Binance Coin (BNB) has stayed above $600 since November 8 but has struggled to retest $700 or near its all-time high.

This stagnation has left many BNB holders disappointed, raising the question: can BNB reach a new peak?

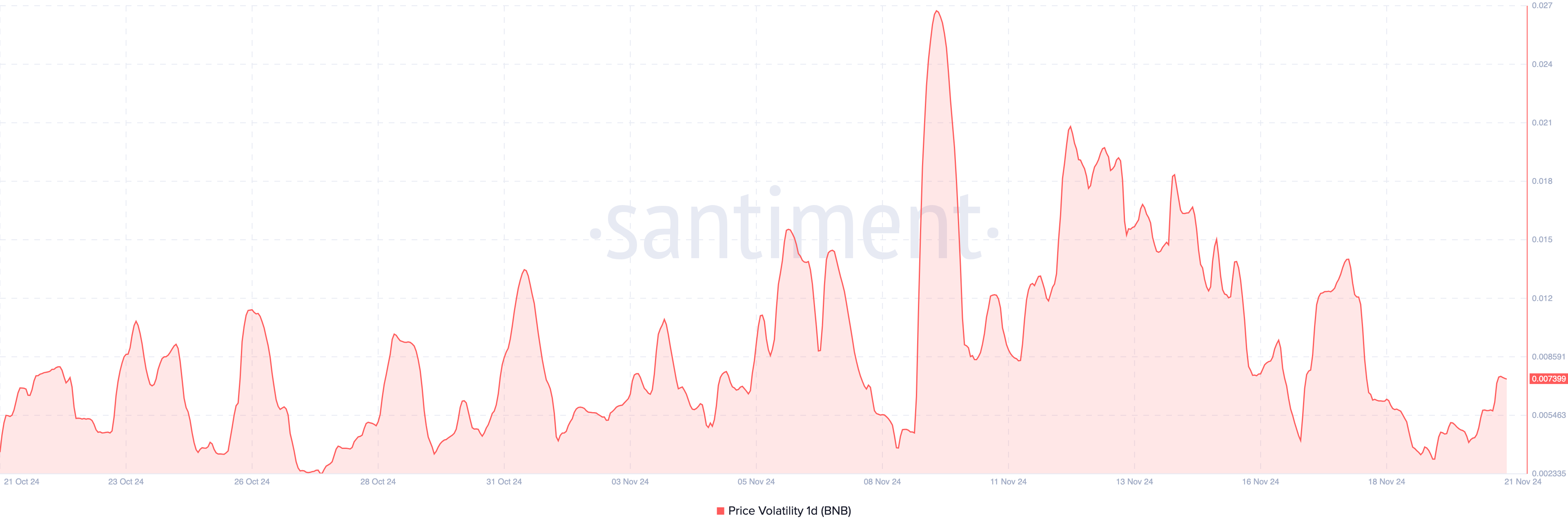

Binance Coin Experiences Low Volatility, Falling Interest

While BNB trades around $612, the volatility around it appears to be the reason why it has remained above $600 but has yet to make another substantial price increase.

When an asset is described as volatile, it means its price experiences significant fluctuations within a short timeframe. High volatility signals greater risk due to unpredictable price swings, but it also offers the potential for higher rewards.

Therefore, if buying pressure increases during high volatility, the asset’s price might increase significantly. If this volatility comes during high selling pressure, the price might tumble significantly.

According to Santiment, BNB’s one-day volatility has declined from its recent peak, suggesting reduced price fluctuations. This drop in volatility could make it difficult for BNB to achieve a notable breakout above the $600 mark, as the market may lack the momentum needed for a significant move.

In addition, Open Interest (OI), a metric that tracks the level of speculative activity around a cryptocurrency, has declined. High OI usually signals increased capital inflows into contracts, often indicating strong buying pressure capable of driving prices upward.

Conversely, a drop in OI reflects reduced liquidity in the market, often associated with selling pressure and a potential price decline. For BNB, the OI has remained relatively stagnant since November 19, indicating that traders are hesitant to inject additional liquidity or take on new contracts.

Further, the OI is notably lower at $532.08 million than on November 14. This lack of speculative activity indicates reduced market momentum, reinforcing the likelihood that BNB’s price will struggle to break above the $600 threshold.

BNB Price Prediction: Drop to $551 Likely

Similar to Open Interest, BNB’s price has followed a consistent trend since July, repeatedly facing resistance around $612. This indicates persistent efforts by bears to prevent the cryptocurrency from challenging its $724 all-time high.

Currently, with BNB trading near the same resistance level, a decline is possible. Historical patterns suggest that if the coin fails to break through, it could retrace to $551, as it did previously.

However, a surge in volatility paired with strong buying pressure could challenge this outlook. In such a scenario, BNB might not stop at holding above $600 but also climb toward $660—or even retest the $724 high.