BNB price jumped 3% on April 21 as bullish investors look set to invalidate the bearish sentiment in the altcoin market. Can the BNB bull rally find enough momentum to overpower the bearish resistance at $340?

BNB chain is a distributed blockchain network created and supported by Binance. Primarily, the BNB chain enables developers to build and host decentralized applications.

On April 21, the price of its native BNB coin surged 3% as markets reacted to Binance’s confirmation of the $1 billion deal to purchase the assets of the defunct crypto lender, Voyager. Among other on-chain indicators, the spike in trading activity across the BNB chain network signals a potential shift from the recent bearish outlook.

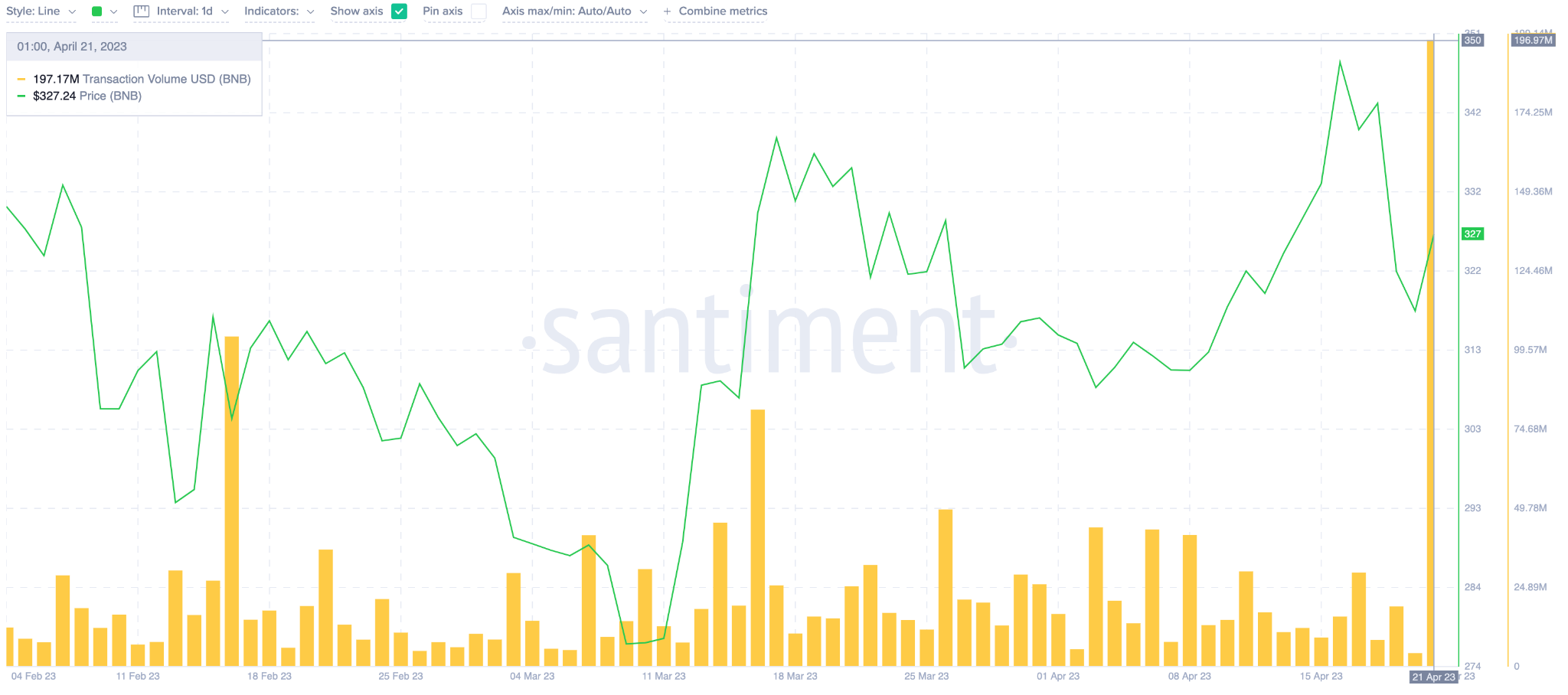

BNB Trading Activity Reaches a 3-month High

The volume of daily transactions on the BNB network has spiked toward $200 million for the first time since early February. The Transaction Volume metric aggregates the dollar value of all transactions carried out on a blockchain network daily.

A spike in trading volume suggests heightened interest in the asset, and investors may be willing to pay higher prices.

Looking closely at the historical data, the last time BNB daily transaction volume crossed $200 million was on Jan 31. And the price rose by another 7% before retracing. If this pattern repeats, the BNB holders can expect some upside in the coming days.

