The Brazilian Securities and Exchange Commission (CVM) has approved the launch of the world’s first spot Solana-based exchange-traded fund (ETF).

The financial product is still in its pre-operational phase, awaiting final approval from Brazil’s main stock exchange, B3.

Brazil Aims to Lead the Crypto Market

The spot Solana ETF is managed by Brazilian asset manager QR Asset, with Vortx handling its operations. The product will mirror the CME CF Solana Dollar Reference Rate. The index is a benchmark rate that aims to provide a reliable value of Solana in USD.

Consequently, this move highlights Brazil’s proactive approach to regulated crypto investments and its ambition to become a leader in the field.

Theodoro Fleury, Chief Investment Officer of QR Asset, expressed his enthusiasm about the ETF’s introduction.

“This ETF reaffirms our commitment to offering quality and diversification to Brazilian investors. We are proud to be global pioneers in this segment, consolidating Brazil’s position as a leading market for regulated investments in crypto assets,” Fleury said.

Read more: Solana ETF Explained: What It Is and How It Works

The initiative marks an important step in integrating Solana into mainstream financial systems. Notably, this ETF is the first Solana-based product in Brazil.

Over recent years, Brazil has demonstrated a strong inclination toward such pioneering financial products. B3 has been instrumental in adopting crypto trends, having listed several ETFs, including a Bitcoin ETF and an Ethereum ETF, between 2021 and 2022. Most recently, in March 2024, it began offering BlackRock’s iShares Bitcoin Trust ETF (IBIT).

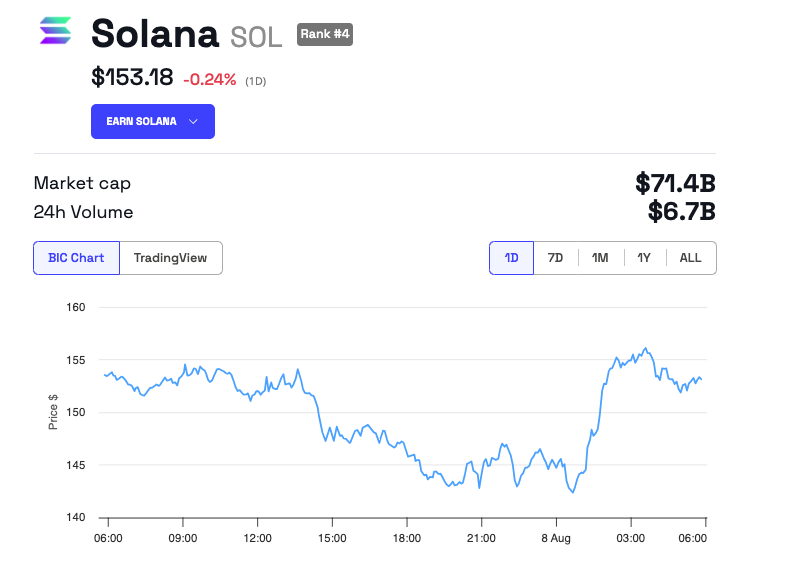

Despite this development, there has been no notable impact on the price of Solana. As of writing, it is trading at $153, down by 0.24% in the past 24 hours.

Meanwhile, the US is witnessing similar developments in the Solana ETF space. In June, investment firms VanEck and 21Shares filed for a spot Solana ETF with the US Securities and Exchange Commission (SEC). Additionally, in July, the Chicago Board Options Exchange (CBOE) filed form 19b-4s for Solana ETFs with the SEC, inviting public comment on this rule change proposal.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

Moreover, the regulatory outlook for altcoins like Solana in the US might be improving. A recent adjustment in the SEC’s lawsuit against Binance, which exempted Solana and certain other altcoins from being classified as securities, has fueled optimism about the regulatory future of these digital assets.

Consequently, experts are optimistic about these developments smoothing the path for future Solana ETF approvals.

“Since SOL is no longer classified as a security, SOL ETFs may be regulated according to the “commodity model,” similar to what BTC and ETH have already experienced. Of course, this does not directly identify ETH and SOL as commodities; it is just that their regulatory authority will be dominated by the CFTC rather than the SEC. Under the premise that the CFTC endorses SOL, the approval and listing of SOL ETFs will become smoother,” Griffin Ardern, Head at BloFin Research & Options, told BeInCrypto.”