After an extended period of price decline, marked by the formation of a descending triangle, the popular meme coin Book of Meme (BOME) has initiated a rebound.

It is poised to cross above the upper line of the triangle, which has formed resistance since May 28. In the last week, the altcoin’s value has surged by almost 10%.

SponsoredBook of Meme Makes a Move Toward Resistance

When lower highs and lows connect to create a downward-sloping trendline, an asset’s price movement forms a descending triangle. This is a bearish signal that suggests a spike in selling pressure.

The downward-sloping trendline represents resistance, while the horizontal line forms support. In BOME’s case, it faced resistance at $0.015 and found support at $0.008.

As of this writing, the meme coin trades at $0.009, having seen a 6% uptick in price in the past seven days.

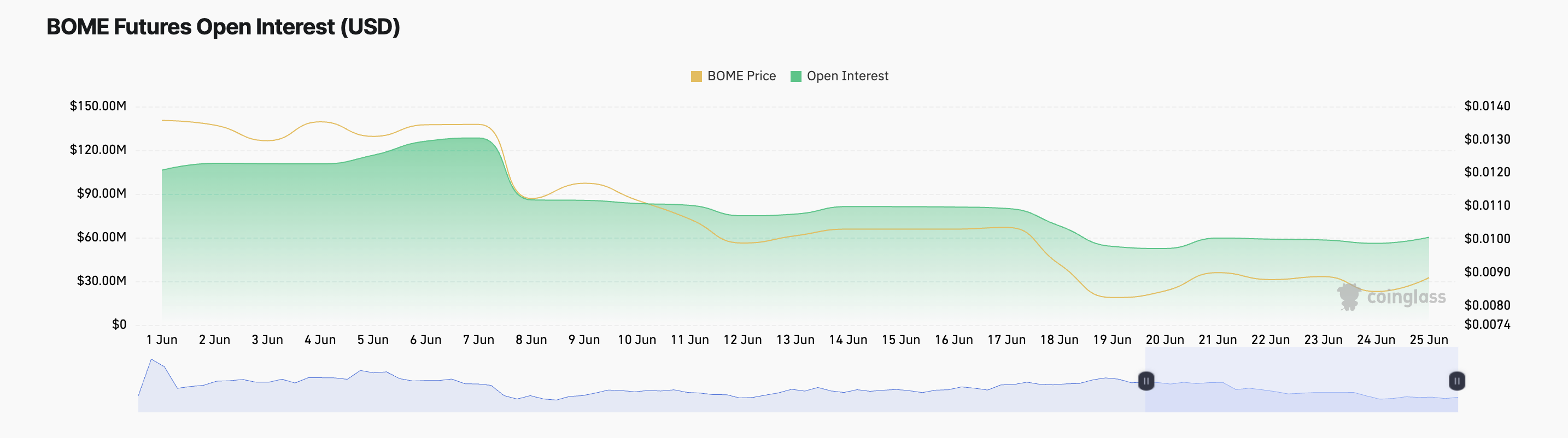

The resurgence in activity around BOME can also be gleaned from its futures open interest, which has trended upward during the same period.

SponsoredCurrently, BOME’s futures open interest is $60.25 million. In the past six days, this has increased by 14%.

Read More: BOOK OF MEME (BOME) Price Prediction 2024/2025/2030

Open interest measures the total number of outstanding futures or options contracts that have not been settled or closed. When it rises, it suggests an influx of traders opening new positions.

This leads to more active contracts in the market. It is a bullish signal, which implies a spike in market activity and traders’ interest.

SponsoredBOME Price Prediction: Look Before You Leap

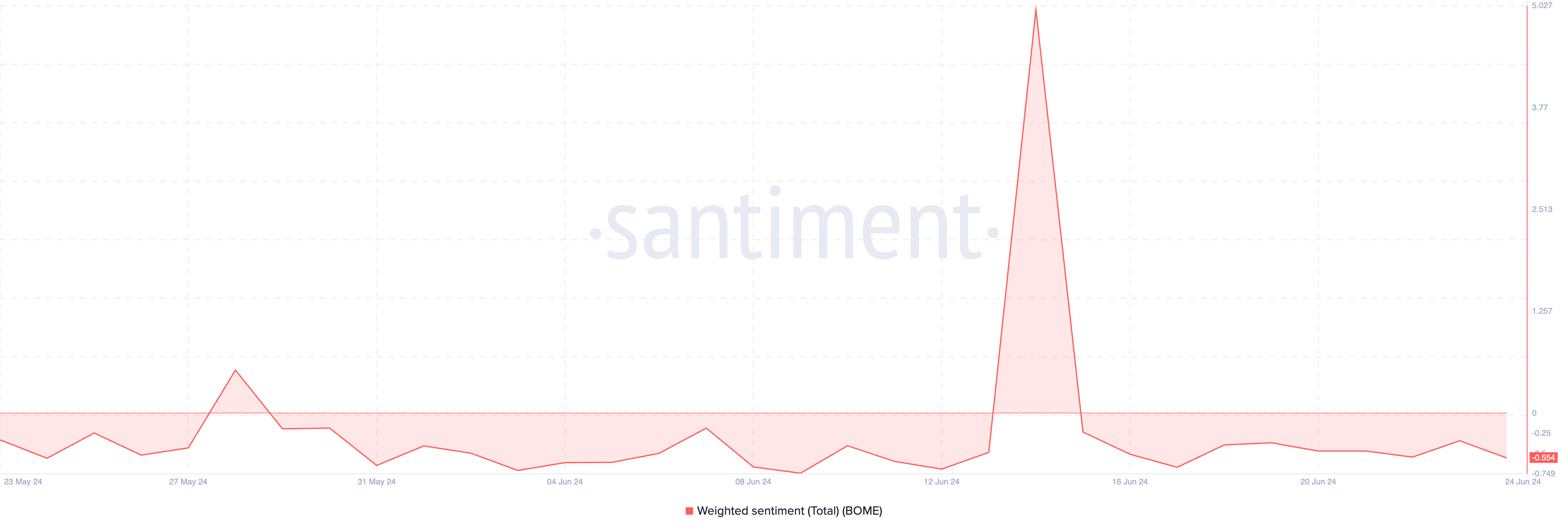

Although BOME has witnessed a minor rebound in the last week and appears ready to trade above resistance, the bearish bias toward it is still significant.

On-chain, its weighted sentiment has been below zero since June 16. As of this writing, the metric’s value is -0.55.

This metric measures the overall positive or negative bias in discussions about a crypto asset on social media platforms. When it is negative, it suggests that most mentions about that asset express negative emotions like fear, uncertainty, and doubt (FUD).

For any significant rally in BOME’s price, sentiment has to shift from bearish to bullish.

If this happens and buying activity gains momentum, the meme coin will rally past resistance to trade above $0.01.

However, if bearish sentiment persists and the bears manage to force a correction of BOME’s current gains, its price will plummet toward support at $0.008.