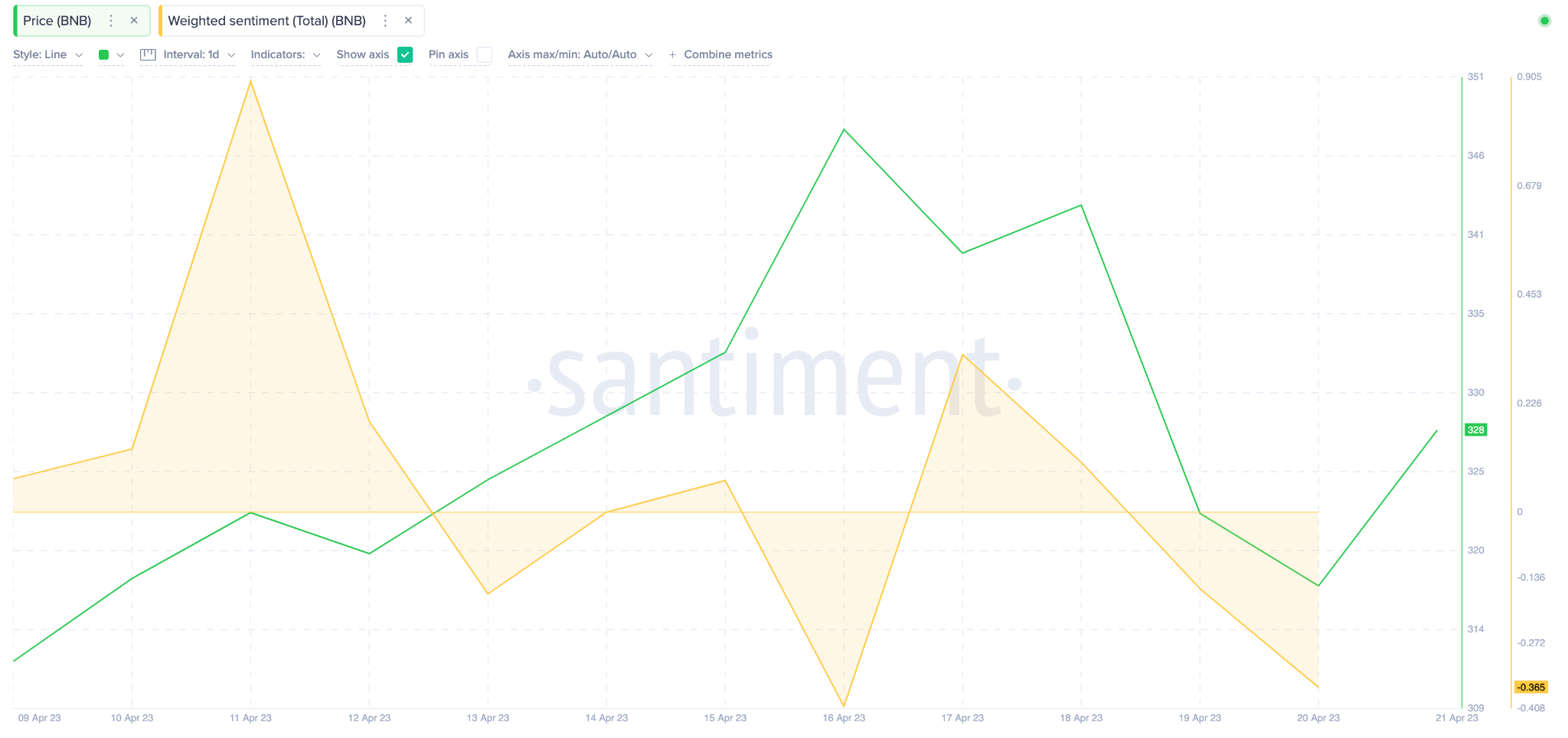

Negative Sentiment Dominates the Altcoin Market

Over the past week, the global cryptocurrency market cap has declined by 7%, sparking bearish concerns across the altcoin market. On-chain data shows that BNB has not been left out. The BNB Weighted Sentiment has trended near zero in the last 7 trading days.

Weighted Sentiment tracks stakeholders’ perceptions about an asset’s price prospects by measuring the ratio of positive social mentions to negatives.

When Weighted Sentiment trends are negative for an extended period, it often signals that this market may be oversold. This could mean that BNB is due for a bullish reversal.

In summary, the negative sentiment and spike in BNB trading volume may create a unique buying opportunity for savvy investors.

