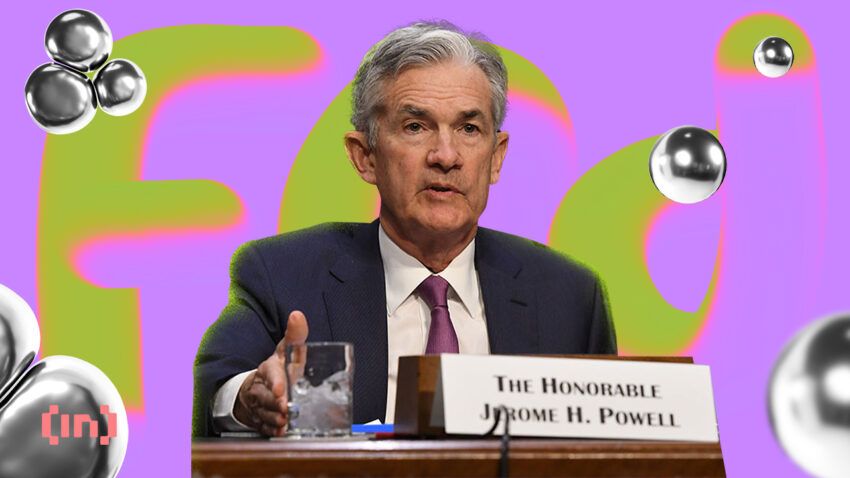

Cryptocurrency markets were buoyed in anticipation of positive remarks from Federal Reserve (Fed) Chairman Jerome Powell.

Update 30 Nov. (19:00UTC): Federal Reserve Chair Jerome Powell stated that the Fed could expect to lift interest rates by half a percentage point in December. The increase would be smaller than the last four increases. Powell also commented on the labor market needing to cool down in order to determine if inflation would decrease towards the 2% goal.

At the time of updating, the crypto market remained steady on the day, with Bitcoin touching $17,000, up 3.30% on the day. While Ethereum was up 5.63% touching $1,285.

Market analysts expect that Powell will shed light on what steps the Fed will take at its upcoming policy meeting. During the past four meetings, the central bank raised interest rates by 0.75 percentage points to aggressively combat inflation.

Now, the Fed is expected to slow the pace of its monetary policy tightening, with a 50 basis points raise. As financial markets have rallied in anticipation of this development, so, too, have crypto markets.

Markets Anticipating Powell’s remarks

Future markets jumped in anticipation of Powell’s speech, with Dow Jones Industrial Average futures rising 38 points, or 0.14%. Meanwhile, S&P 500 futures and Nasdaq 100 futures climbed 0.2% and 0.4%, respectively.

Crypto markets seem even more positively predisposed to the Fed chair’s upcoming remarks. Bitcoin rose over 2% over the past 24 hours, while Ethereum netted a nearly 4% boost. XRP, Dogecoin and Cardano also saw gains of 1.5%, 1% and 0.85% respectively.

Meanwhile, overall cryptocurrency market capitalization rose 1.7% in the past day to $888 billion.

Next Moves From the Fed

Powell will give his speech at the Brookings Institution, a think tank, at 1:30 p.m. Eastern Standard Time. His remarks will come just two days prior to the release of the Nov. unemployment numbers from the U.S. Labor Department.

These will give some indication of whether the Fed’s aggressive approach has had a measurable impact on the labor market. The release of Nov’s consumer price data, in less than two weeks, will also demonstrate the Fed’s effects on inflation.

While these numbers could still affect the Fed’s upcoming decision, economists believe it will proceed with a half-point rate hike. However, much speculation remains about how the Fed will continue into next year, which Powell’s remarks could shed light on.

Many commentators believe that if indicators remain steady, the Fed will continue to downshift at its first meeting of 2023.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.