Popular Solana-based meme coin Book of Meme (BOME) has consolidated within a price range since April 9, forming a horizontal channel.

At press time, the meme coin trades at $0.0084, poised to fall below a critical support level.

Book of Meme Seeks a New Price Low

When an asset trends within a horizontal channel, its price fluctuates within a relatively narrow range, bouncing between a resistance level at the top and a support level at the bottom. It happens when a relative balance between buying and selling pressures prevents the asset’s price from trending strongly in either direction.

BOME has faced resistance at $0.014 and found support at $0.008. The last time the meme coin traded below this support level was on June 24, when it closed at $0.0072.

With a growing bearish bias toward BOME, its bulls may yet be unable to defend this critical support level.

Readings from the token’s Directional Movement Index (DMI) confirm this. As of this writing, BOME’s negative directional index (red), at 24.77, is above its positive directional index (blue), at 15.19.

Read More: BOOK OF MEME (BOME) Price Prediction 2024/2025/2030

An asset’s DMI measures the strength and direction of its price trends. When it is set up this way, it means that the asset is experiencing a stronger downtrend than upward pressure. This is a bearish signal that shows sellers are more dominant than buyers. It is often interpreted as a sign to exit long positions and consider short ones.

Further, the decline in BOME’s Price Volume Trend (PVT) indicator confirms the current bearish sentiment toward the meme coin.

An asset’s PVT is also a momentum-based indicator that measures an asset’s price trends. When it is declining, it implies that selling pressure is increasing, indicating a bearish trend.

BOME’s PVT initiated its most recent decline on June 27 and has since trended downward. At press time, the indicator’s value is -13.57 billion.

BOME Price Prediction: Only a Shift in Sentiment Can Save this Meme Coin

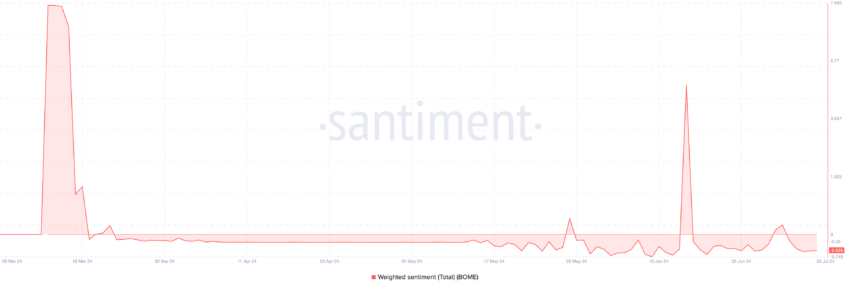

BOME’s mentions across social media platforms are currently plagued by negative emotions. This is based on readings from its weighted sentiment, which is -0.53 as of this writing.

The metric measures the overall mood of the market regarding an asset. It tracks the sentiment trailing the asset and the volume of social media discussions.

When its value is below zero, most social media discussions about the asset are fueled by negative emotions like fear, uncertainty, and doubt. This is a known precursor to a continued price decline.

If this trend continues, BOME may fall to support at $ 0.008 and even trade below it.

Read More: How to Buy BOOK OF MEME (BOME) and Everything Else To Know

However, this projection will be invalidated if the meme coin sees a shift in market sentiment from bearish to bullish. This may push its value up to $0.009.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.