Investors celebrated the latest inflation report from the United States, which came in below market expectations.

The consumer price index (CPI) rose 0.1% in November, according to the U.S. Bureau of Labor Statistics. This was lower than the 0.3% figure expected by economists, and the 0.4% increase recorded in October. Meanwhile, CPI rose 7.1% year-on-year, versus an estimate of 7.3%, and down from 7.5% in October.

Market reactions

Markets reacted jubilantly to the prospect that inflation could finally be weakening its hold on the economy. The 10-year Treasury bond yield fell below 3.5% after the results were released, while U.S. stocks futures soared. For instance, futures tied to the S&P 500 jumped 2.8%, while futures tied to the Dow added 2.2%. Nasdaq-100 futures also rose 3.8%, which suggested a jump for tech stocks overall.

As the inflation data reflected weakening economic growth in the United States, foreign currencies managed to gain on the dollar. For example, the British pound and the Euro both achieved six-month highs against the US dollar. The euro was up 1.2% to 1.0663 against the dollar, while the sterling was 1.3% higher to 1.2432, within an hour of the inflation data. European stocks were also up, as the pan-European Stoxx 600 jumped 1.6%, as all sectors and major bourses climbed.

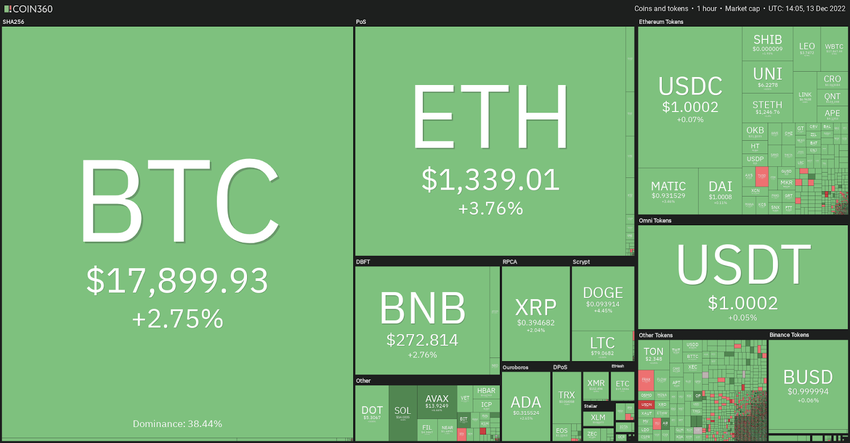

Cryptocurrency markets also responded enthusiastically to the news. Within 30 minutes of the release of the inflation data, Bitcoin rose some 2.75%, while Ethereum jumped 3.76%. Over the past day, total cryptocurrency market capitalization rose 3.5% to just over $900 billion.

Waiting on the Fed

Weakening inflation is a welcome economic indicator to many, as it has made this past year one of the most economically difficult for some time. Not only has rampant inflation raised the prices of most basic goods and services, but its remedy has also been painful.

In an effort to tame persistent inflation, the U.S. Federal Reserve started aggressively pursuing monetary policy tightening. During its last three meetings, the Fed consecutively raised interest rates by 75 basis points. Now, with inflation reported as lower than expected, many feel confident the monetary authority will follow through with an easing.

During its final session of the year, economists expect the Federal Reserve to raise interest rates by just 0.5%. Similar decisions will also be made later this week by the Bank of England, the European Central Bank, and the Swiss National Bank.