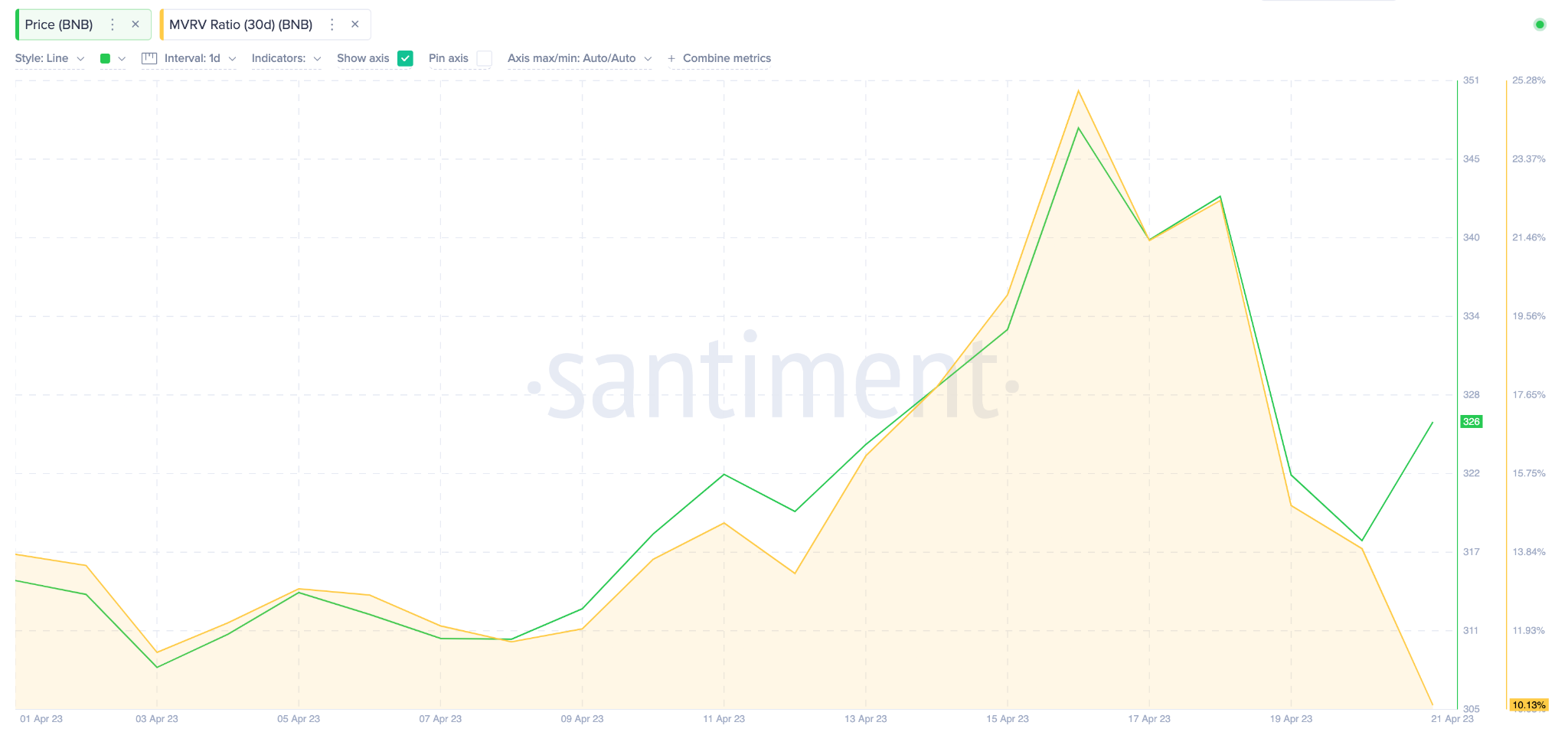

BNB Price Prediction: Holders could hold out for $340

Bullish holders have fiercely defended the $315 support level in the past week. And Santiment’s Market-Value to Realized-Value (MVRV) data indicates they could now push for more gains.

As things stand, most XRP holders bought in the last 30 days are sitting on profits of about 10%. The chart below shows they would likely hold out for 5% more gains before selling once BNB price approaches $340.

But if BNB breaks that resistance, the bulls can push the rally toward the $365 zone before they start booking profits.

Still, the bears can negate the bullish stance if BNB price can drop below $315. However, investors looking to keep their profits above the 3% range could provide support at that zone.

If that support level gives way, XRP could decline further toward the 2% loss range at $300. Here, however, holders may choose to cut their losses and inadvertently trigger a rebound.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.