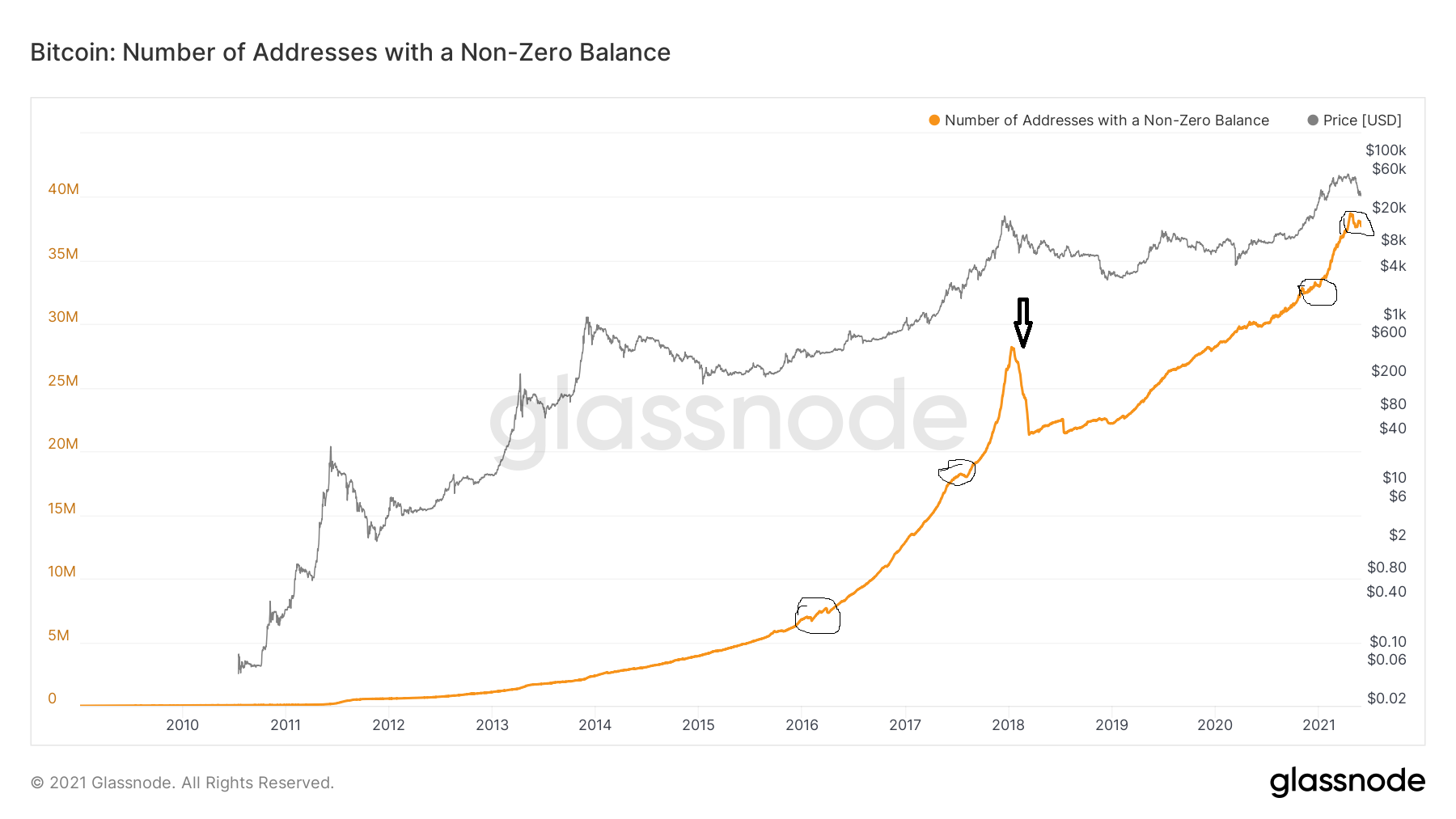

Total number of BTC addresses

The number of non-zero BTC addresses has decreased slightly since the April 14 all-time high. Historically, this figure has generally mirrored the price movement. Therefore, the biggest decrease was seen after the 2018 top.

After the beginning of the 2015 bull run, there were two minor decreases and one major dip. The third instance occurred right after the then all-time high price of $20,000 was reached in December 2017.

In the current bull run, there have been two minor decreases (circled in black). Therefore, if the pattern holds true, it’s imperative that a lower low is not created. In that case, another significant upward movement could follow before the final top

This would also fit with other long-term on-chain indicators, which suggest this is only the middle of the bull run.

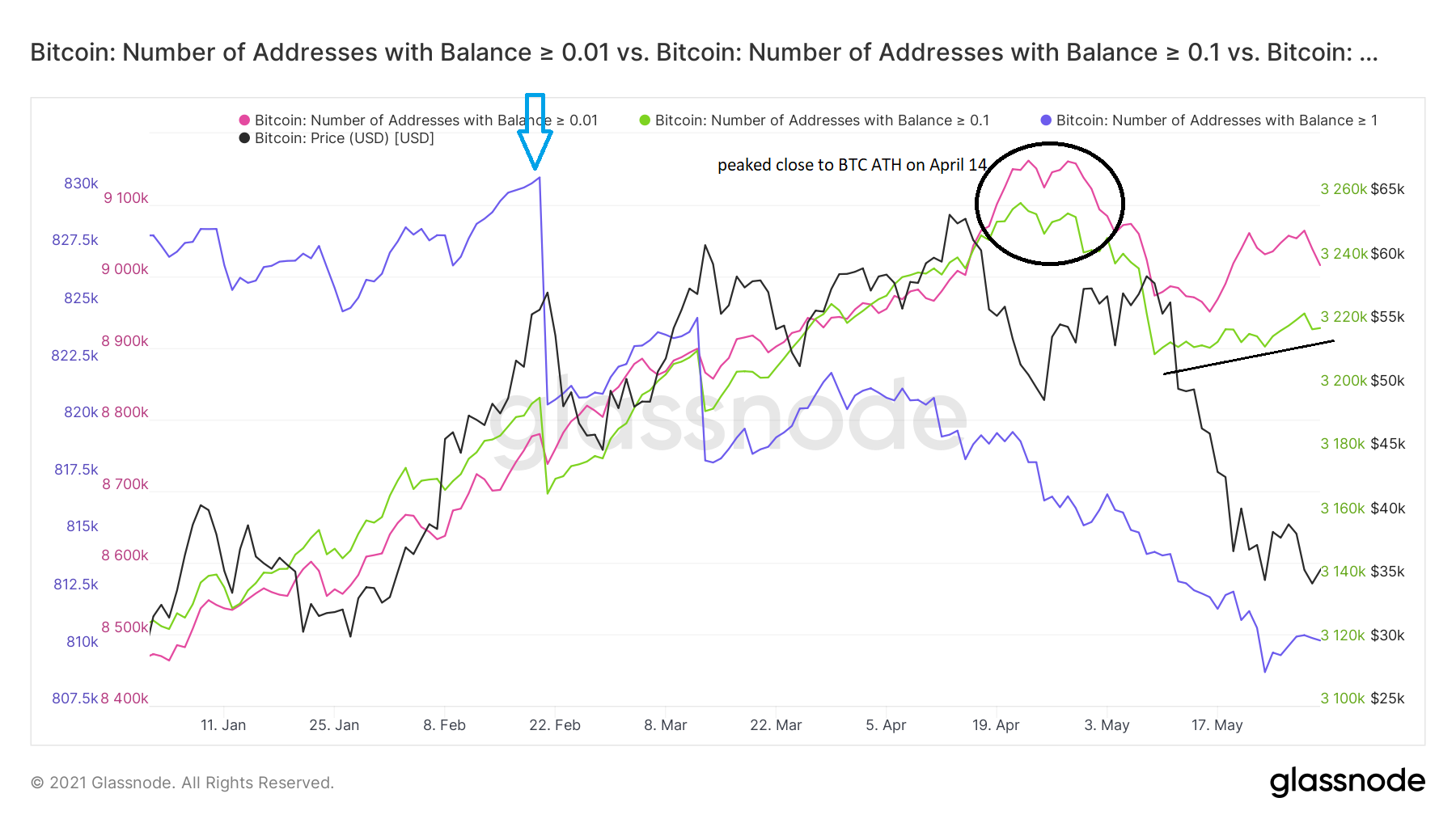

Addresses categorized by quantity

The number of addresses that hold relatively small quantities of BTC, meaning from 0.01 to 1 BTC peaked near the April 14, 2021 all-time high (black circle).

This figure has decreased considerably since. However, the decrease ended on May 13. Therefore, despite the ongoing price decrease, participants are not yet completely liquidating their holdings but are rather holding at a loss (black line).

The number of accounts holding more than one BTC (blue) peaked much earlier, on Feb. 21, when the price was close to $50,000. It has been decreasing since.

This is likely due to the bigger accounts having accumulated earlier and as a result selling in profit during the upward movement.

This is even more evident when looking at larger accounts with holdings above 10 BTC.

The largest accounts, those holding over 10,000 coins, actually bottomed during April 14 (black). Therefore, while small accounts were at a peak, the number of accounts with very large holdings was at a low, since it is probable they sold the run-up to the all-time high.

However, the number of accounts holding over 10,000 BTC has been increasing steadily since. The number of accounts holding over 1.000 coins also bottomed on May 19 (blue) and has been increasing since.

The trend of accounts holdings 10 to 100 BTC was similar to those holding 1-10, meaning that it peaked in March and has been decreasing since.

To conclude, there is a distinct pattern in place that shows the different behavior of small and large accounts. While the former have been selling during the correction, the latter have been buying the dip.

For BeInCrypto’s previous bitcoin analysis, click here.